As tax season approaches, it’s important for individuals to be familiar with the necessary forms needed to file their taxes. One of the most common forms is the IRS 1040 Form, which is used by individuals to report their annual income and calculate their tax liability. For the year 2025, the IRS has updated the 1040 Form to ensure that taxpayers are able to accurately report their financial information.

The IRS 1040 Form 2025 Printable is easily accessible online and can be downloaded for free from the IRS website. This form is essential for individuals who need to report their income, deductions, and credits for the tax year 2025. By using this form, taxpayers can ensure that they are in compliance with federal tax laws and avoid any penalties for inaccuracies in their tax returns.

Download and Print Irs 1040 Form 2025 Printable

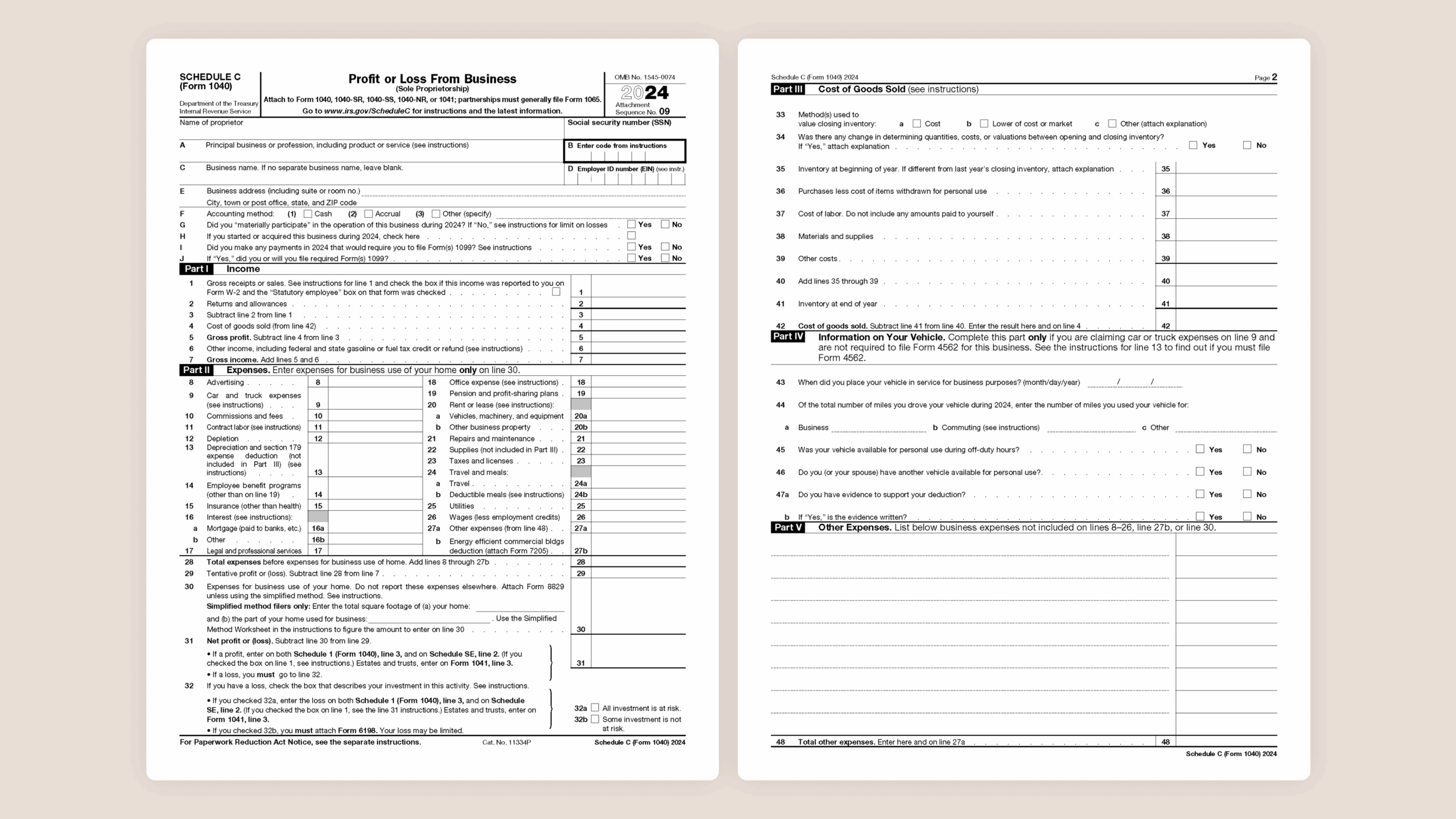

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

When filling out the IRS 1040 Form 2025 Printable, taxpayers will need to provide their personal information, including their name, address, and Social Security number. They will also need to report their income from various sources, such as wages, interest, dividends, and retirement accounts. Additionally, taxpayers will need to claim any deductions and credits that they are eligible for to reduce their tax liability.

It’s important for individuals to carefully review the instructions provided with the IRS 1040 Form 2025 Printable to ensure that they are accurately reporting their financial information. Any errors or omissions on the form could result in delays in processing their tax return or potential audits by the IRS. By taking the time to fill out the form correctly, taxpayers can avoid any unnecessary complications with their taxes.

In conclusion, the IRS 1040 Form 2025 Printable is a crucial document for individuals to use when filing their taxes for the year 2025. By accurately reporting their income, deductions, and credits on this form, taxpayers can ensure that they are in compliance with federal tax laws and avoid any penalties for inaccuracies. It’s important for individuals to familiarize themselves with this form and seek assistance from a tax professional if needed to ensure that their tax return is filed correctly.