When it comes to filing taxes as a truck owner or operator, one of the important forms you need to be familiar with is the IRS 2290 form. This form is used to report and pay the Heavy Vehicle Use Tax (HVUT) for vehicles with a gross weight of 55,000 pounds or more. It is essential to file this form annually to stay compliant with IRS regulations.

For the convenience of taxpayers, the IRS offers a printable version of the 2290 form for the year 2025. This printable form can be easily accessed from the IRS website and filled out manually. It is a straightforward process that allows truck owners to accurately report their HVUT and make the necessary payments.

Save and Print Irs 2290 Form 2025 Printable

The Evans 2290 E File HVUT Form 2290 U0026 Get Schedule 1 In Minutes

The Evans 2290 E File HVUT Form 2290 U0026 Get Schedule 1 In Minutes

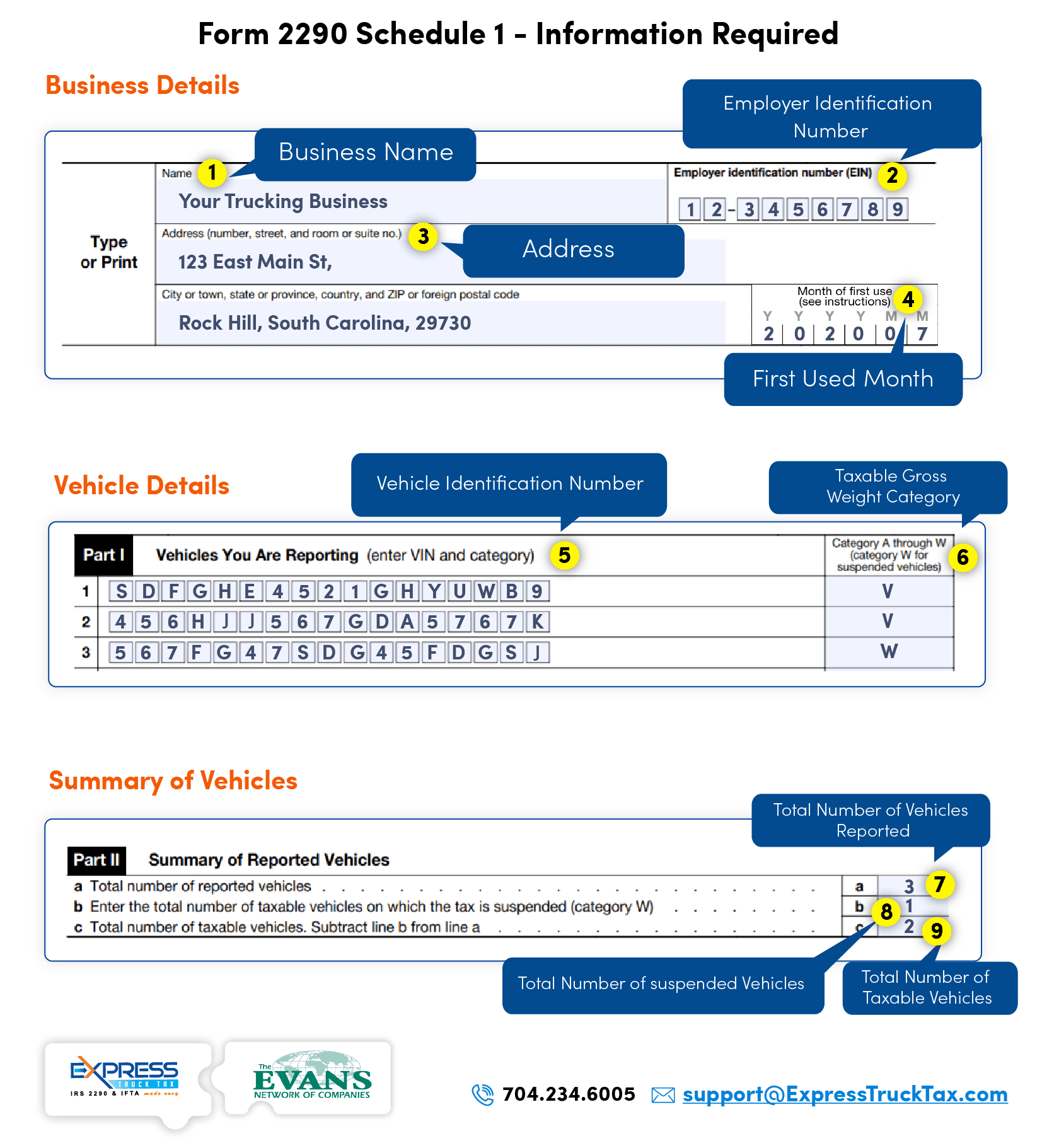

When filling out the IRS 2290 form for 2025, truck owners will need to provide information such as the vehicle identification number (VIN), taxable gross weight, and the first month the vehicle was used on the road during the tax period. It is important to double-check all the information provided to avoid any errors that could lead to penalties or delays in processing.

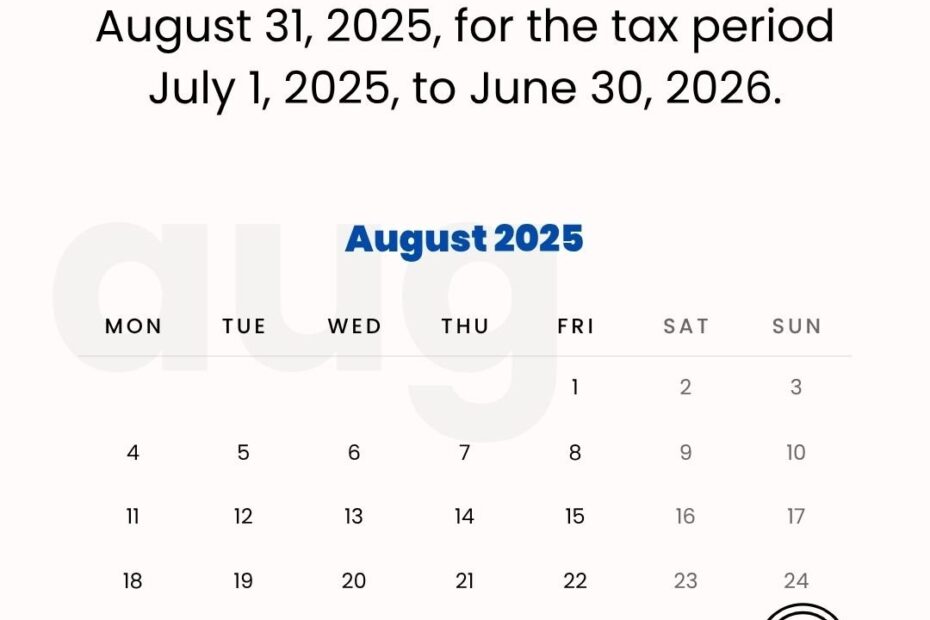

Once the form is filled out correctly, truck owners can submit it to the IRS along with the payment of the HVUT. The deadline for filing the IRS 2290 form for the tax year 2025 is typically August 31st. Failure to file by this deadline can result in penalties and interest charges, so it is crucial to submit the form on time.

In conclusion, the IRS 2290 form for 2025 is an essential document for truck owners to report and pay the Heavy Vehicle Use Tax. By utilizing the printable version of the form provided by the IRS, taxpayers can easily fulfill their obligations and avoid any potential issues with non-compliance. Remember to file the form accurately and on time to stay in good standing with the IRS.