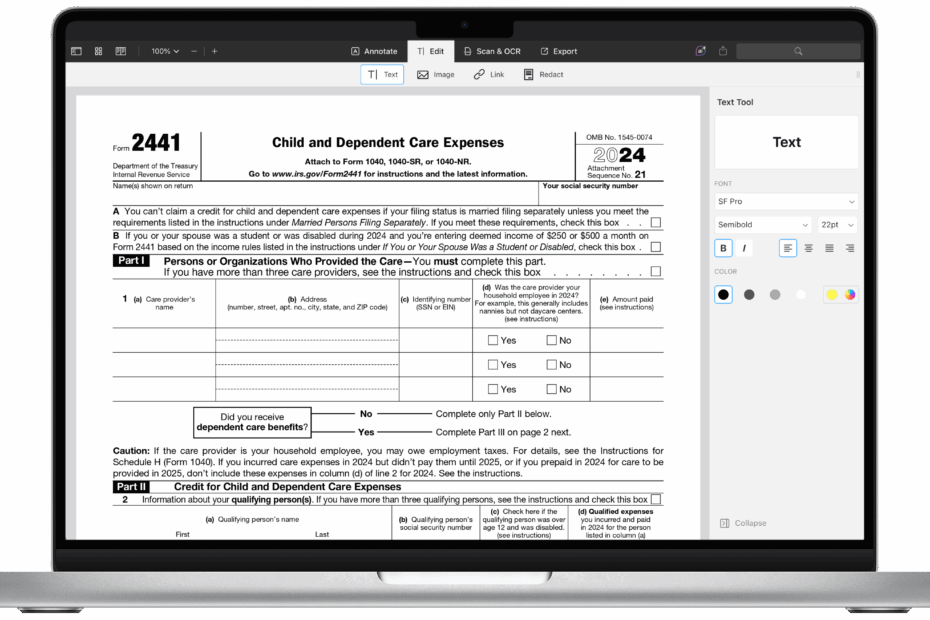

Filing taxes can be a daunting task, especially when it comes to claiming deductions for child and dependent care expenses. IRS Form 2441 is the document you need to fill out in order to claim these expenses on your tax return.

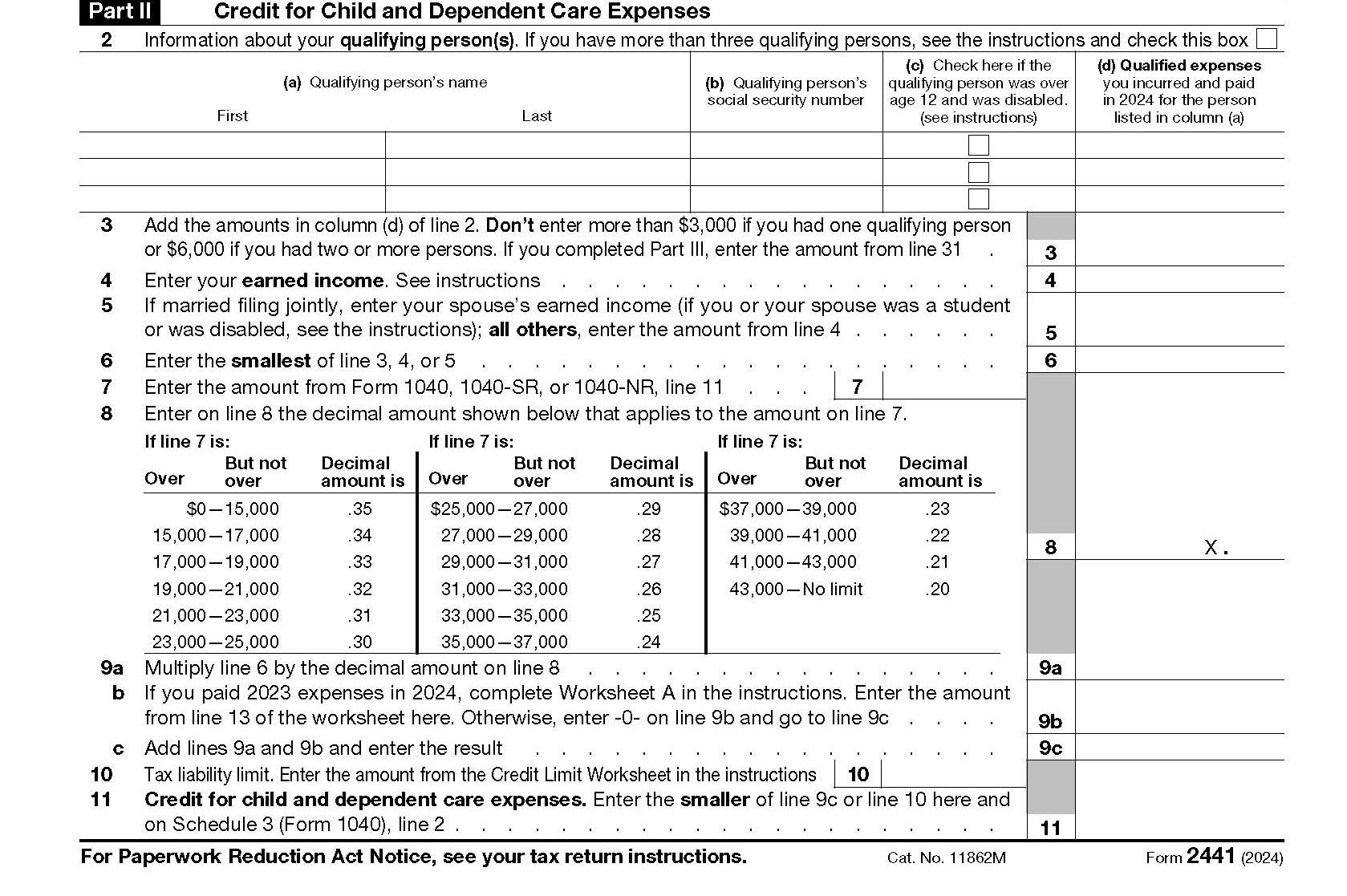

Form 2441 is used to calculate the amount of credit you are eligible for based on your qualifying expenses. This credit can help offset the cost of child and dependent care, allowing you to save money on your taxes.

Quickly Access and Print Irs Form 2441 Printable

IRS Form 2441 Child And Dependent Care Expenses

IRS Form 2441 Child And Dependent Care Expenses

Understanding IRS Form 2441

When filling out Form 2441, you will need to provide information about the care provider, the amount of expenses incurred, and details about the individuals for whom the care was provided. This form is essential for claiming the Child and Dependent Care Credit, which can be a significant tax benefit for many families.

It is important to keep accurate records of your child and dependent care expenses throughout the year to ensure you have all the information you need to complete Form 2441 correctly. This includes receipts, invoices, and any other documentation that supports your claims.

Once you have completed Form 2441, you will need to include it with your tax return when filing with the IRS. The information provided on this form will be used to determine the amount of credit you are eligible for, so it is important to fill it out accurately and completely.

By utilizing Form 2441 and claiming the Child and Dependent Care Credit, you can save money on your taxes while also receiving assistance with the cost of caring for your loved ones. Be sure to consult with a tax professional if you have any questions or need assistance with completing this form.

In conclusion, IRS Form 2441 is a valuable tool for individuals and families who incur child and dependent care expenses. By understanding how to properly fill out this form and claiming the credits you are eligible for, you can maximize your tax savings and receive assistance with the cost of caring for your loved ones.