When tax season rolls around, many individuals and businesses find themselves in need of more time to file their taxes. If you’re one of those people, an IRS extension may be just what you need. By filing for an extension, you can get an additional six months to submit your tax return without facing any penalties.

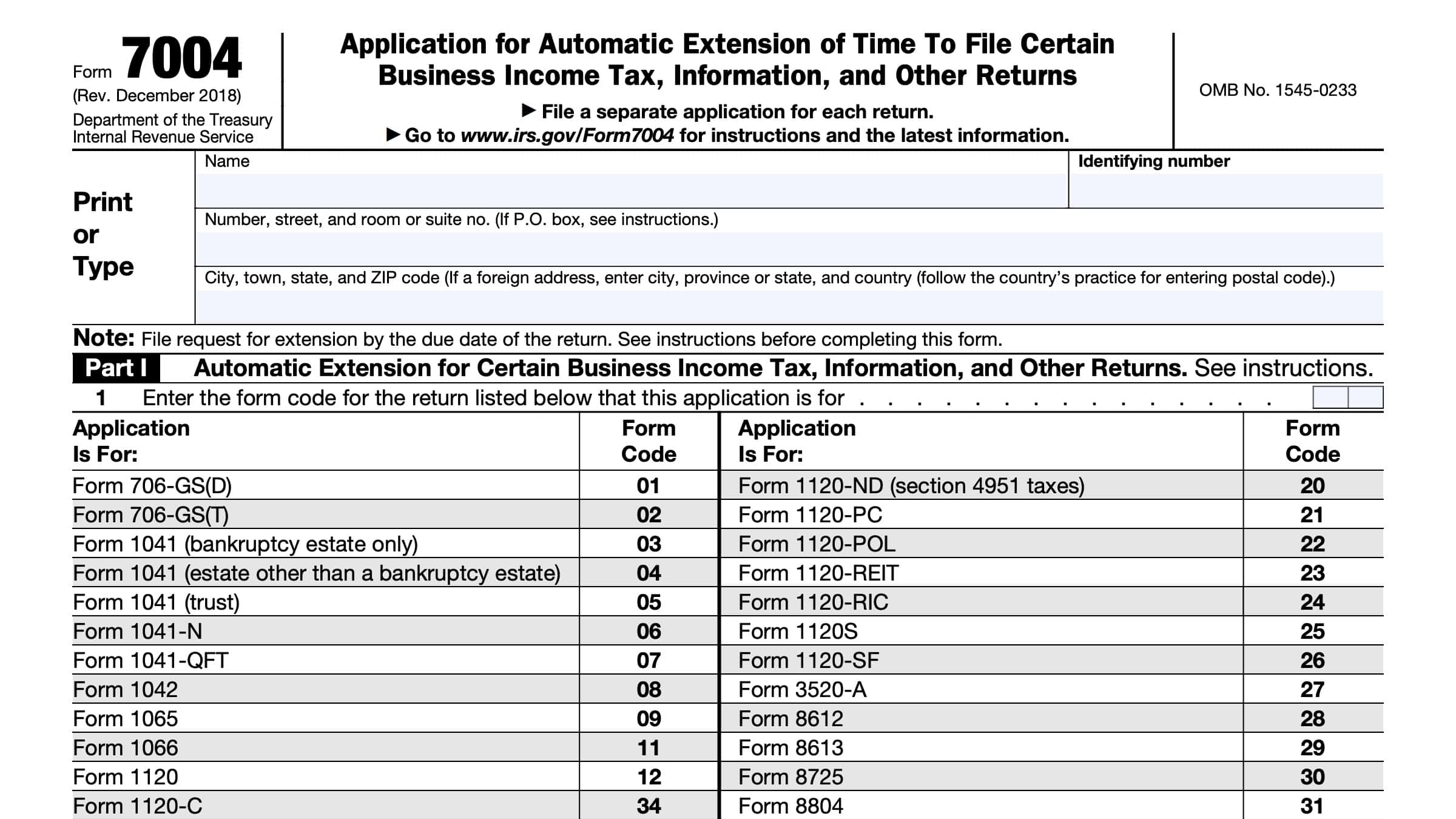

One way to request an extension is by using the IRS Extension Printable Form. This form allows you to quickly and easily apply for an extension without the need for any fancy software or online tools. Simply download the form from the IRS website, fill it out, and mail it in before the tax deadline.

Download and Print Irs Extension Printable Form

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

When filling out the IRS Extension Printable Form, be sure to provide accurate information including your name, address, Social Security number, and estimated tax liability. It’s important to note that while an extension gives you more time to file, it does not give you more time to pay any taxes owed. Be sure to make a payment with your extension request to avoid interest and penalties.

Once you’ve completed the form, you can mail it to the appropriate IRS address based on your location. Be sure to send it in well before the tax deadline to ensure it is received on time. You should receive a confirmation from the IRS once they have processed your extension request.

Remember, filing for an extension is not a way to avoid paying your taxes. It simply gives you more time to gather all the necessary information and ensure your return is accurate. If you find yourself needing more time to file your taxes, consider using the IRS Extension Printable Form to request an extension and avoid any unnecessary penalties.

Don’t let the stress of tax season get you down. With the IRS Extension Printable Form, you can easily request more time to file your taxes and ensure everything is done correctly. Take advantage of this tool and give yourself the peace of mind knowing you have the extra time you need.