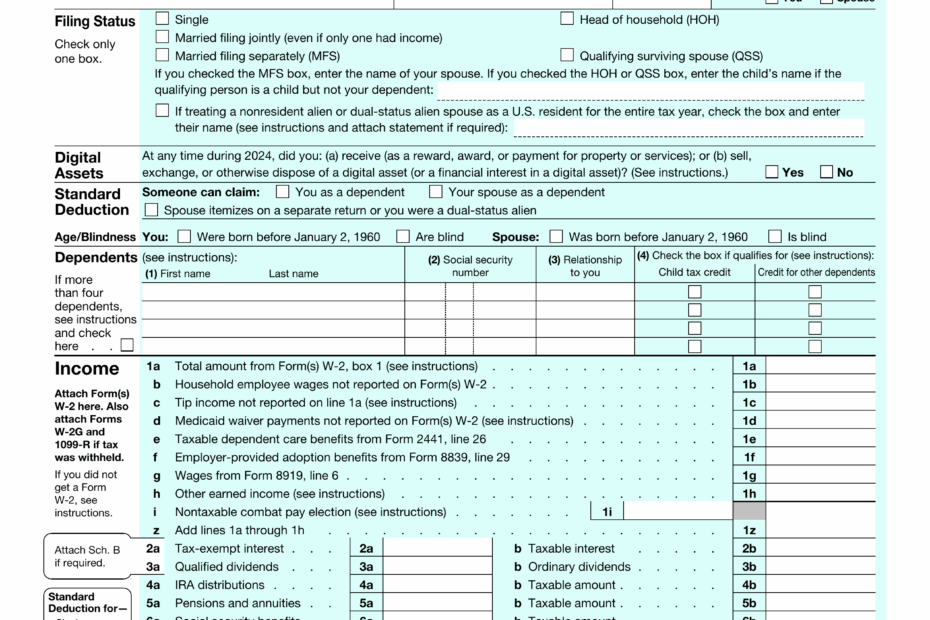

As we approach the year 2025, it is important to stay informed about any changes in tax forms and regulations. One form that may be of interest to seniors is the IRS Form 1040 SR, specifically designed for taxpayers aged 65 and older. This form provides a simplified way for seniors to report their income and claim deductions, ensuring they receive any tax benefits they are entitled to.

For those looking to prepare for their taxes in 2025, having access to printable versions of IRS forms can be incredibly helpful. The IRS Form 1040 SR for 2025 will likely be available online for taxpayers to download and fill out at their convenience. This form can be a valuable tool for seniors who want to ensure they are accurately reporting their income and taking advantage of any available deductions.

