As tax season approaches, many individuals and businesses are scrambling to gather all the necessary documents to file their taxes. One essential component of this process is obtaining the correct IRS tax forms. While these forms can be easily accessed online, some prefer to have physical copies on hand for reference or documentation purposes.

Printable IRS tax forms are a convenient option for those who prefer to have hard copies of their tax documents. These forms can be easily downloaded and printed from the IRS website or other reputable sources. Having physical copies of these forms can also be helpful for individuals who may not have reliable internet access or prefer to have tangible documents.

Easily Download and Print Printable Irs Tax Forms

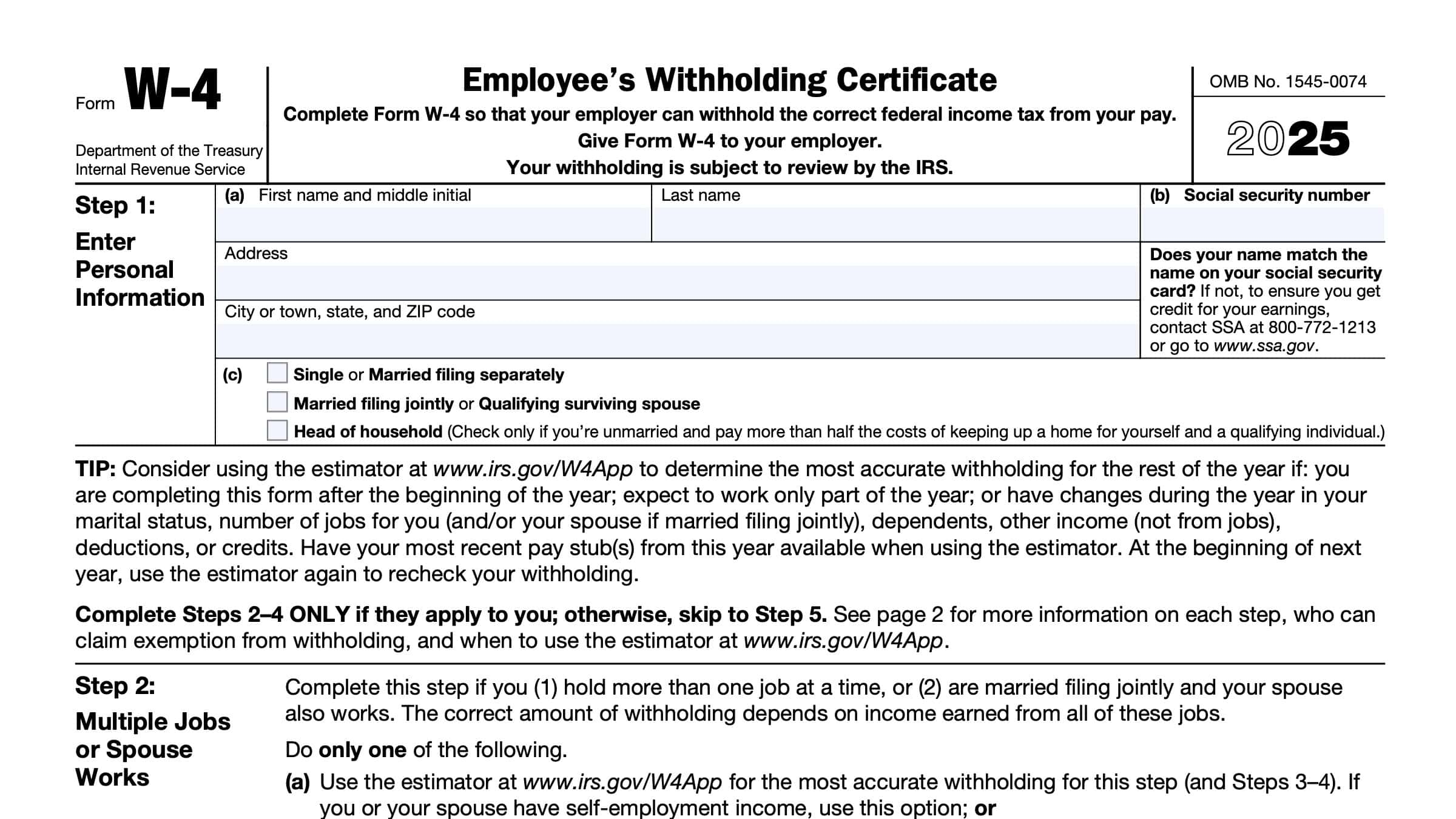

IRS Form W 4 Instructions Employee S Withholding Certificate

IRS Form W 4 Instructions Employee S Withholding Certificate

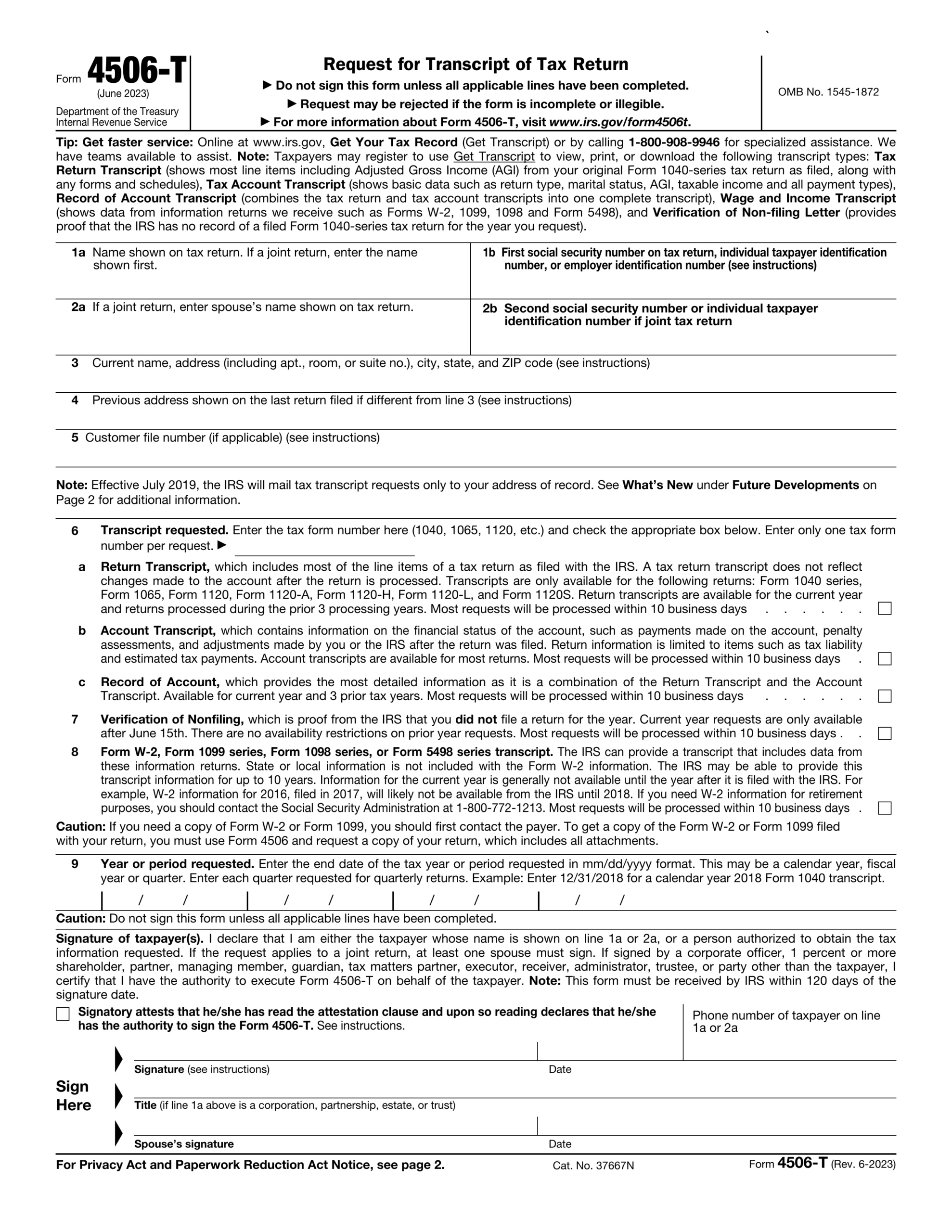

There are several types of IRS tax forms available for download and printing, including Form 1040 for individual income tax returns, Form 941 for employer’s quarterly federal tax returns, and Form W-9 for requesting taxpayer identification numbers and certifications. These forms are essential for properly reporting income, deductions, and credits to the IRS.

