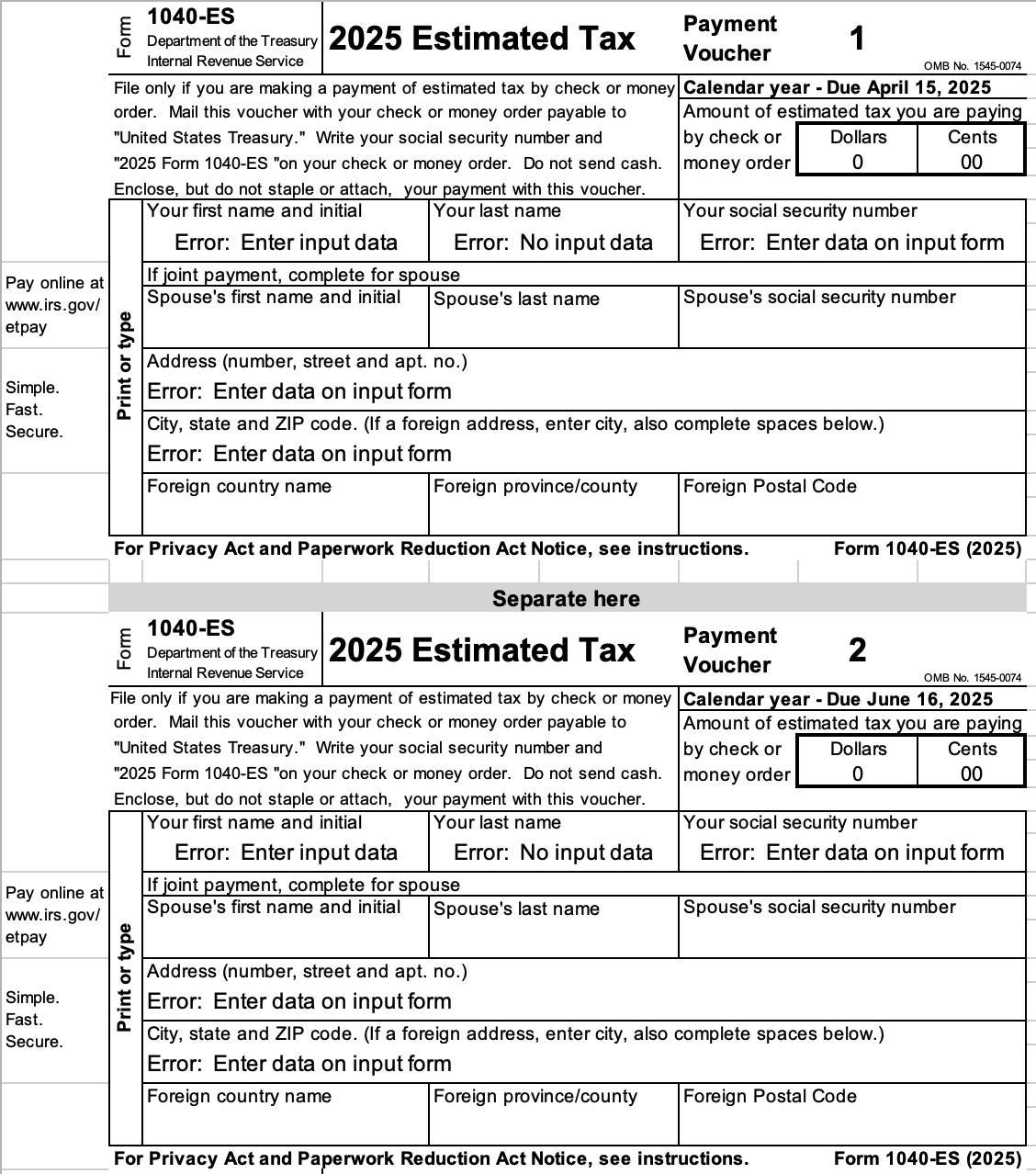

IRS Form 1040 ES is used by individuals who are self-employed or have income that is not subject to withholding tax to calculate and pay estimated taxes on a quarterly basis. For the year 2025, the IRS has released the printable version of Form 1040 ES to assist taxpayers in fulfilling their tax obligations.

By using Form 1040 ES, taxpayers can estimate their tax liability for the year and make timely payments to avoid penalties and interest charges. This form includes sections for reporting income, deductions, credits, and other relevant information to calculate the amount of estimated tax due.

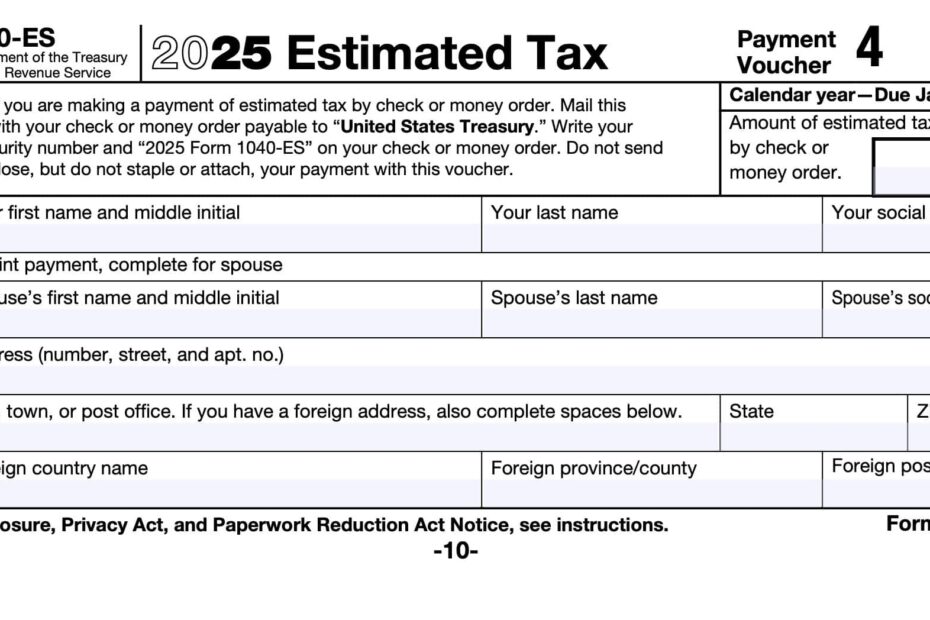

Irs Form 1040 Es 2025 Printable

Irs Form 1040 Es 2025 Printable

Quickly Access and Print Irs Form 1040 Es 2025 Printable

New 2025 Excel 1040ES Federal Workbook Etsy

New 2025 Excel 1040ES Federal Workbook Etsy

When filling out Form 1040 ES for 2025, taxpayers should carefully review the instructions provided by the IRS to ensure accurate reporting and calculation of estimated taxes. It is important to keep track of income and expenses throughout the year to make an informed estimate of tax liability and avoid underpayment.

One of the key features of Form 1040 ES is the ability to make payments electronically using the IRS Direct Pay system or by check or money order. Taxpayers can choose to make equal quarterly payments or adjust their payments based on changes in income or deductions during the year.

After completing Form 1040 ES for 2025 and making the necessary payments, taxpayers should retain a copy of the form for their records and keep track of payment dates and amounts. It is also recommended to consult with a tax professional or use online tax software to ensure compliance with tax laws and regulations.

In conclusion, IRS Form 1040 ES 2025 Printable is a valuable tool for self-employed individuals and others with income not subject to withholding tax to calculate and pay estimated taxes. By completing this form accurately and making timely payments, taxpayers can avoid penalties and interest charges and stay in compliance with their tax obligations.