As a freelancer or independent contractor, it is crucial to stay organized when it comes to tax season. One essential document that you need to be familiar with is the IRS Form 1099 NEC. This form is used to report nonemployee compensation, such as fees, commissions, prizes, and awards, that you have received throughout the year.

By having the IRS Form 1099 NEC printable, you can easily keep track of your income and report it accurately to the IRS. This form is typically provided to you by the clients or companies that have paid you more than $600 in nonemployee compensation during the tax year. It is important to include this information on your tax return to avoid any penalties or audits from the IRS.

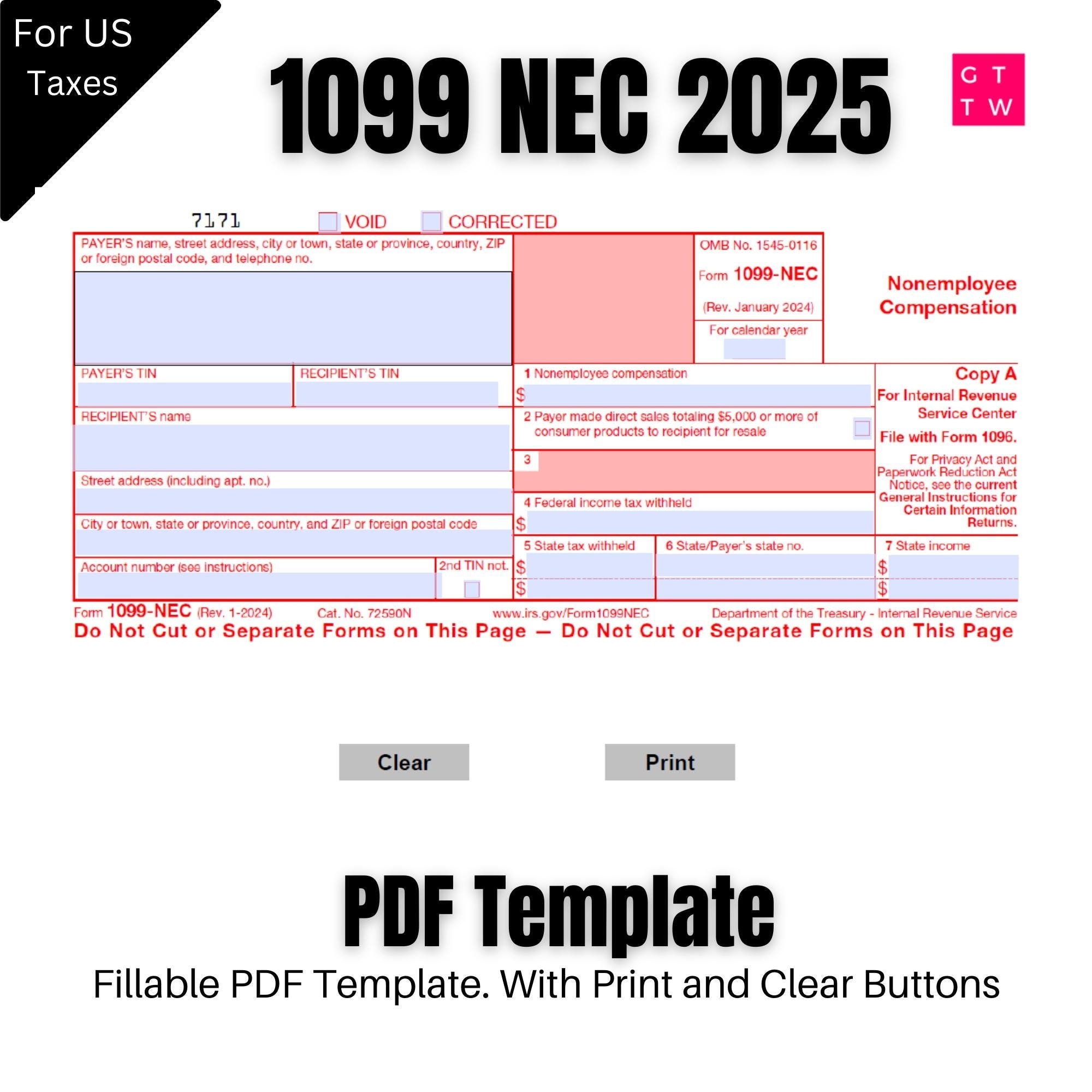

Easily Download and Print Irs Form 1099 Nec Printable

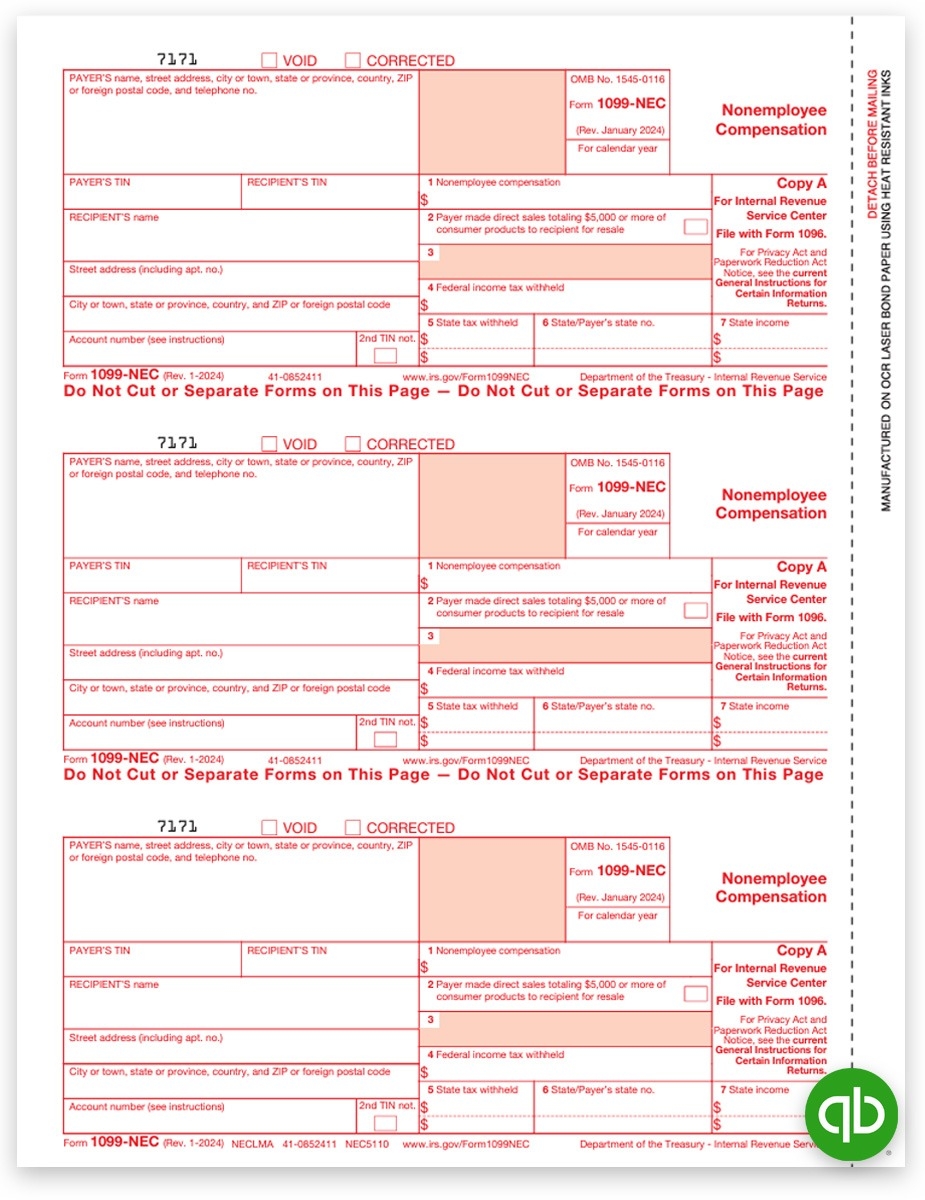

Intuit QuickBooks 1099 NEC Form IRS Copy A DiscountTaxForms

Intuit QuickBooks 1099 NEC Form IRS Copy A DiscountTaxForms

IRS Form 1099 NEC Printable

When you receive the IRS Form 1099 NEC from your clients, it is important to review it carefully to ensure that all the information is accurate. If there are any discrepancies, you should contact the issuing party immediately to have it corrected. Once you have verified the information, you can use the IRS Form 1099 NEC printable to fill out your tax return.

