As we approach tax season, it is crucial for individuals to have access to the necessary forms to accurately file their taxes. One such form is the IRS 1040 Form, which is used by taxpayers to report their annual income to the Internal Revenue Service. Having a printable version of this form can make the process much more convenient and efficient for taxpayers.

With the IRS 1040 Form 2025 Printable, individuals can easily access the form online and print it out from the comfort of their own home. This eliminates the need to visit a tax office or wait for the form to arrive in the mail, saving taxpayers valuable time and effort. Additionally, having a printable version of the form allows individuals to fill it out at their own pace and double-check their information before submitting it.

Quickly Access and Print Irs 1040 Form 2025 Printable

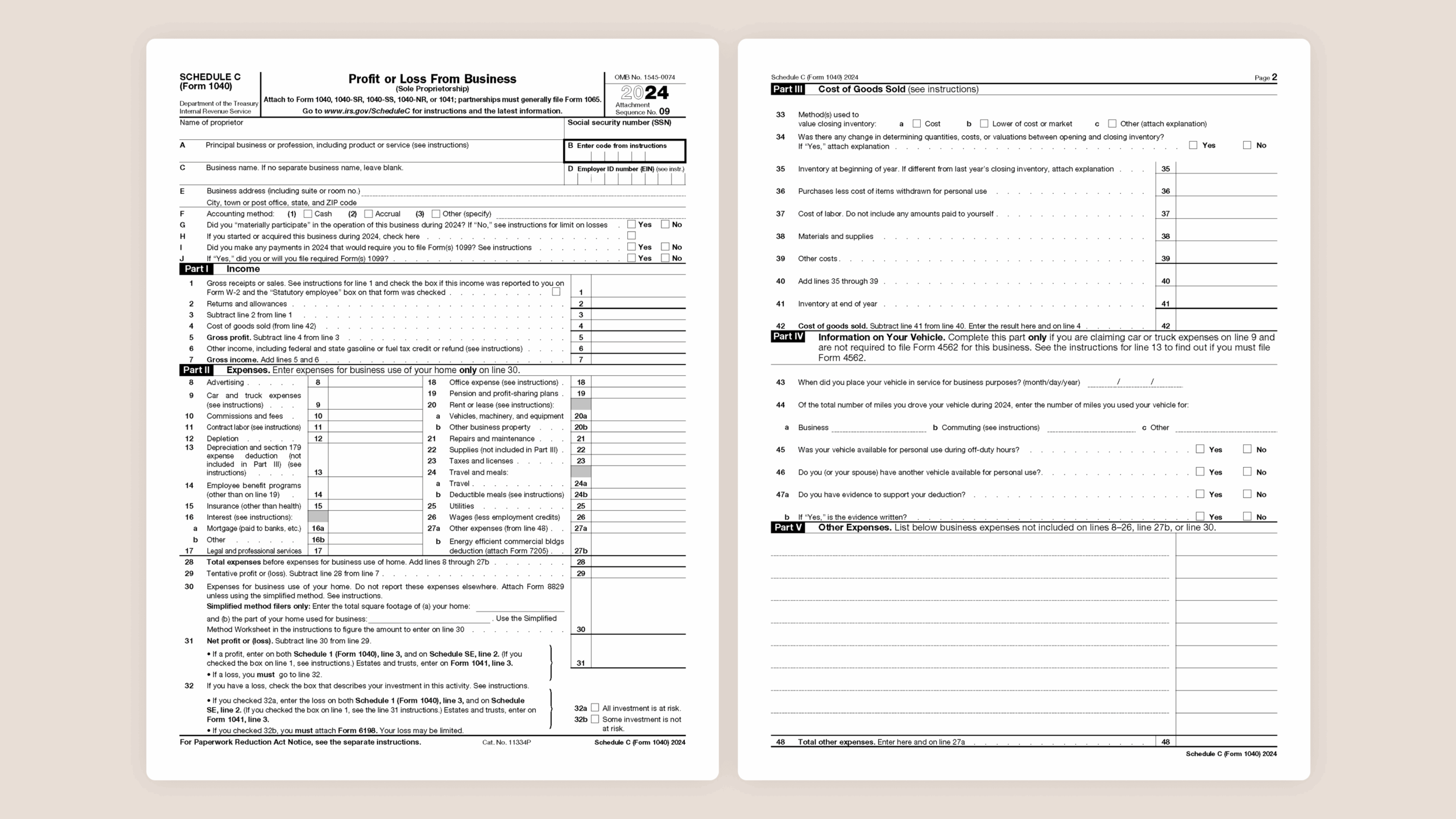

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

IRS 1040 Form 2025 Printable

The IRS 1040 Form 2025 Printable is designed to be user-friendly and easy to understand. It includes all the necessary fields for taxpayers to report their income, deductions, and credits accurately. The form also provides instructions on how to fill it out correctly, making it accessible to individuals of all tax knowledge levels.

By utilizing the IRS 1040 Form 2025 Printable, taxpayers can ensure that they are filing their taxes correctly and in compliance with IRS regulations. This can help prevent costly mistakes and potential audits in the future. Additionally, having a printable version of the form makes it easier for individuals to keep a record of their tax information for future reference.

In conclusion, the IRS 1040 Form 2025 Printable is a valuable tool for individuals to accurately file their taxes. By having access to this form online and being able to print it out at their convenience, taxpayers can streamline the tax-filing process and avoid potential errors. It is essential for individuals to take advantage of this resource to ensure they are meeting their tax obligations and avoiding any unnecessary penalties.