As taxpayers reach the age of 65 or older, they may be eligible to use the IRS 1040 SR form, which is specifically designed for seniors. This form offers larger text and a more straightforward layout, making it easier for older individuals to navigate through the tax filing process. It provides a simplified way to report income, deductions, and credits, ensuring that seniors can accurately file their taxes without unnecessary confusion.

Using the IRS 1040 SR Printable Form can save seniors time and frustration during tax season. This form eliminates the need for complicated calculations and offers clear instructions for filling out each section. It also includes helpful tips for common tax situations that seniors may encounter, making it a valuable resource for older individuals who want to ensure that their taxes are filed correctly.

Get and Print Irs 1040 Sr Printable Form

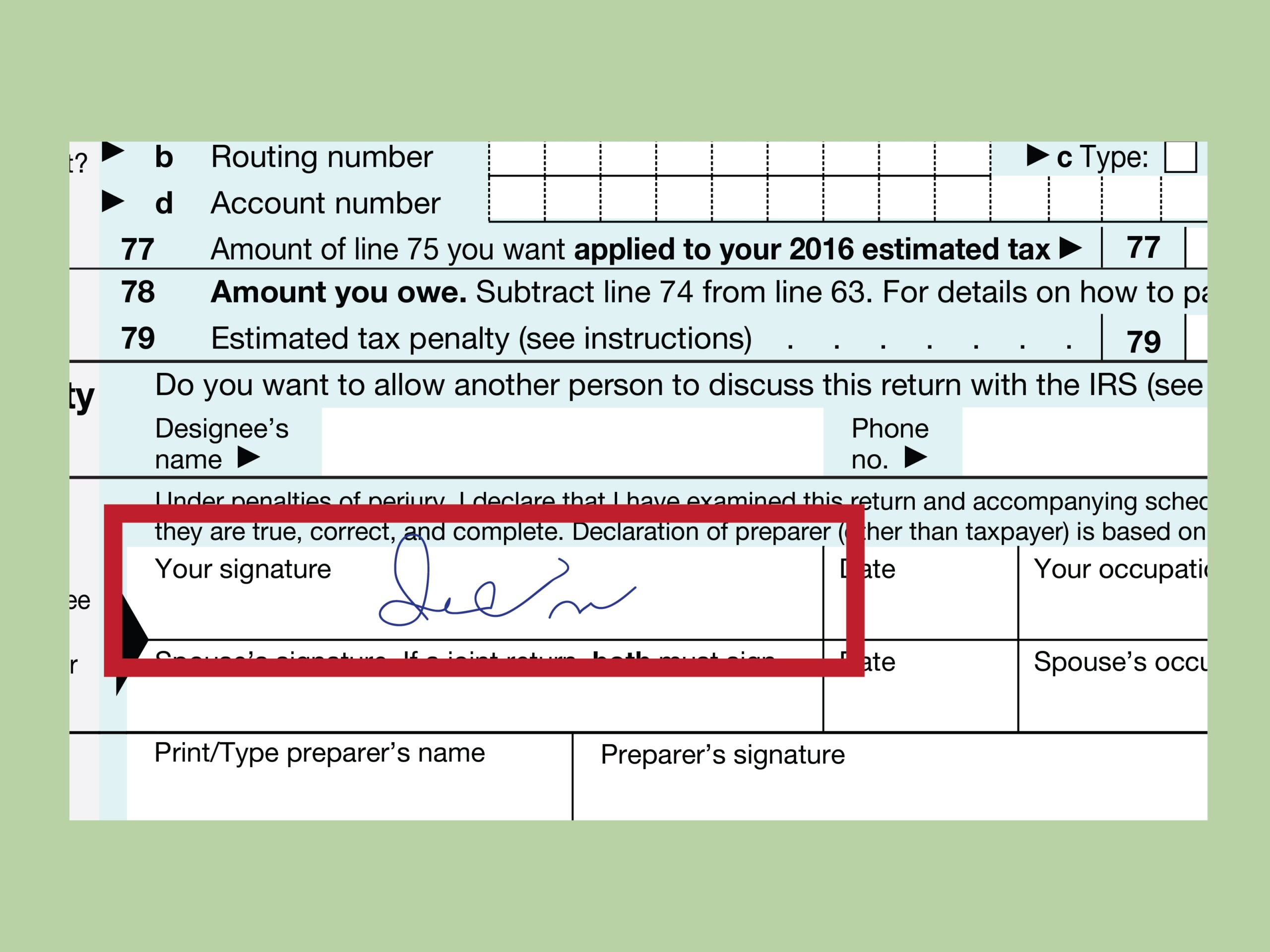

How To Fill Out IRS Form 1040 With Pictures WikiHow

How To Fill Out IRS Form 1040 With Pictures WikiHow

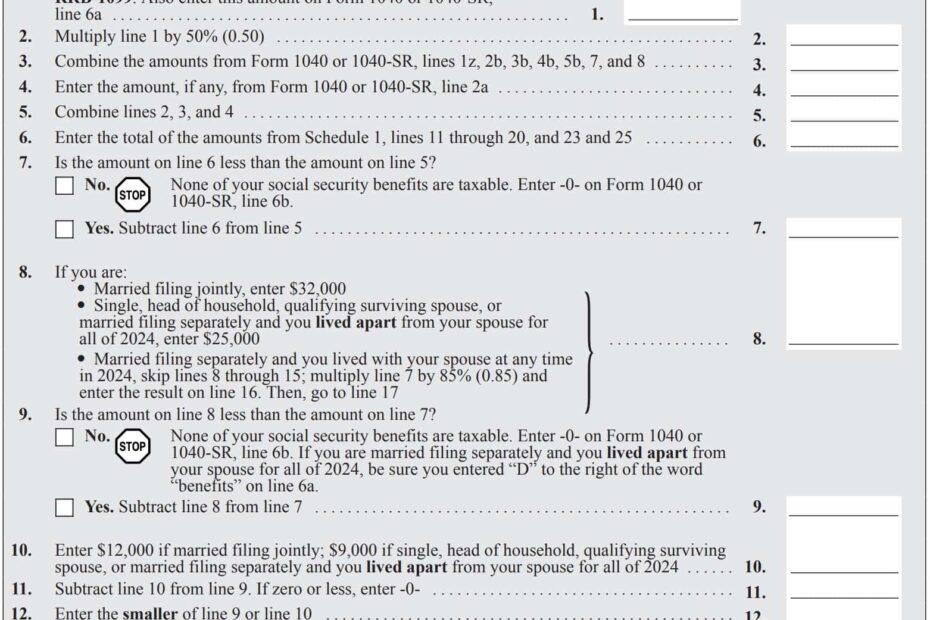

When using the IRS 1040 SR Printable Form, seniors can easily report their income from various sources, including retirement accounts, Social Security benefits, and investments. They can also claim deductions for medical expenses, charitable contributions, and other eligible expenses. The form provides a comprehensive overview of the tax credits available to seniors, such as the Credit for the Elderly or the Disabled, helping them maximize their tax savings.

One of the key benefits of the IRS 1040 SR form is its simplicity and ease of use. Seniors can easily download and print the form from the IRS website, fill it out at their own pace, and submit it by mail or electronically. The form also includes clear guidelines for attaching any necessary schedules or additional documents, ensuring that seniors can file their taxes accurately and efficiently.

Overall, the IRS 1040 SR Printable Form offers seniors a user-friendly option for filing their taxes and accessing important tax credits. By using this form, older individuals can simplify the tax filing process and ensure that they are taking advantage of all available deductions and credits. Whether filing independently or with the help of a tax professional, seniors can benefit from the ease and convenience of the IRS 1040 SR form.