As tax season approaches, it’s important for individuals and businesses to familiarize themselves with the various tax forms they may need to file. One such form is the IRS 1099 form, which is used to report income other than wages, salaries, and tips. This form is crucial for individuals who receive income from sources such as freelance work, rental properties, or investments.

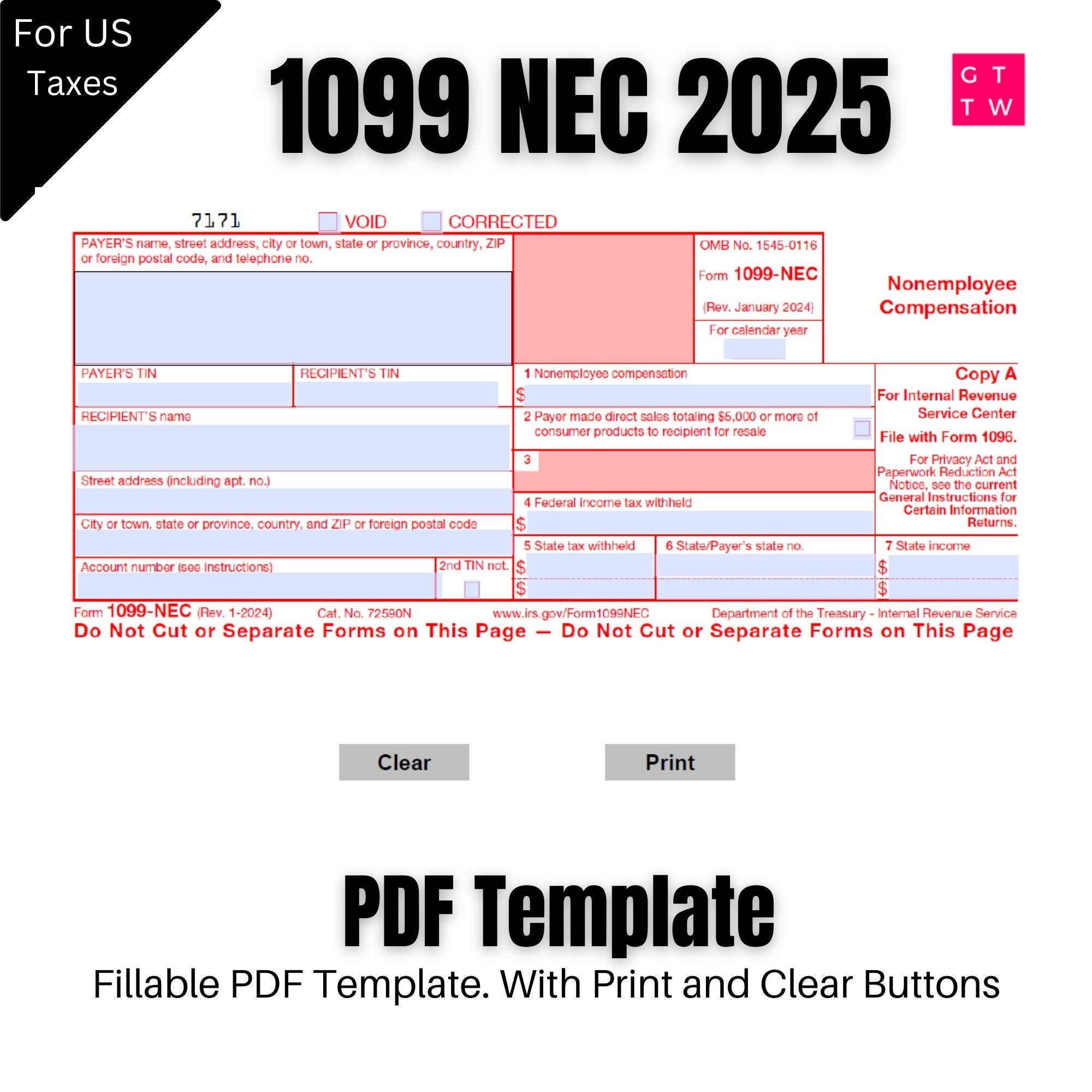

For the year 2025, the IRS has made available a printable PDF version of the 1099 form, making it easier for taxpayers to access and fill out the necessary information. This digital format allows for greater convenience and efficiency, as individuals can simply download the form from the IRS website and complete it electronically.