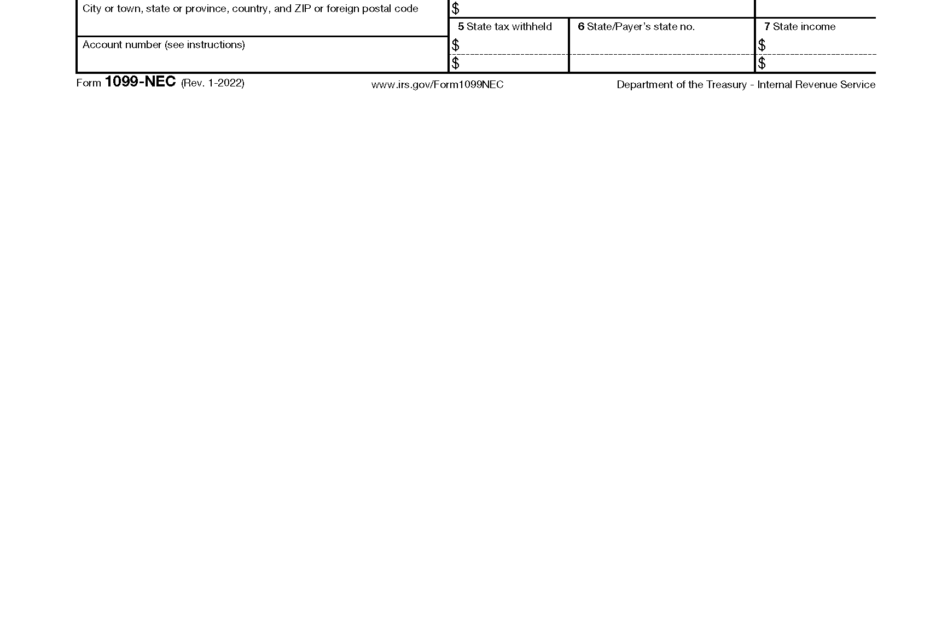

When filling out the form, you will need to provide your personal information, the client’s information, and the total amount of nonemployee compensation that you have received. You will also need to report any federal income tax withheld, if applicable. Once you have completed the form, you can submit it along with your tax return to the IRS by the deadline.

Having the IRS Form 1099 NEC printable on hand will make the tax filing process much smoother and more efficient. It will also help you avoid any errors or omissions that could lead to penalties or audits. By staying organized and keeping accurate records of your income, you can ensure that you are in compliance with the IRS regulations and avoid any potential issues down the road.

In conclusion, the IRS Form 1099 NEC printable is a valuable tool for freelancers and independent contractors to report their nonemployee compensation accurately. By using this form and keeping detailed records of your income, you can stay on top of your tax obligations and avoid any potential issues with the IRS. Make sure to download and print the form when needed to ensure a smooth tax filing process.