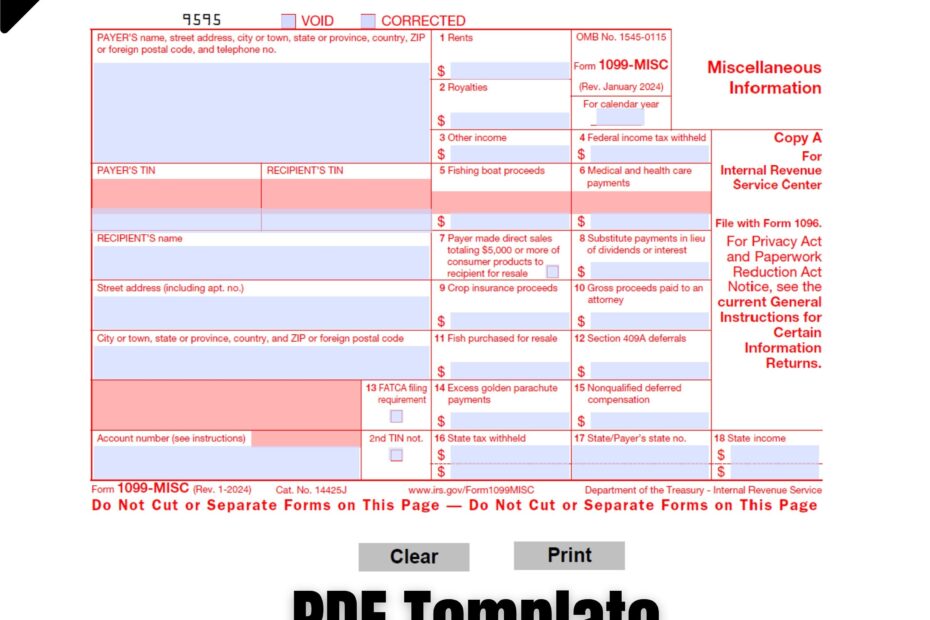

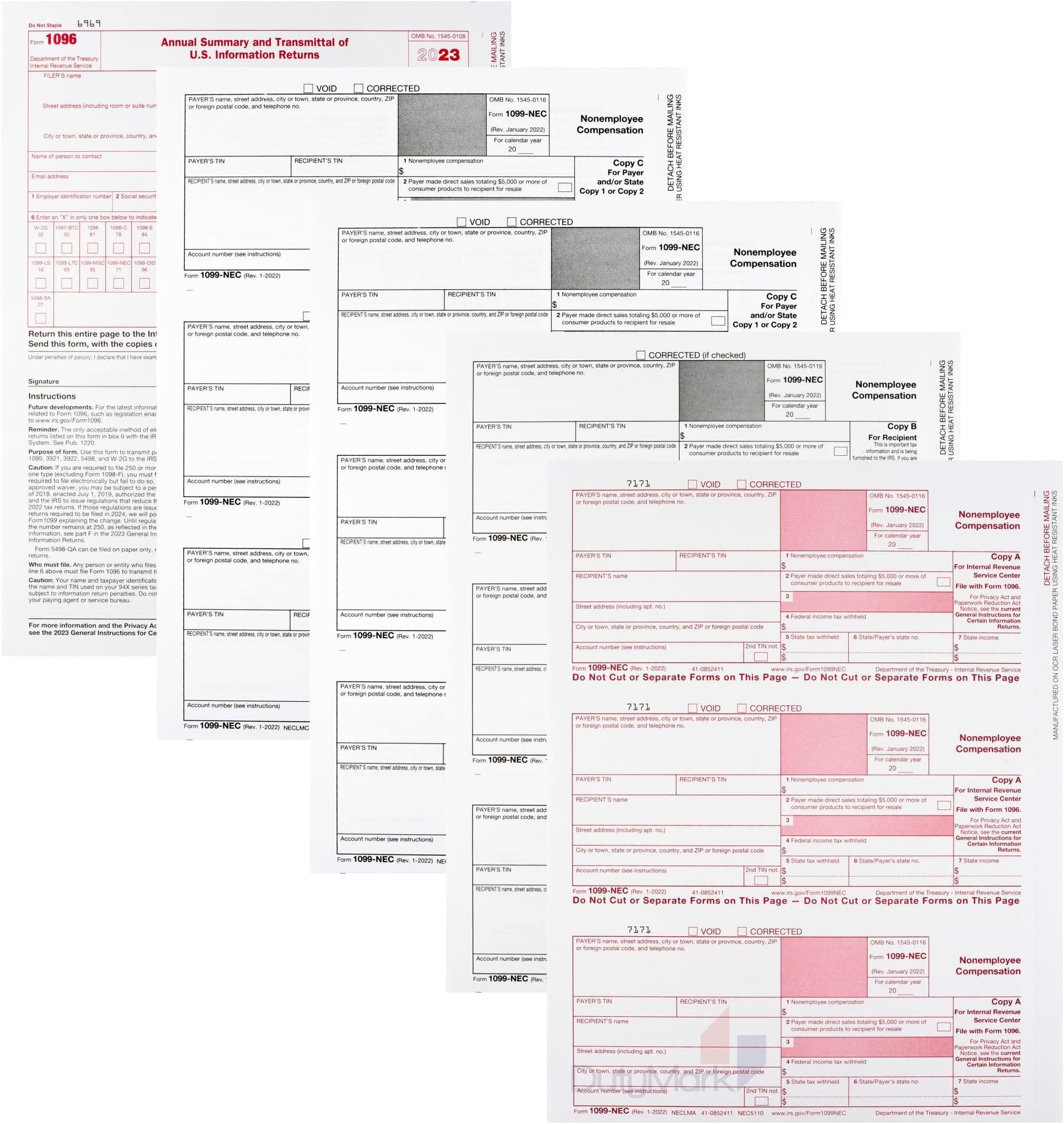

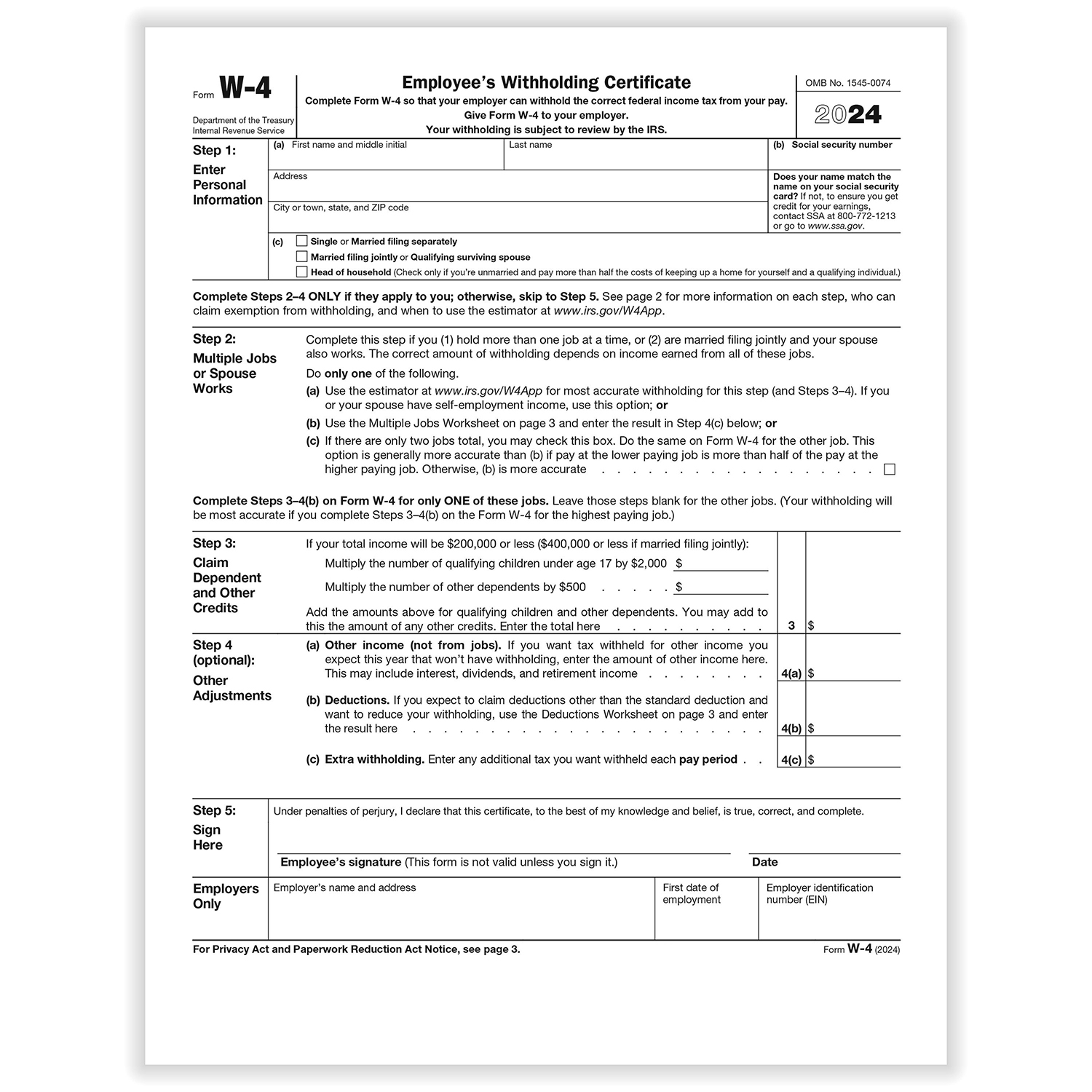

As tax season approaches, it’s important for individuals and businesses to be prepared with the necessary forms to file their taxes accurately and on time. The IRS 2024 tax forms are essential documents that help taxpayers report their income, deductions, and credits to determine their tax liability or refund. These forms are available for download and printing on the IRS website, making it convenient for taxpayers to access them at any time.

With the IRS 2024 tax forms printable, taxpayers can easily fill out the required information, such as their personal details, income sources, and deductions. These forms provide a structured format for taxpayers to report their financial information in an organized manner, ensuring