Irs 1099 Form 2025 Printable Pdf

Irs 1099 Form 2025 Printable Pdf

Save and Print Irs 1099 Form 2025 Printable Pdf

1099 NEC Editable PDF Fillable Template 2025 With Print And

1099 NEC Editable PDF Fillable Template 2025 With Print And

IRS 1099 Form 2025 Printable PDF

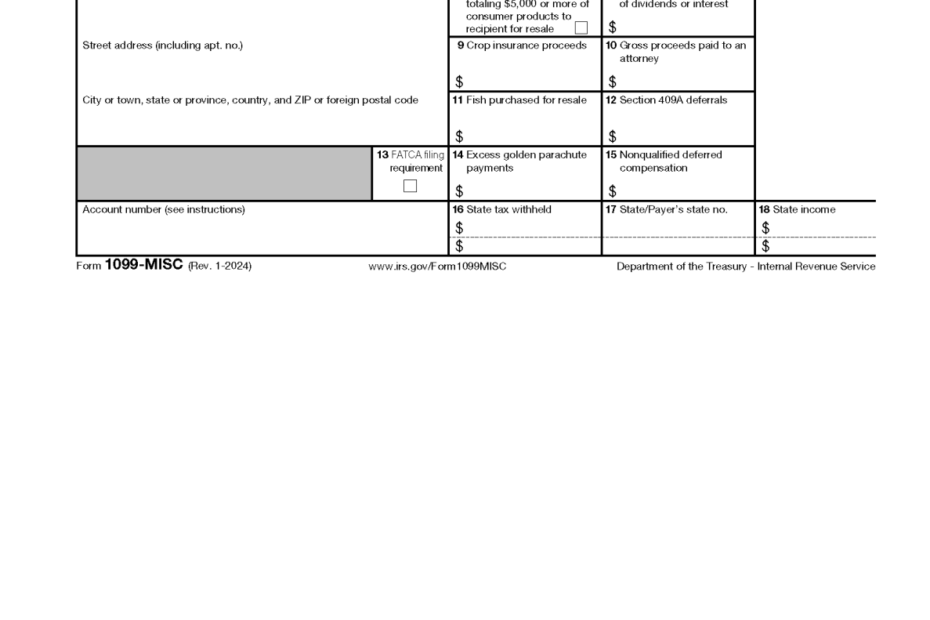

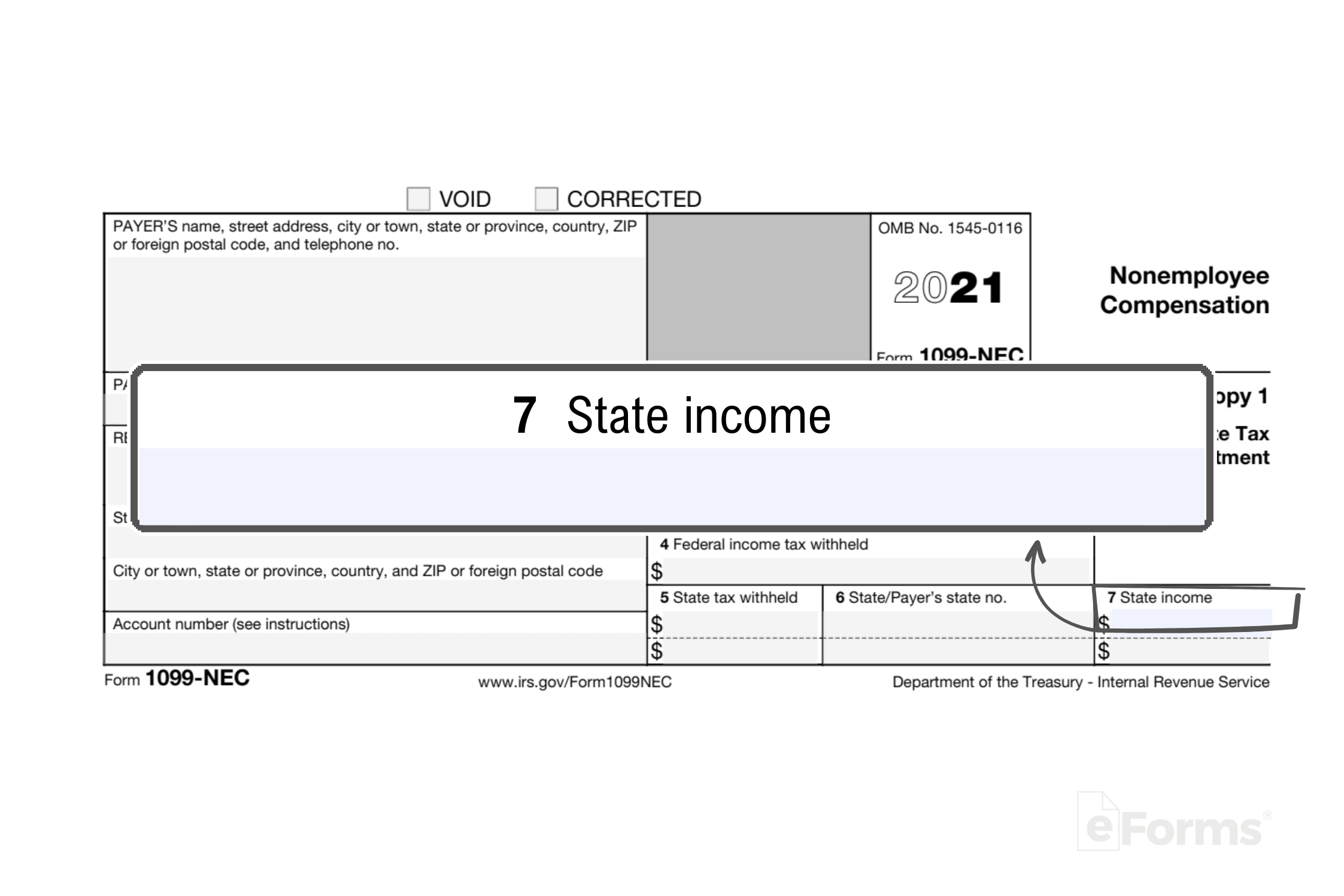

The IRS 1099 form is divided into several categories, such as 1099-INT for interest income, 1099-DIV for dividends, and 1099-MISC for miscellaneous income. Each category requires specific information to be reported, such as the amount of income received and the recipient’s identifying information. By utilizing the printable PDF version of the form, taxpayers can easily navigate through these sections and ensure that all necessary details are accurately recorded.

Additionally, the IRS 1099 form serves as a crucial document for both taxpayers and the IRS to track income and ensure compliance with tax laws. Failing to report income can result in penalties and audits, making it essential for individuals and businesses to carefully review and submit their 1099 forms in a timely manner.

With the availability of the IRS 1099 form 2025 printable PDF, taxpayers can take advantage of the digital format to streamline the tax filing process. By accurately reporting income and utilizing the resources provided by the IRS, individuals and businesses can avoid potential issues and ensure a smooth tax season.

In conclusion, the IRS 1099 form 2025 printable PDF offers a convenient and efficient way for taxpayers to report income other than wages. By understanding the importance of this form and utilizing the digital format provided by the IRS, individuals and businesses can navigate the tax filing process with ease and confidence.