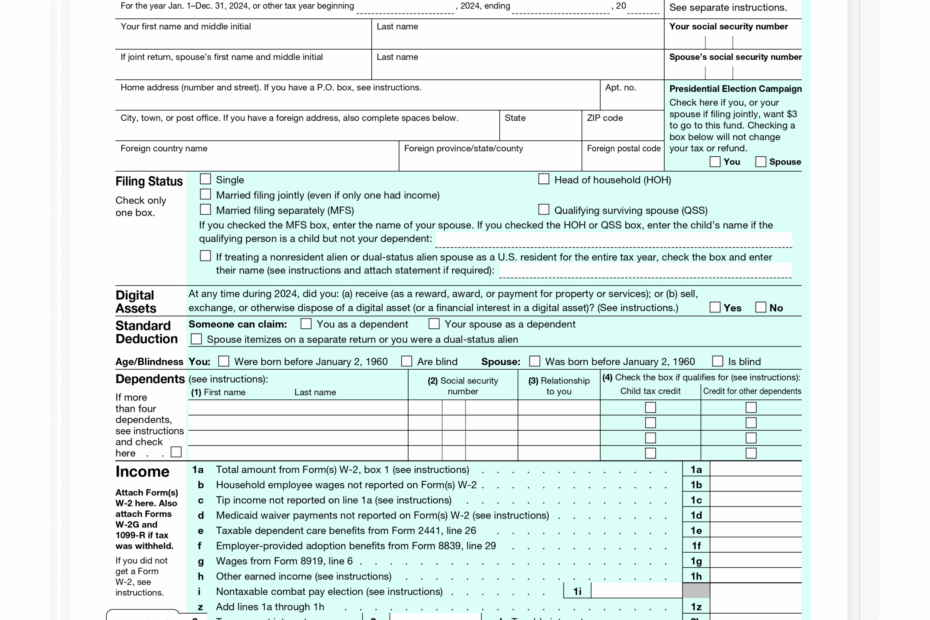

Filling out tax forms can be a daunting task for many individuals, but the IRS Form 1040a Printable makes the process a little bit easier. This form is designed for taxpayers with simple tax situations who do not need to itemize deductions. It is a shorter and simpler version of the standard Form 1040, making it ideal for those who want to file their taxes quickly and easily.

With the IRS Form 1040a Printable, you can easily report your income, claim deductions, and calculate your tax owed or refund due. This form is available for download on the IRS website, making it convenient for taxpayers to access and fill out at their own pace.

