The IRS 1040 Form is a crucial document for taxpayers in the United States. It is used to report annual income, claim deductions and credits, and calculate tax liability. The IRS regularly updates the form to reflect changes in tax laws and regulations.

For the year 2025, taxpayers can access the IRS 1040 Form in a printable PDF format. This allows individuals to easily fill out the form electronically or manually, depending on their preference. The PDF version of the form also ensures that all calculations are accurate and legible.

Irs 1040 Form 2025 Printable Pdf

Irs 1040 Form 2025 Printable Pdf

Easily Download and Print Irs 1040 Form 2025 Printable Pdf

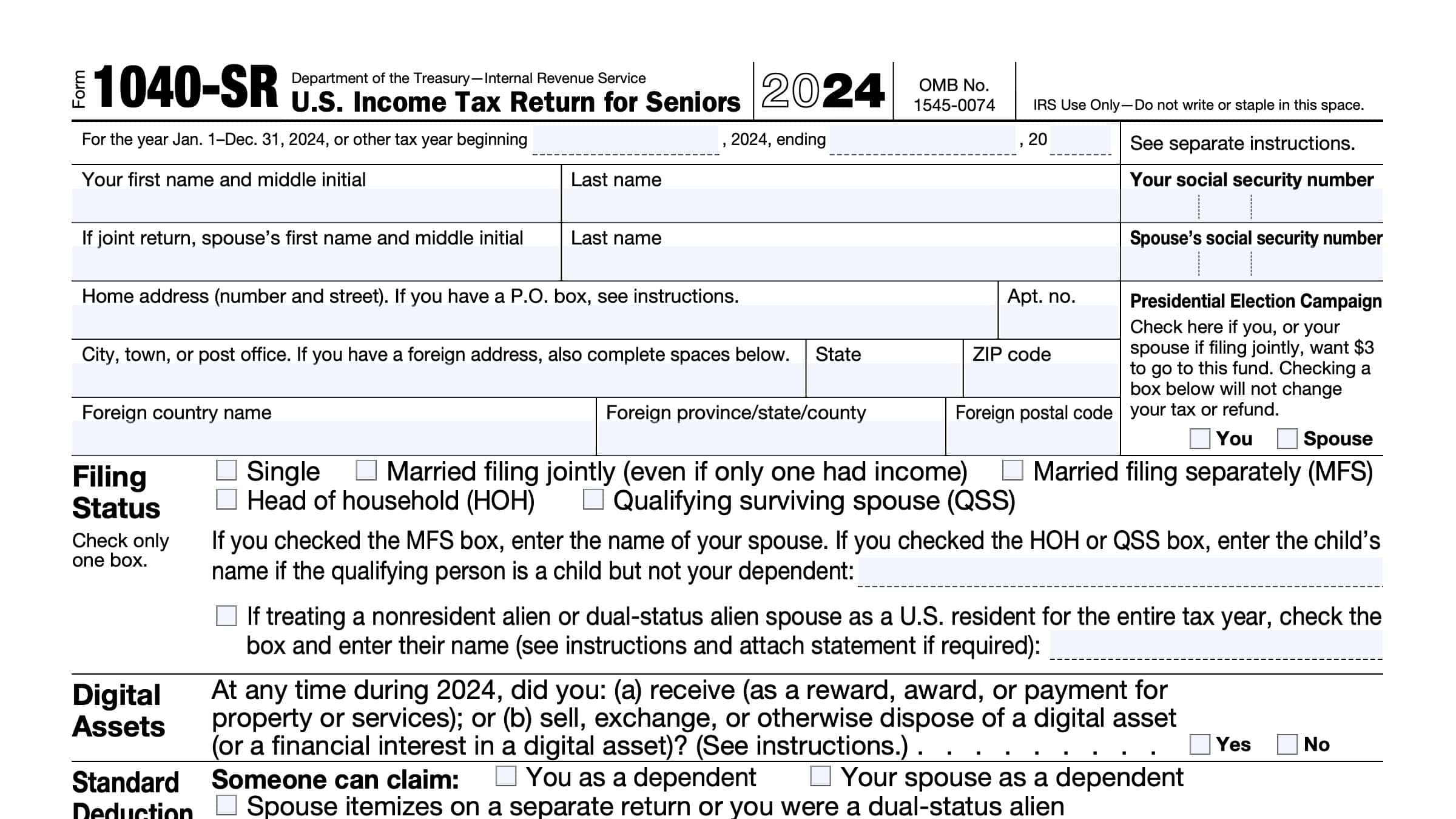

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

When using the IRS 1040 Form 2025 Printable PDF, taxpayers should ensure they have all necessary information handy, such as W-2 forms, 1099s, and receipts for deductions. It is important to carefully review the instructions provided by the IRS to avoid any errors or discrepancies on the form.

One of the key advantages of the IRS 1040 Form 2025 Printable PDF is its accessibility. Taxpayers can download the form from the IRS website or various online tax preparation platforms. This makes it convenient for individuals to file their taxes accurately and timely.

In addition to the IRS 1040 Form, taxpayers may also need to fill out additional schedules and forms depending on their financial situation. These supplementary documents can be easily found on the IRS website and should be submitted along with the 1040 Form.

Overall, the IRS 1040 Form 2025 Printable PDF simplifies the tax filing process for individuals and ensures compliance with federal tax laws. By utilizing this electronic format, taxpayers can accurately report their income, claim deductions, and calculate their tax liability without any hassle.

In conclusion, the IRS 1040 Form 2025 Printable PDF is a valuable resource for taxpayers to file their taxes efficiently and accurately. By following the instructions provided and gathering all necessary documents, individuals can confidently submit their tax returns and fulfill their obligations to the IRS.