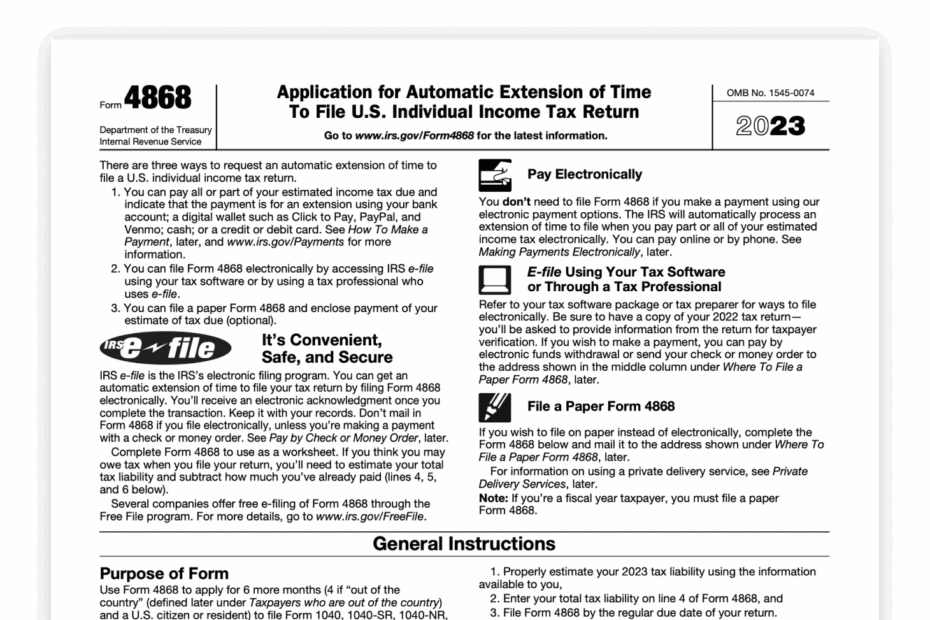

As tax season approaches, many individuals and businesses find themselves scrambling to get their finances in order and file their taxes on time. If you’re in need of an extension to file your taxes, IRS Tax Form 4868 is here to help. This form allows you to request an automatic extension of time to file your individual income tax return. It provides an additional six months to submit your tax return, giving you more time to gather all necessary documents and information.

Submitting IRS Tax Form 4868 is a simple process that can be done online or by mail. This form is especially useful for those who may not be able to meet the original tax filing deadline of April 15th. By filling out Form 4868, you can avoid late filing penalties and have until October 15th to submit your tax return without facing any additional fees.

Save and Print Printable Irs Tax Form 4868

How To File IRS Tax Extension Form 4868

How To File IRS Tax Extension Form 4868

Printable IRS Tax Form 4868

For those looking to request an extension using IRS Tax Form 4868, it is important to have the necessary documents on hand. The form requires basic information such as your name, address, social security number, and estimated tax liability. You will also need to provide an estimate of your total tax liability for the year and any payments you have already made towards that amount.

Once you have filled out Form 4868, you can choose to submit it electronically or by mail. If filing electronically, you can use tax preparation software or online services approved by the IRS. If mailing the form, be sure to send it to the correct address listed on the IRS website. It is recommended to keep a copy of the completed form for your records.

After submitting IRS Tax Form 4868, you will receive a confirmation from the IRS acknowledging your request for an extension. This will provide you with peace of mind knowing that your extension has been approved and you have additional time to file your tax return. Remember, while Form 4868 grants an extension for filing your taxes, it does not extend the deadline for paying any taxes owed. Be sure to pay any estimated taxes by the original deadline to avoid penalties and interest.

In conclusion, IRS Tax Form 4868 is a valuable tool for individuals and businesses who need extra time to file their taxes. By following the instructions and providing accurate information, you can successfully request an extension and avoid late filing penalties. Take advantage of this extension form to ensure that your tax return is submitted accurately and on time.