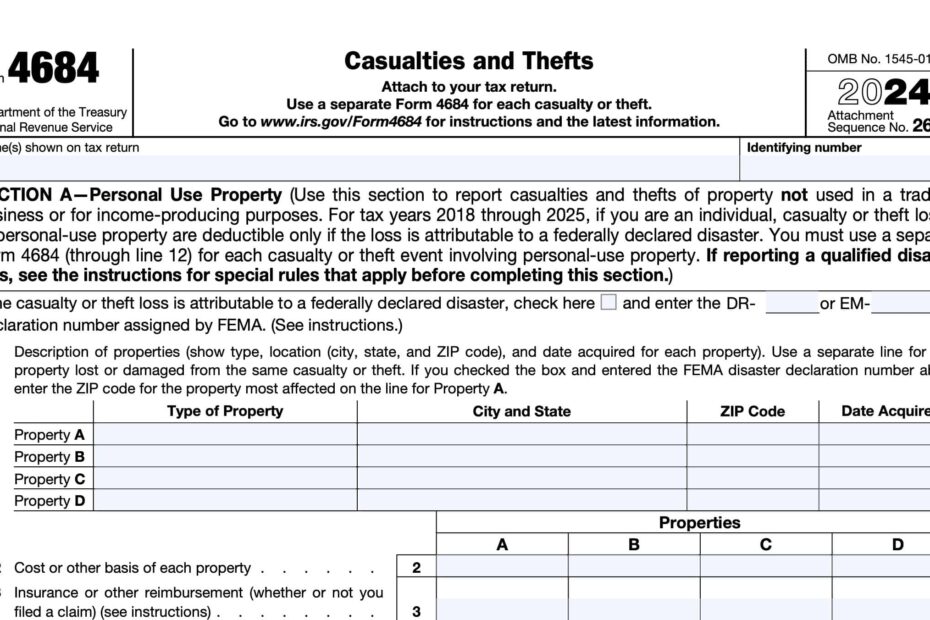

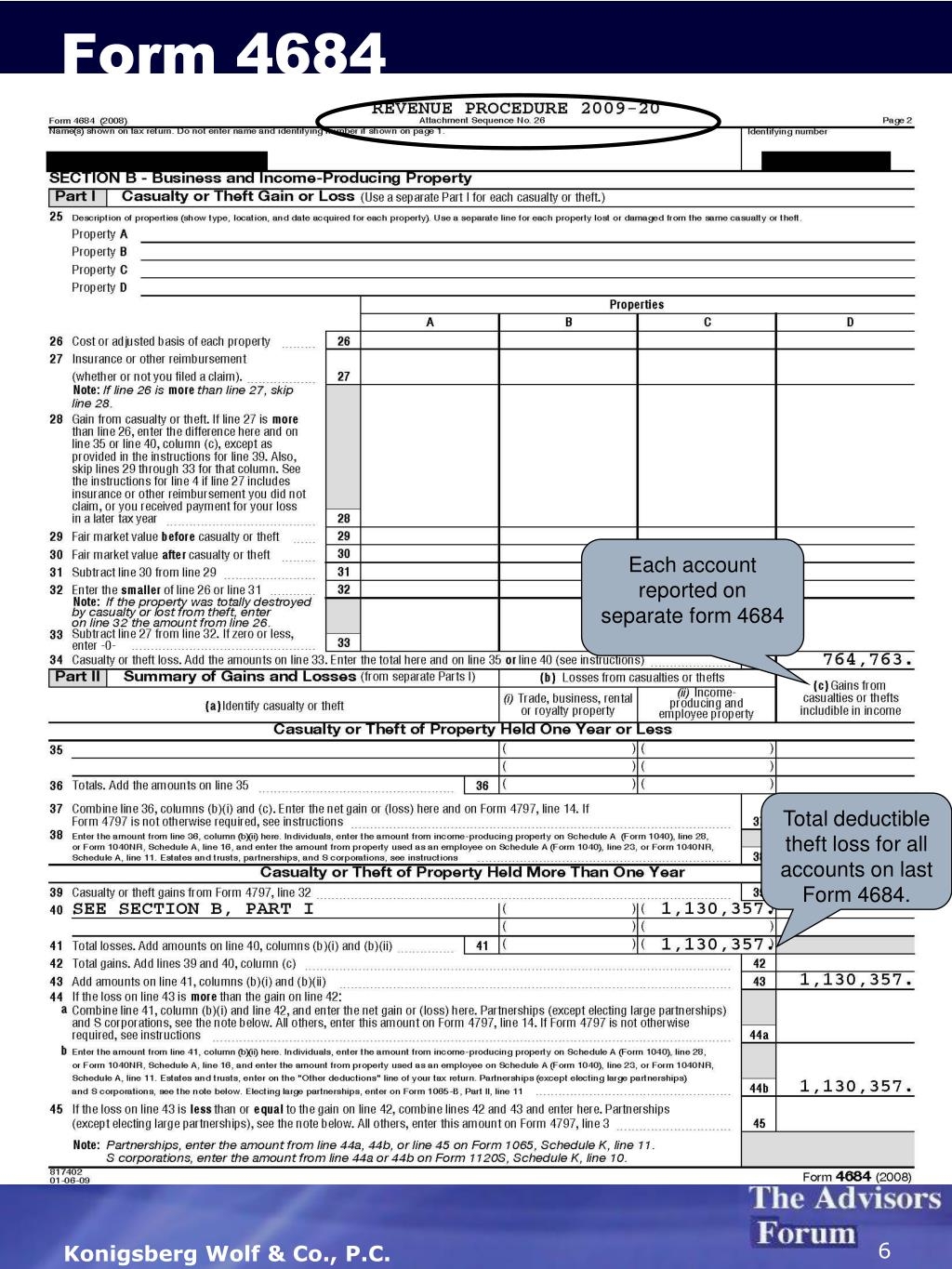

Facing a disaster or casualty can be a devastating experience, but the IRS provides some relief through Form 4684. This form helps individuals who have suffered losses due to theft, vandalism, fire, or natural disasters to claim a deduction on their taxes.

It is important to be aware of the eligibility criteria and documentation required when filling out Form 4684. This form allows you to calculate the amount of your casualty or theft loss, which can then be used as a deduction on your tax return.

Quickly Access and Print Irs Form 4684 Printable

Form 4684 Casualties And Thefts 2024 2025 Fill PDF Guru

Form 4684 Casualties And Thefts 2024 2025 Fill PDF Guru

When filling out Form 4684, you will need to provide details about the type of casualty or theft, the date it occurred, the value of the property lost, and any insurance reimbursements received. It is essential to accurately report this information to ensure that you receive the appropriate deduction.

Once you have completed Form 4684, you can submit it along with your tax return to the IRS. It is recommended to keep a copy of the form for your records in case of any future audits or inquiries from the IRS.

Overall, Form 4684 provides a valuable opportunity for individuals to recoup some of the losses incurred from a disaster or casualty. By following the guidelines and accurately filling out the form, you can benefit from a deduction on your taxes and alleviate some of the financial burden caused by the unfortunate event.

In conclusion, Form 4684 is a useful tool for individuals who have experienced losses due to theft, vandalism, fire, or natural disasters. By providing the necessary information and documentation, you can claim a deduction on your taxes and receive some relief during a difficult time. Make sure to consult with a tax professional if you have any questions or need assistance in filling out Form 4684.