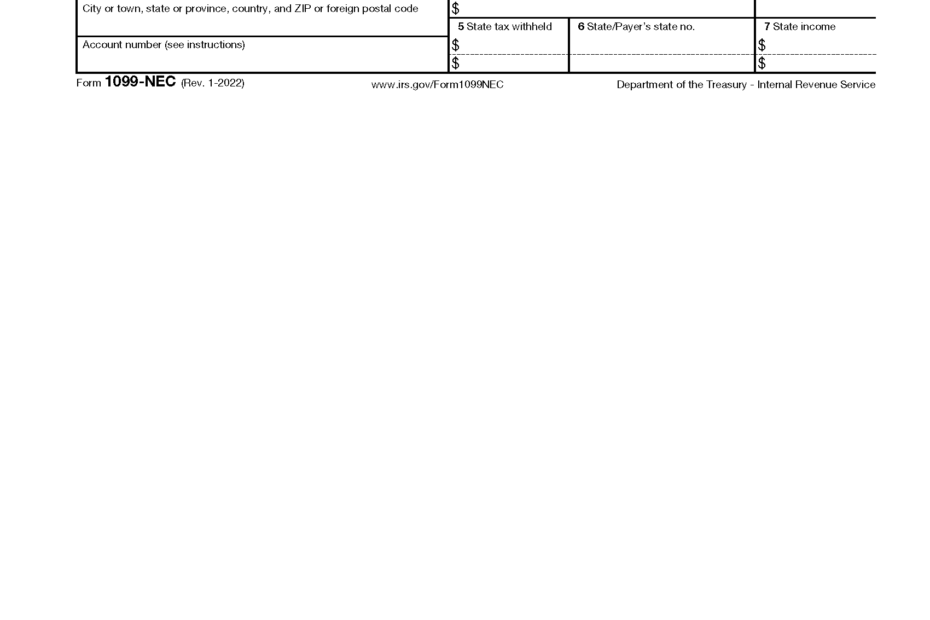

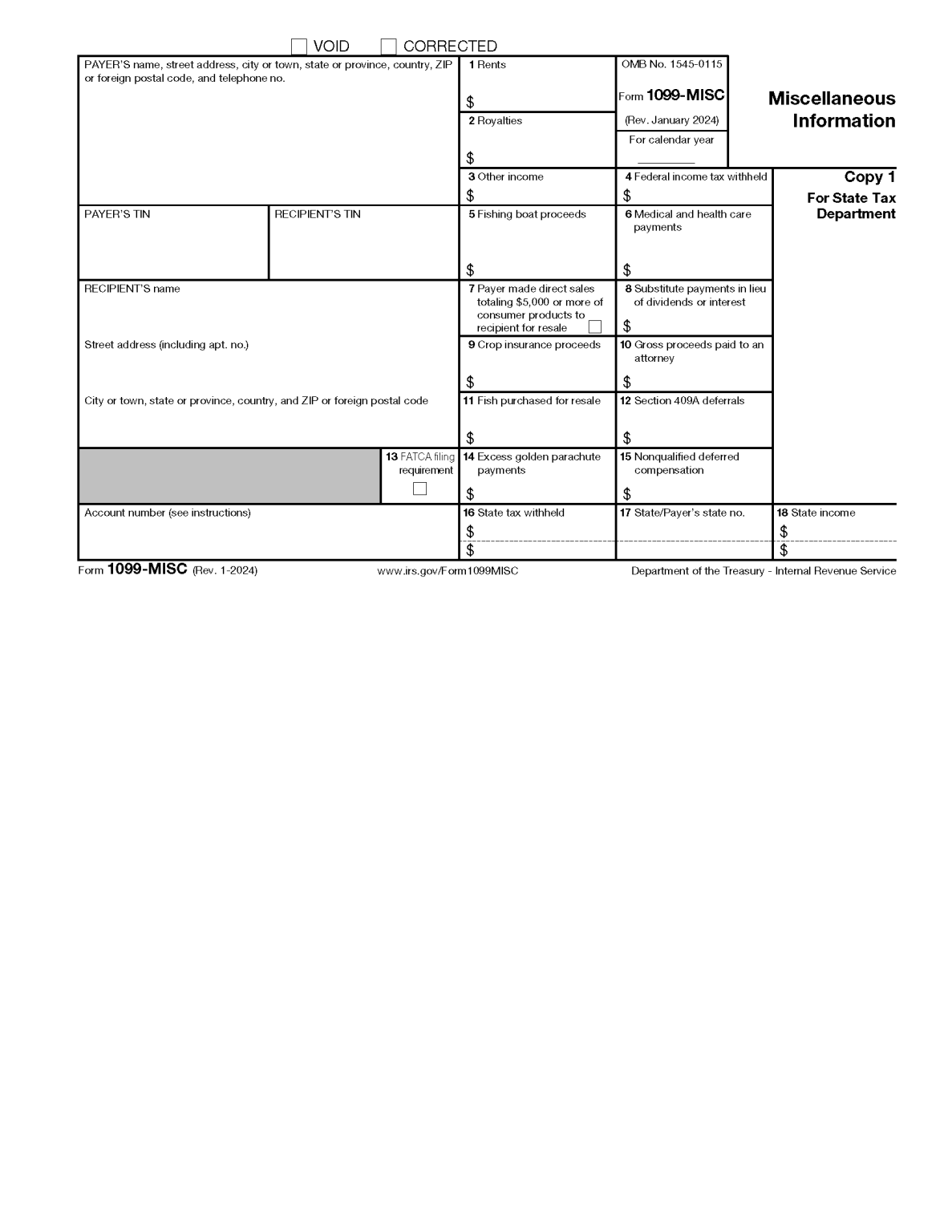

IRS Form 1099 NEC is used to report nonemployee compensation to the IRS. In 2025, the form has undergone some changes, making it important for businesses to stay updated on the latest version. It is crucial for businesses to accurately report nonemployee compensation to avoid any penalties or fines.

Businesses need to ensure that they provide accurate information on Form 1099 NEC to both the IRS and the payee. This includes details such as the recipient’s name, address, taxpayer identification number, and the total amount of nonemployee compensation paid throughout the year. Failing to report this information accurately can result in penalties from the IRS.

Irs Form 1099 Nec 2025 Printable

Irs Form 1099 Nec 2025 Printable

Save and Print Irs Form 1099 Nec 2025 Printable

When filing Form 1099 NEC for the year 2025, businesses must ensure that they use the correct version of the form. The IRS provides a printable version of Form 1099 NEC on their website, making it easy for businesses to access and fill out the form. It is important to follow the instructions provided by the IRS to ensure that the form is completed correctly.

Businesses should also keep detailed records of all nonemployee compensation payments made throughout the year. This will help ensure that the information reported on Form 1099 NEC is accurate and up-to-date. It is recommended to keep copies of all forms and documentation for at least three years in case of an audit by the IRS.

Overall, businesses must stay informed about the latest changes to IRS Form 1099 NEC and ensure that they are using the correct version when reporting nonemployee compensation. By accurately reporting this information, businesses can avoid potential penalties and fines from the IRS.

In conclusion, IRS Form 1099 NEC 2025 Printable is an essential document for businesses to report nonemployee compensation to the IRS. It is important for businesses to use the correct version of the form and accurately report all necessary information to avoid any penalties. By staying informed and following the IRS guidelines, businesses can effectively file Form 1099 NEC for the year 2025.