that they comply with tax laws and regulations. By using the printable forms, taxpayers can avoid errors and potential audit risks that may result from incomplete or inaccurate information.

Save and Print Irs 2024 Tax Forms Printable

2024 IRS W 4 Form HRdirect Worksheets Library

2024 IRS W 4 Form HRdirect Worksheets Library

One of the most commonly used IRS 2024 tax forms is the 1040 form, which is used by individuals to report their annual income and claim deductions and credits. Additionally, businesses may need to use forms such as the 1120 for corporations or the 1065 for partnerships to report their business income and expenses. These forms are essential for taxpayers to fulfill their tax obligations and avoid penalties for non-compliance.

It’s important for taxpayers to review the instructions provided with the IRS 2024 tax forms printable to ensure that they accurately report their financial information. These instructions provide guidance on how to fill out the forms correctly, which can help taxpayers avoid common mistakes that may delay their tax refunds or trigger IRS audits. By following the instructions carefully, taxpayers can ensure that their tax returns are completed accurately and submitted on time.

In conclusion, the IRS 2024 tax forms printable are essential tools for taxpayers to report their income, deductions, and credits accurately to fulfill their tax obligations. By using these forms, taxpayers can avoid errors and penalties that may result from incomplete or inaccurate information. It’s important for individuals and businesses to download and print the necessary forms from the IRS website to ensure that they are prepared for the upcoming tax season.