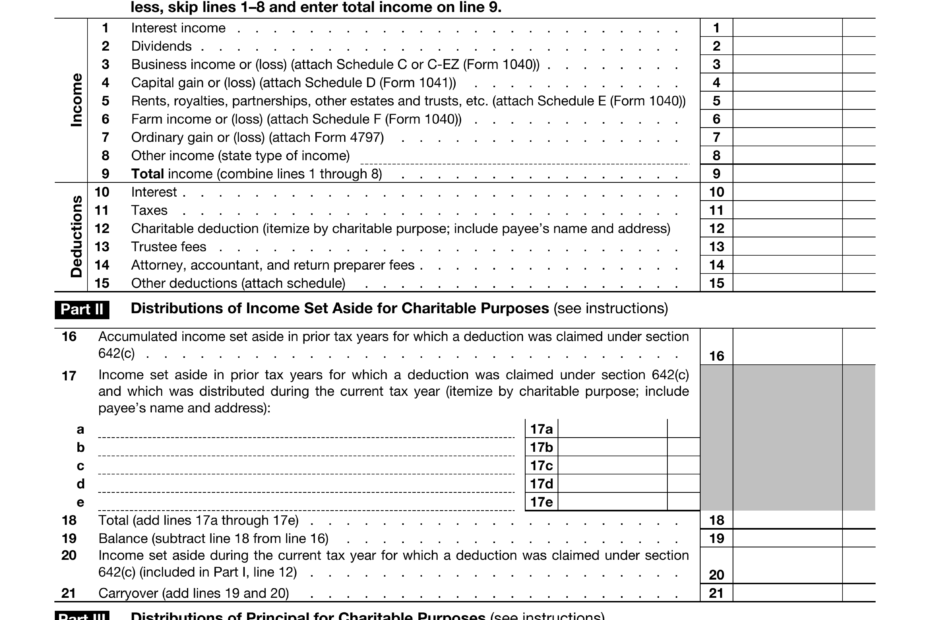

Filing taxes can be a daunting task, especially when it comes to trusts and estates. If you are responsible for administering a trust or estate, you may need to file IRS Form 1041. This form is used to report income, deductions, and distributions for estates and trusts.

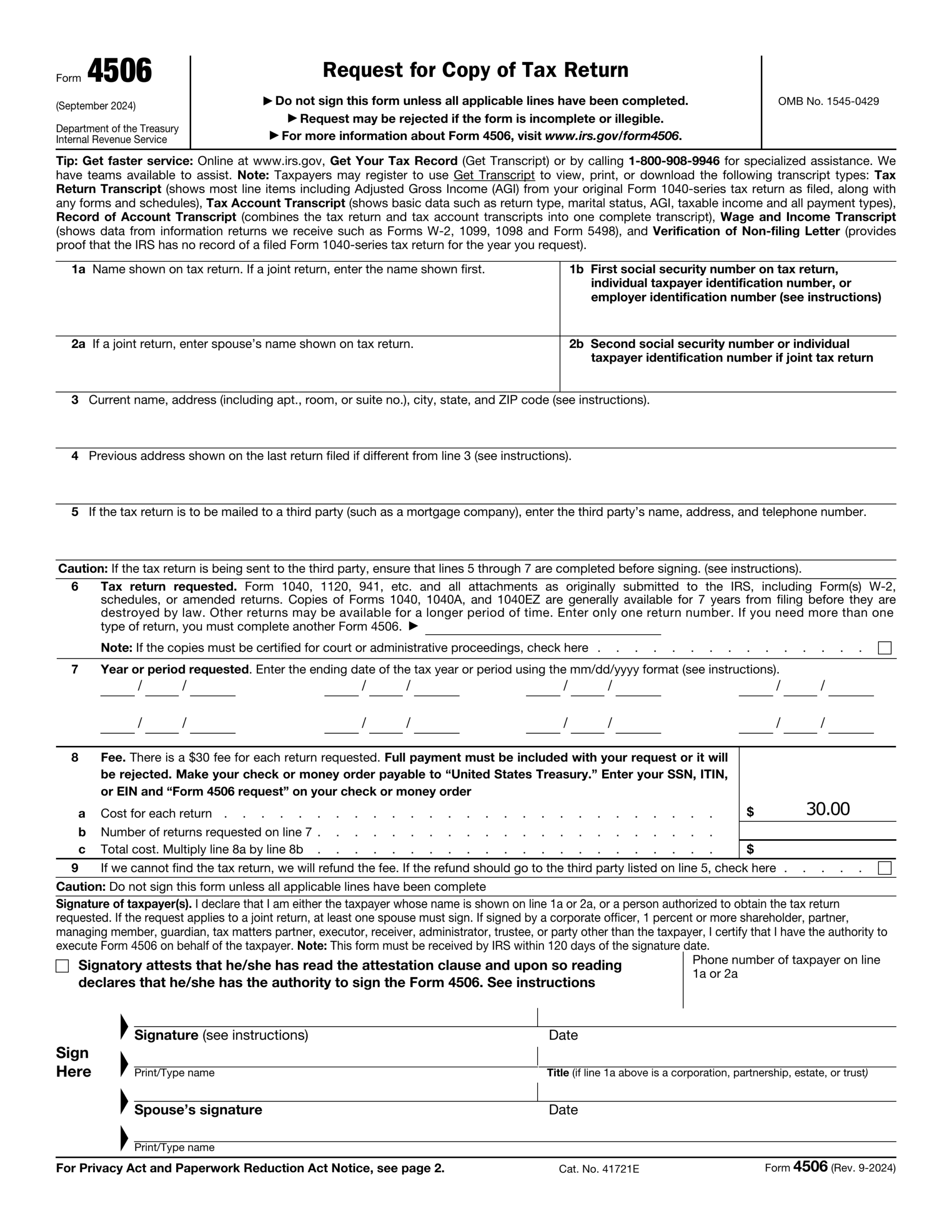

With the advancement of technology, you can now easily access and download IRS Form 1041 Printable online. This makes it convenient for individuals to fill out the form and submit it to the IRS without any hassle. Whether you are a trustee, executor, or administrator, having access to the printable form can simplify the process for you.

Download and Print Irs Form 1041 Printable

Form 1041 A U S Information Return 2024 2025 Fill PDF Guru

Form 1041 A U S Information Return 2024 2025 Fill PDF Guru

Irs Form 1041 Printable

IRS Form 1041 Printable is available on the official IRS website or various tax preparation websites. This form consists of several sections that require you to provide information about the trust or estate, including income, deductions, distributions, and taxes owed. By filling out this form accurately, you can ensure compliance with IRS regulations and avoid any penalties or fines.

When using the printable form, make sure to carefully review the instructions provided by the IRS. It is important to include all necessary information and double-check for any errors before submitting the form. Additionally, you may need to attach supporting documents, such as schedules and statements, to provide a complete picture of the trust or estate’s financial situation.

By utilizing IRS Form 1041 Printable, you can save time and effort in preparing and filing your taxes. The convenience of being able to access the form online allows you to complete the process at your own pace and ensure accuracy in reporting. Whether you are a novice or experienced filer, having the printable form at your disposal can streamline the tax filing process for trusts and estates.

In conclusion, IRS Form 1041 Printable is a valuable resource for individuals responsible for filing taxes for trusts and estates. By utilizing this form, you can accurately report income, deductions, and distributions, ensuring compliance with IRS regulations. Make sure to take advantage of the convenience of accessing the form online to simplify the tax filing process for trusts and estates.