When it comes to tax season, having access to printable forms can make the process much easier and more convenient. The Internal Revenue Service (IRS) provides a wealth of resources on their website, including printable forms that taxpayers can use to file their taxes accurately and on time.

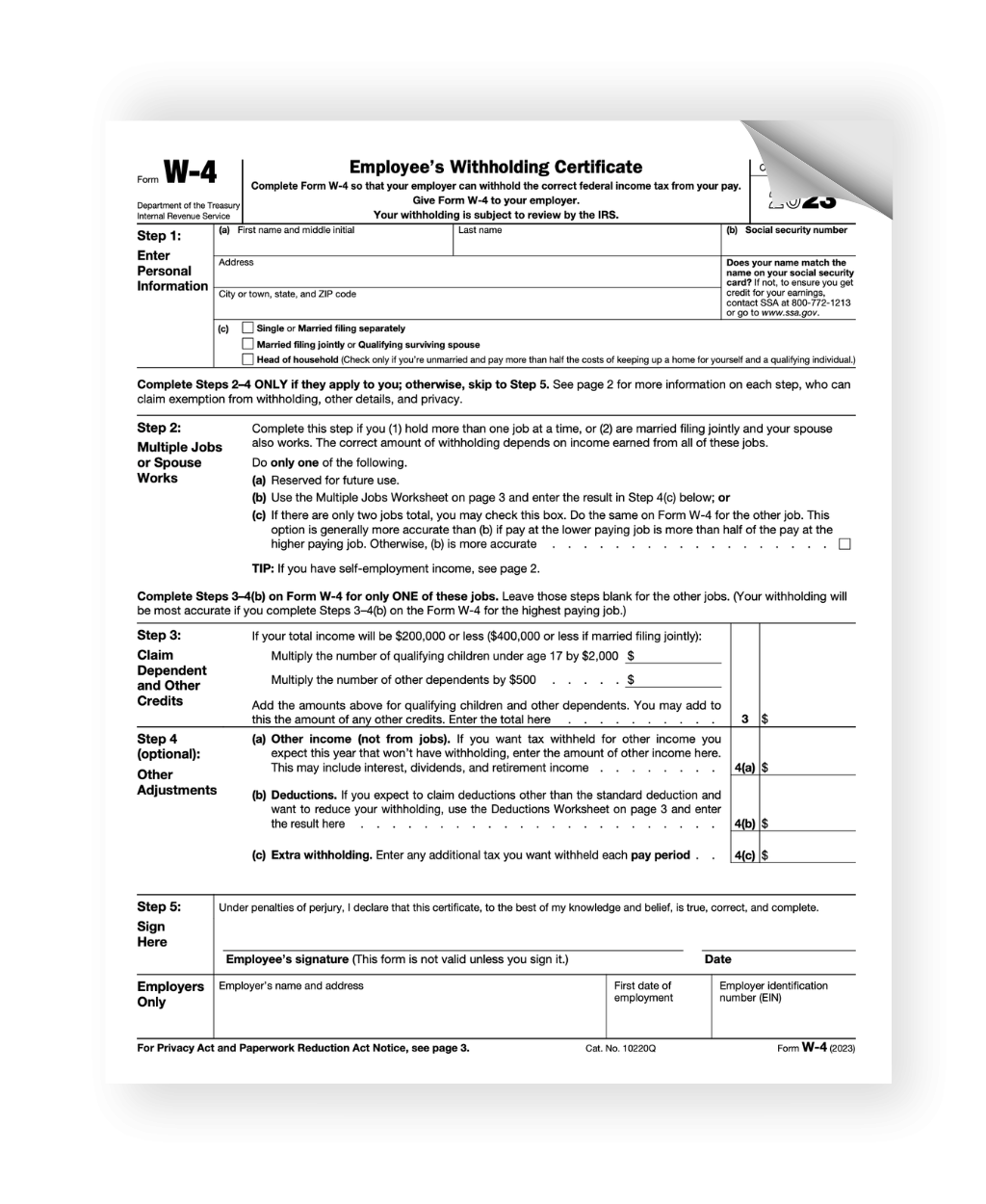

Whether you need to file a 1040 form, a W-2 form, or any other tax-related document, IRS.gov has you covered. These printable forms are easily accessible and can be downloaded and printed from the comfort of your own home. This eliminates the need to visit an IRS office or wait for forms to arrive in the mail, saving you time and hassle.