Irs Form 1040 Sr 2025 Printable

Irs Form 1040 Sr 2025 Printable

Save and Print Irs Form 1040 Sr 2025 Printable

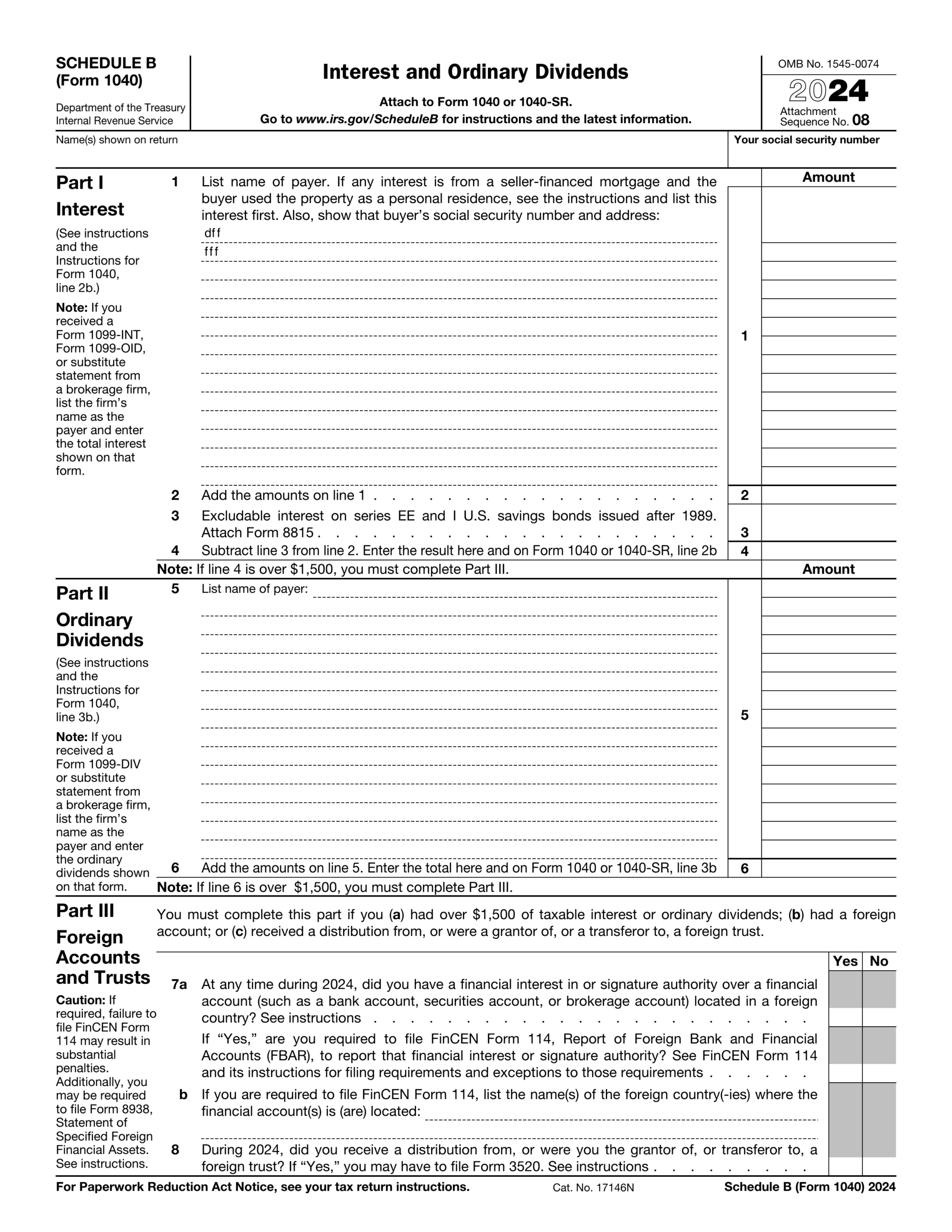

Schedule B Form 1040 2024 2025 Fill PDF Guru

Schedule B Form 1040 2024 2025 Fill PDF Guru

When filling out the IRS Form 1040 SR for 2025, seniors should make sure to include all sources of income, such as retirement benefits, social security payments, and any investment income. Additionally, they should carefully review the instructions provided with the form to ensure they are claiming all applicable deductions and credits. By taking the time to fill out the form accurately, seniors can help minimize their tax liability and potentially receive a larger refund.

Seniors may also want to consider seeking assistance from a tax professional or using tax preparation software to help them navigate the IRS Form 1040 SR for 2025. These resources can provide guidance on how to accurately report income, claim deductions, and avoid common errors that could result in a delay in processing their tax return. With the proper support, seniors can feel confident in their ability to complete their taxes accurately and on time.

In conclusion, the IRS Form 1040 SR for 2025 is a valuable tool for seniors to use when preparing their taxes. By accessing printable versions of this form and following the instructions carefully, seniors can ensure they are accurately reporting their income and claiming all applicable deductions. With the proper support and resources, seniors can navigate the tax filing process with ease and potentially receive a larger refund. Stay informed about any changes to tax forms and regulations as we approach the year 2025 to ensure you are well-prepared for tax season.