As tax season approaches, it’s important for individuals and businesses to stay informed about the latest tax forms and regulations. One key form that many people will need to be familiar with is the IRS 1099 form. This form is used to report various types of income, such as freelance earnings, dividends, and interest payments. For the year 2025, the IRS has made it easier than ever to access and fill out the 1099 form online.

With the convenience of online filing, individuals and businesses can quickly and easily complete their 1099 forms without the hassle of dealing with paper forms and snail mail. The IRS website provides a user-friendly platform that allows users to input their information, calculate their taxes, and submit their forms electronically. This streamlined process not only saves time but also reduces the risk of errors that can occur with manual data entry.

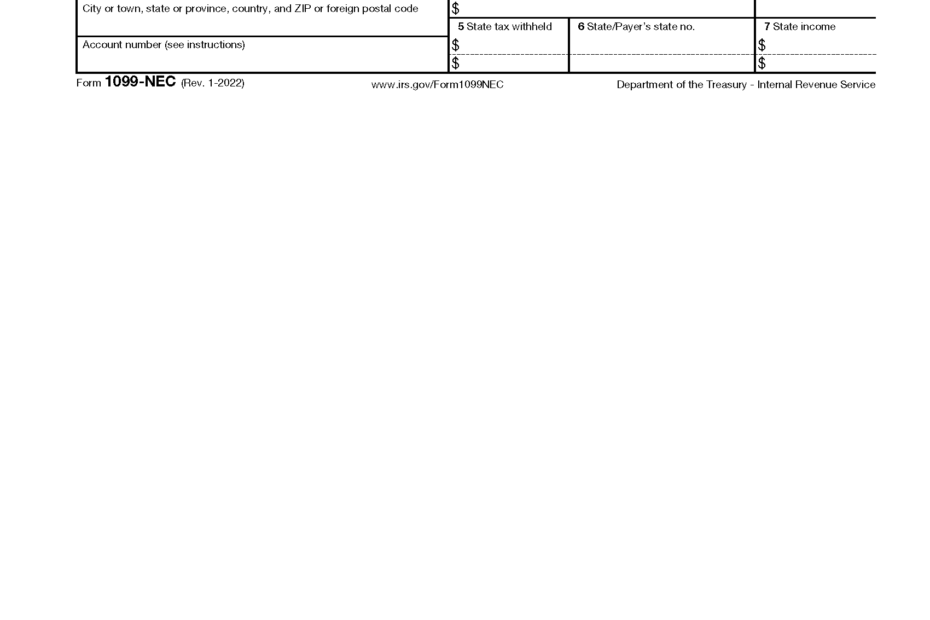

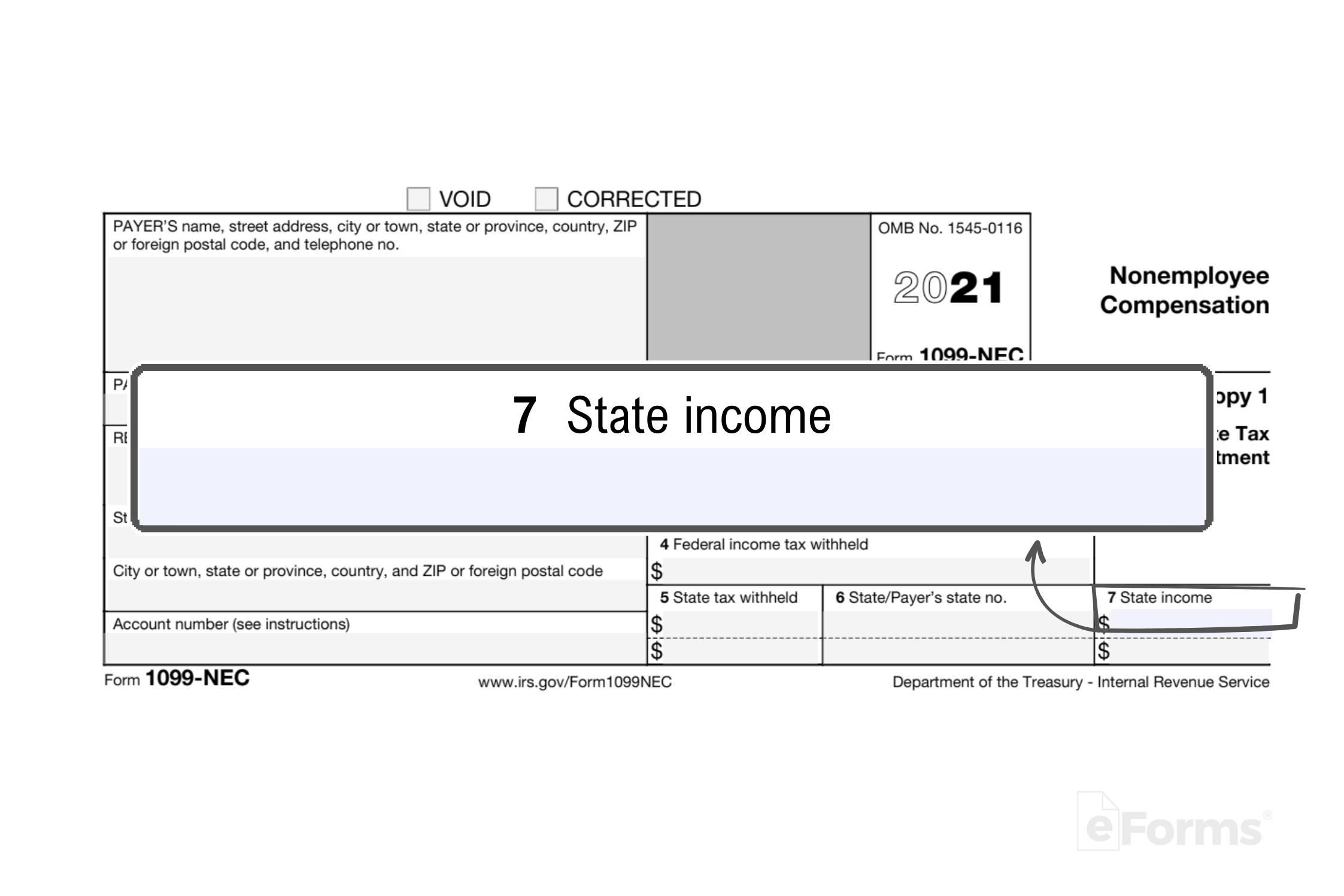

Irs 1099 Form 2025 Online Printable

Irs 1099 Form 2025 Online Printable

Easily Download and Print Irs 1099 Form 2025 Online Printable

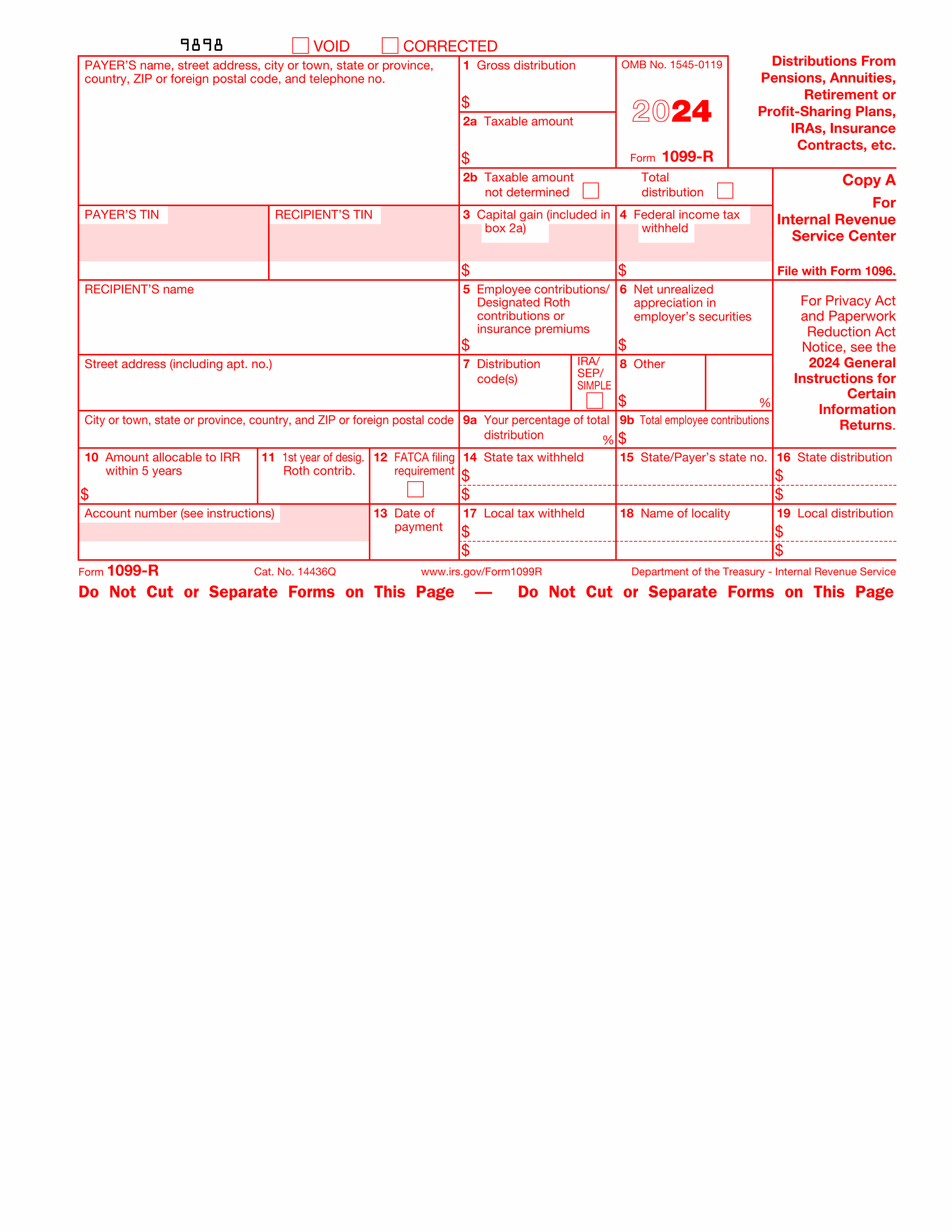

Fill Form 1099 R 2024 2025 Create Edit Forms Online

Fill Form 1099 R 2024 2025 Create Edit Forms Online

When filling out the IRS 1099 form for 2025, it’s important to have all necessary information on hand, such as your Social Security number, employer identification number, and details of the income you received. Double-checking your entries for accuracy is crucial to ensure that your tax return is processed smoothly and without delays. Additionally, be sure to keep copies of your completed form for your records.

Online printable versions of the IRS 1099 form for 2025 can be easily found on the IRS website. These forms can be downloaded, filled out electronically, and then submitted online. This efficient process not only benefits taxpayers but also helps the IRS process returns more quickly and accurately. It’s a win-win for everyone involved.

In conclusion, the IRS 1099 form for 2025 is now more convenient and accessible than ever thanks to online printable options. By taking advantage of this digital tool, taxpayers can save time and effort when filing their taxes. Remember to gather all necessary information, double-check your entries, and keep copies of your completed form. With these tips in mind, you’ll be well on your way to a successful tax season.