Having printable IRS tax forms on hand can also be beneficial for those who prefer to fill out their tax returns manually. While many individuals opt to file their taxes electronically, some still prefer the traditional pen-and-paper method. Printable forms allow for easy completion and submission of tax returns without the need for specialized software or online tools.

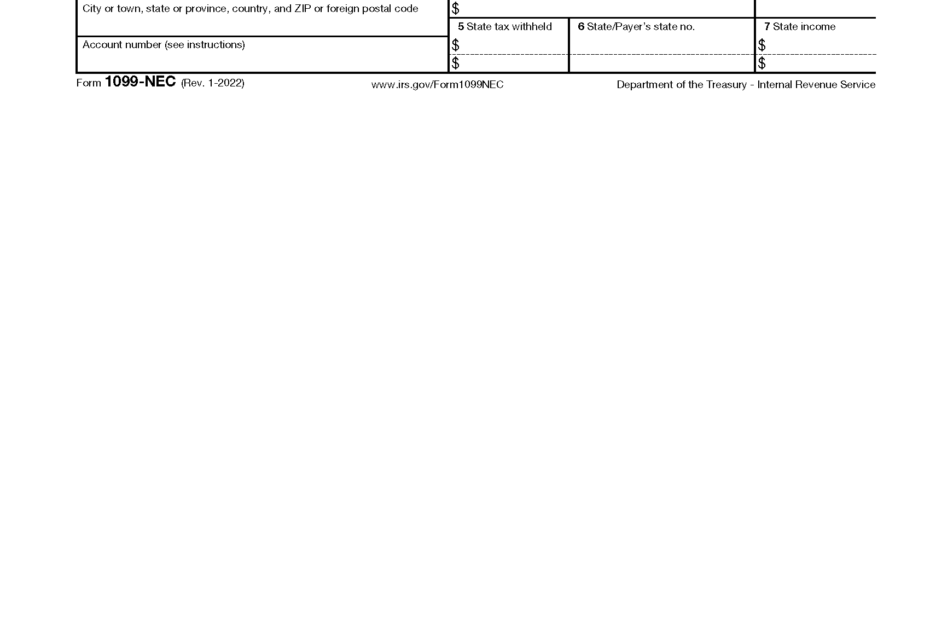

In addition to individual tax forms, businesses may also require printable IRS forms for reporting income, expenses, and other financial information. Forms such as the Schedule C for reporting business income and expenses or Form 1099 for reporting payments to independent contractors are essential for accurate tax reporting and compliance.

Overall, printable IRS tax forms offer a convenient and accessible option for individuals and businesses to obtain the necessary documents for filing their taxes. Whether for reference, documentation, or manual completion, having physical copies of these forms can streamline the tax filing process and ensure compliance with IRS regulations.