Get and Print Irs Form 1040a Printable

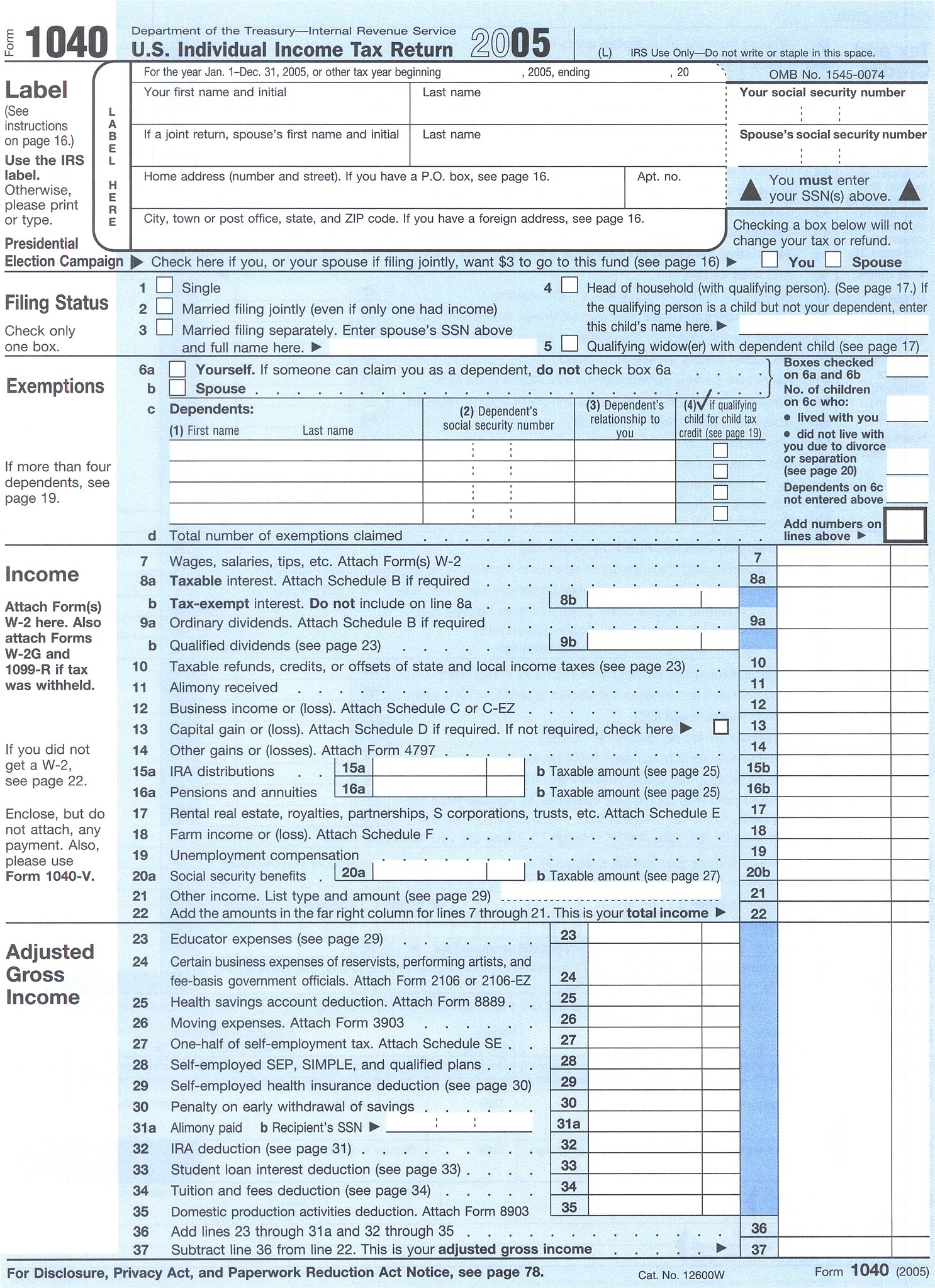

File Form 1040 2005 Jpg Wikimedia Commons

File Form 1040 2005 Jpg Wikimedia Commons

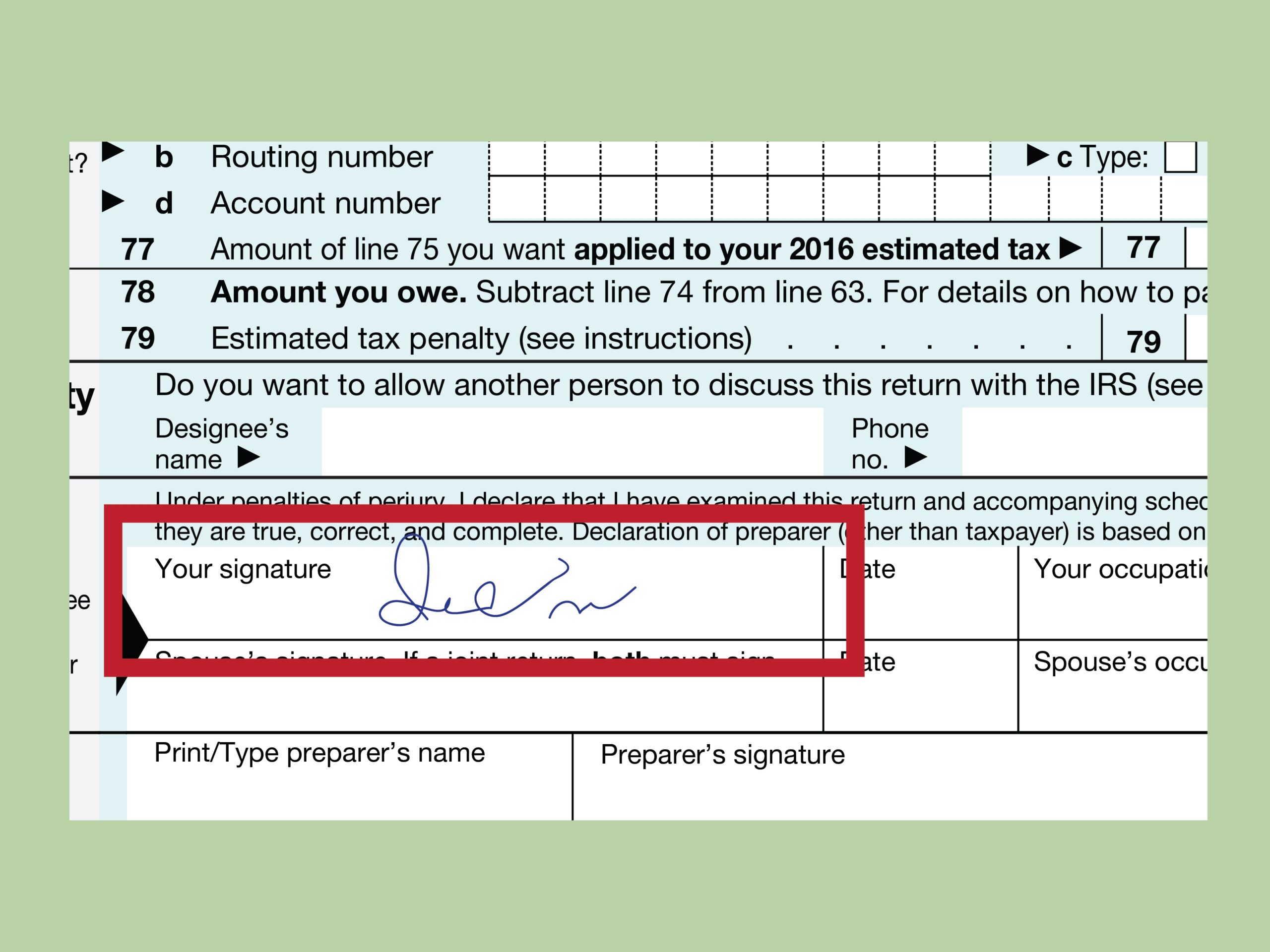

When filling out the IRS Form 1040a Printable, you will need to provide information about your income, deductions, and credits. You will also need to include any supporting documentation, such as W-2 forms or 1099s. Make sure to double-check your entries for accuracy before submitting your form to the IRS to avoid any delays or errors in processing.

One of the advantages of using the IRS Form 1040a Printable is that it simplifies the tax filing process for those with straightforward tax situations. It eliminates the need to itemize deductions, which can save time and effort for taxpayers who do not have a lot of deductions to claim. This form also includes step-by-step instructions to help guide you through the process, making it easier to complete your taxes accurately.

Overall, the IRS Form 1040a Printable is a useful tool for individuals with simple tax situations who want to file their taxes quickly and easily. By providing a simplified version of the standard Form 1040, this form streamlines the tax filing process and makes it more accessible for all taxpayers. So, if you are looking for a hassle-free way to file your taxes, consider using the IRS Form 1040a Printable for your next tax return.