IRS Form 1040X, also known as the Amended U.S. Individual Income Tax Return, is used to correct errors or make changes to a previously filed Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ. This form allows taxpayers to amend their tax return if they made mistakes or need to update information.

It’s important to note that Form 1040X cannot be filed electronically, so you will need to print it out and mail it to the IRS. You should only use this form if you need to make changes to your tax return after it has already been filed.

Save and Print Irs Form 1040x Printable

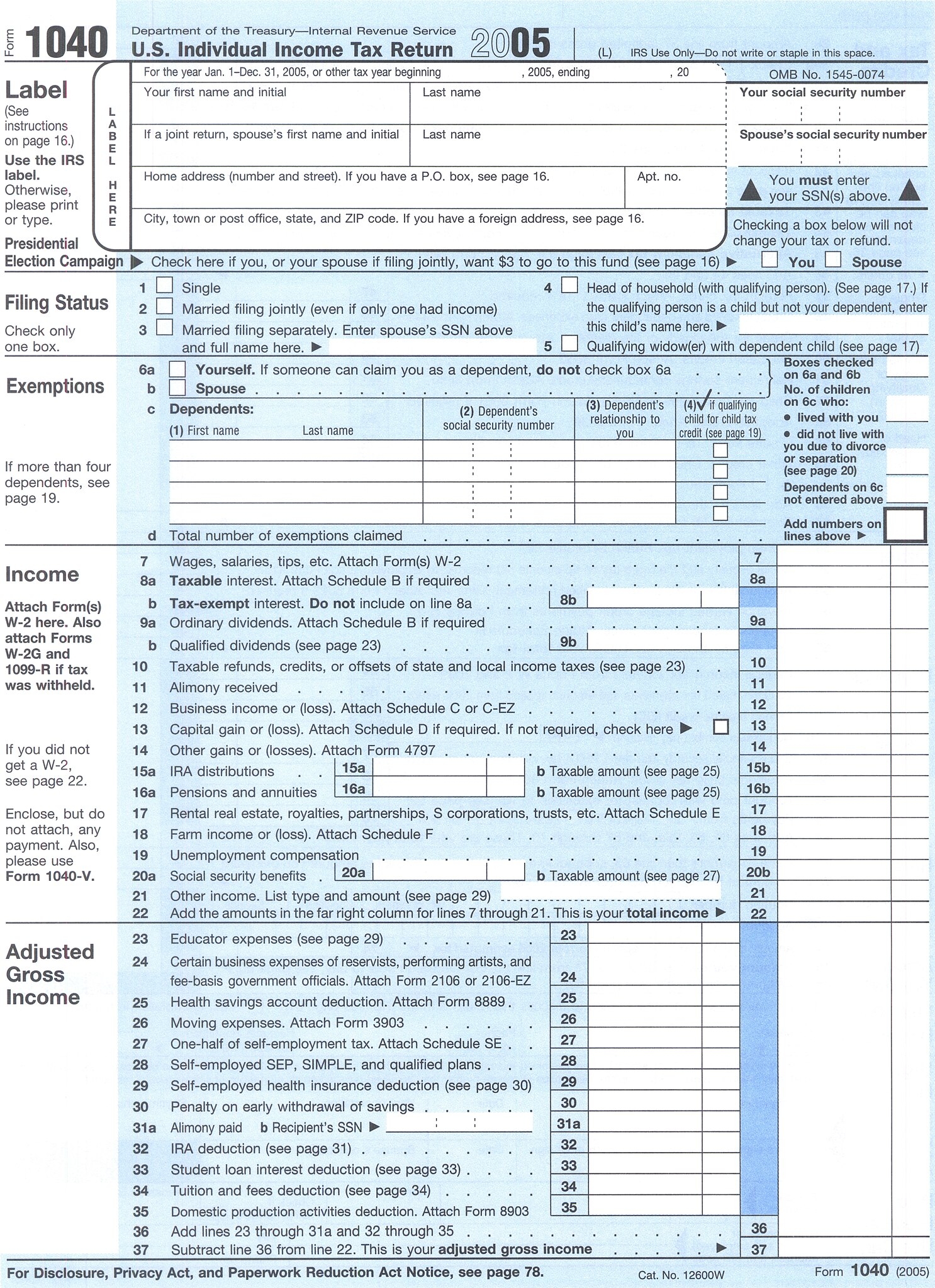

File Form 1040 2005 Jpg Wikimedia Commons

File Form 1040 2005 Jpg Wikimedia Commons

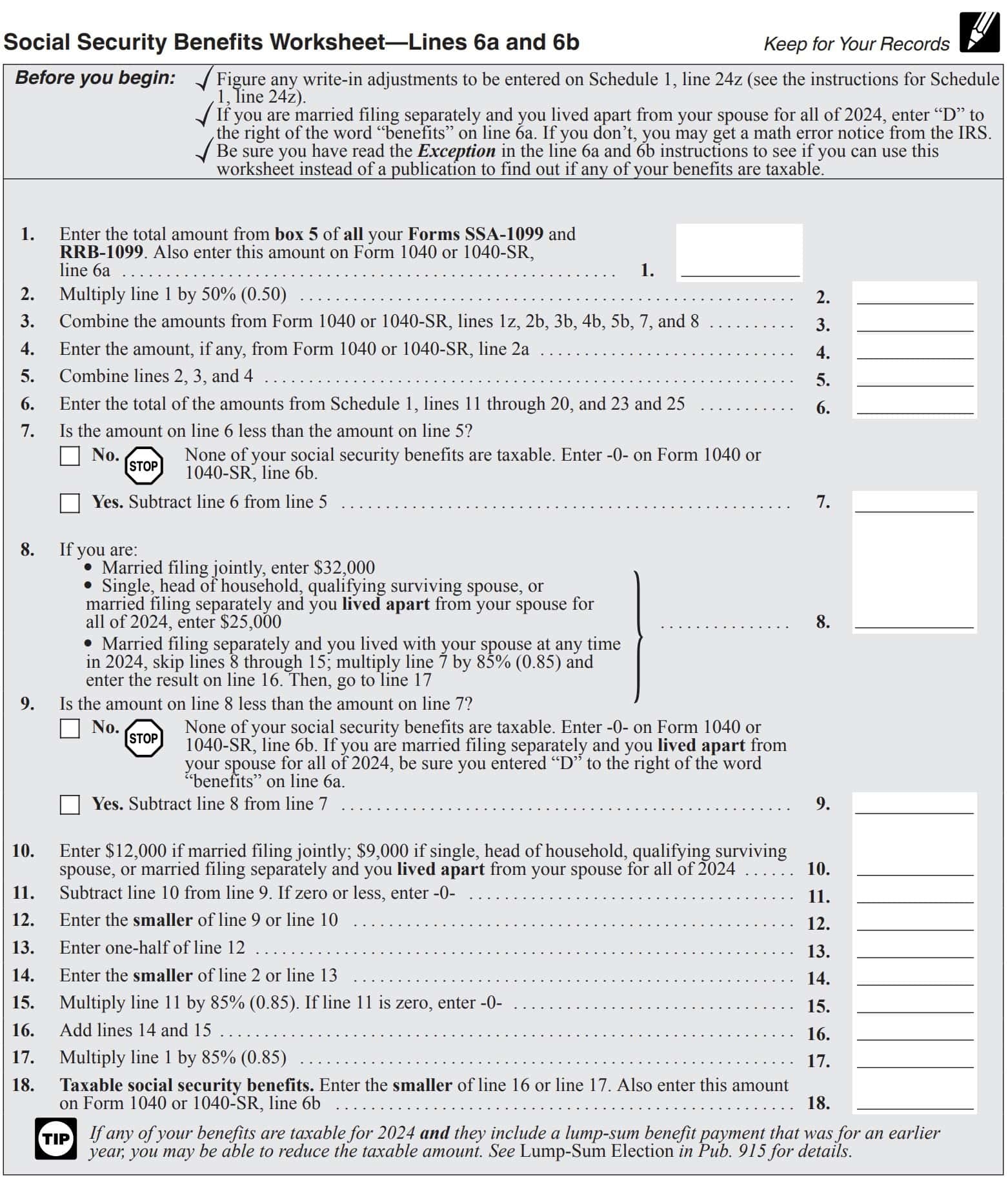

When filling out Form 1040X, you will need to provide your personal information, details about the original return, and the changes you are making. Be sure to include any supporting documentation, such as W-2s or 1099s, to verify the changes you are making.

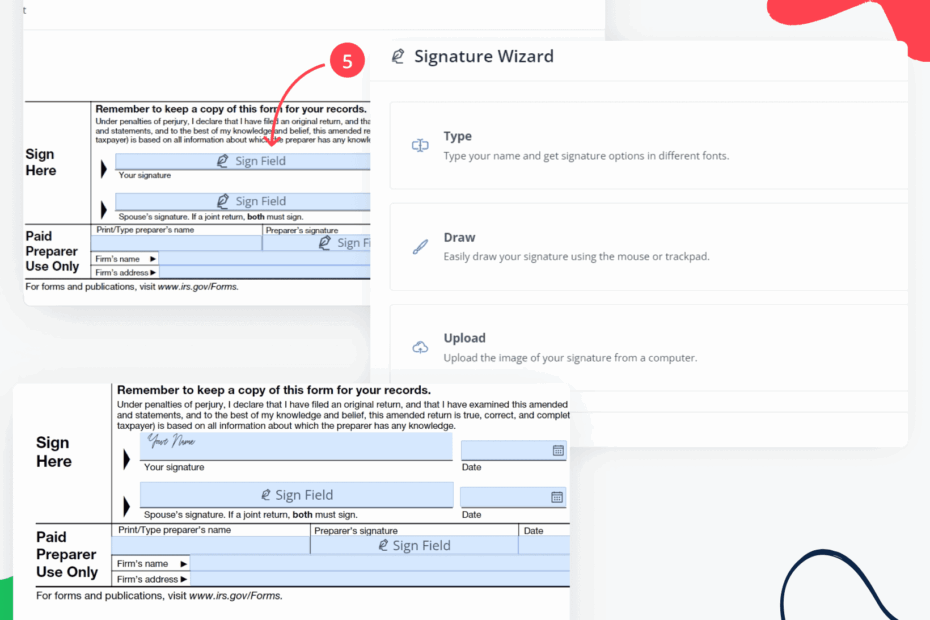

Once you have completed the form, make sure to double-check all the information before mailing it to the IRS. It’s also recommended to keep a copy of the amended return for your records in case you need to reference it in the future.

After you have submitted Form 1040X, it may take some time for the IRS to process the amendment. You can track the status of your amended return using the “Where’s My Amended Return?” tool on the IRS website.

Overall, IRS Form 1040X is a valuable tool for correcting mistakes on your tax return and ensuring that you are reporting the most accurate information to the IRS. By following the instructions carefully and providing all necessary documentation, you can successfully amend your tax return using this printable form.

In conclusion, IRS Form 1040X Printable is a useful resource for taxpayers who need to make changes to their previously filed tax return. By following the instructions and providing all necessary documentation, you can ensure that your amended return is processed accurately by the IRS.