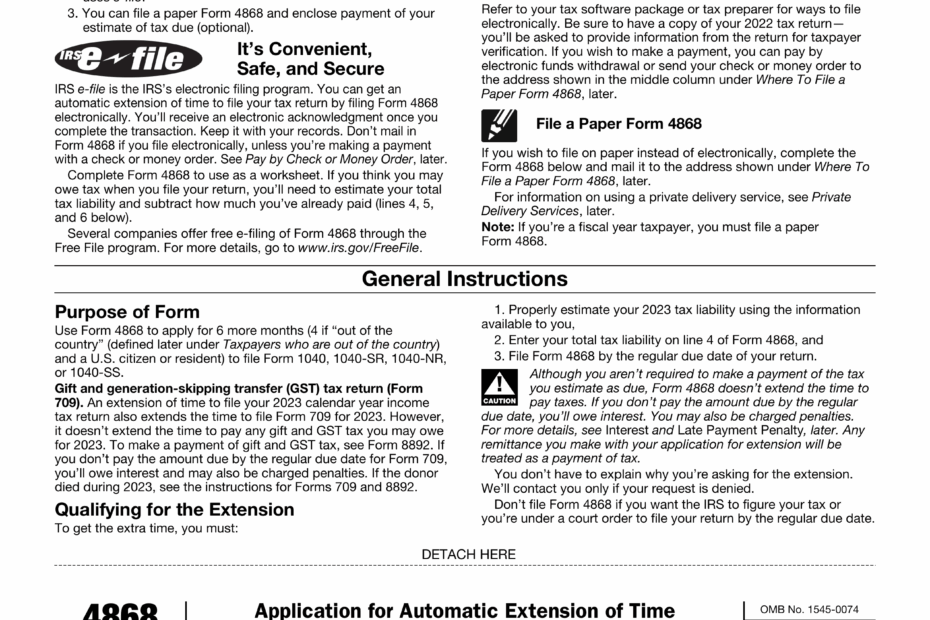

Easily Download and Print Irs.Gov Printable Forms

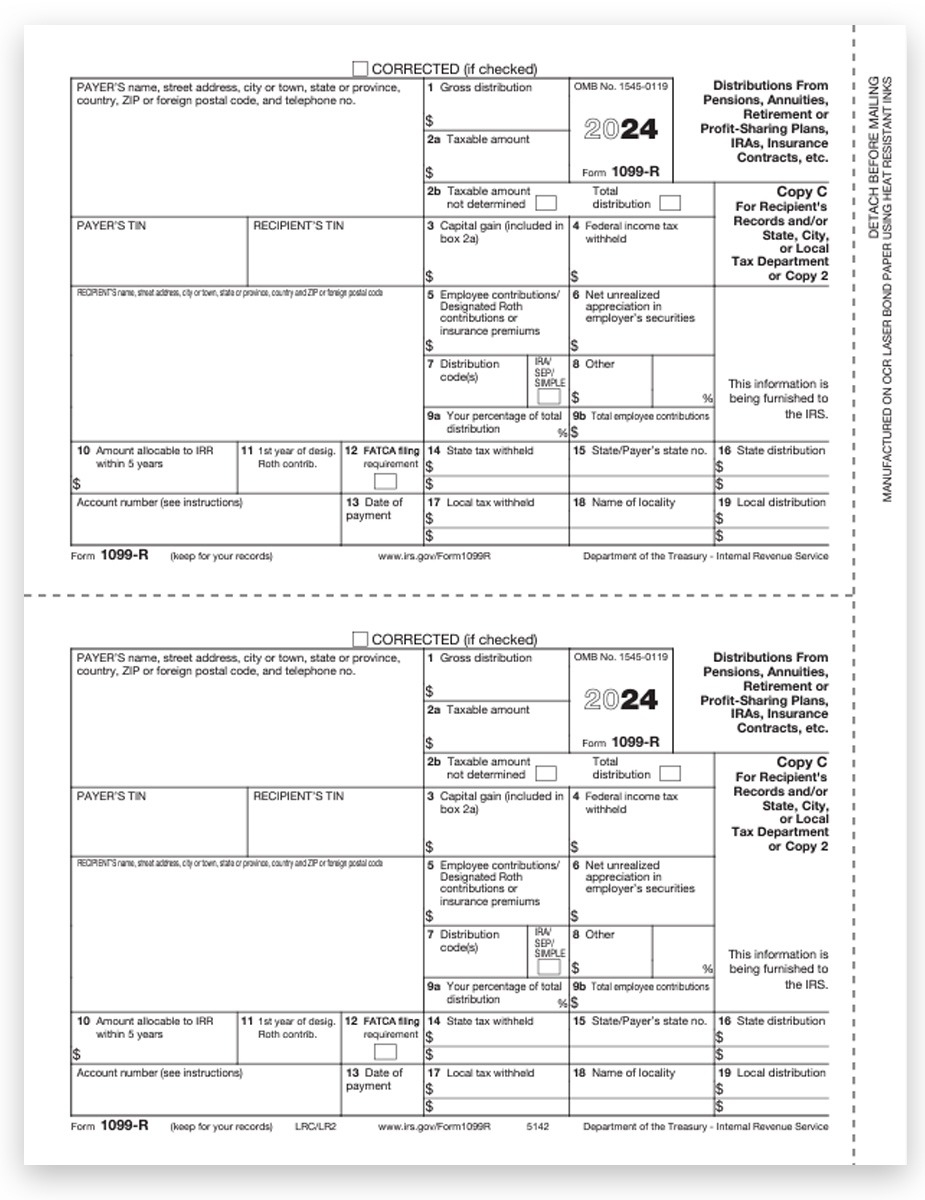

1099R Tax Forms 2024 Copy A For IRS DiscountTaxForms

1099R Tax Forms 2024 Copy A For IRS DiscountTaxForms

On the IRS website, you can find a comprehensive list of printable forms for individuals, businesses, and tax professionals. From income tax forms to employment tax forms, there is a form for every tax-related situation. The forms are available in PDF format, making them easy to view and print on any device.

One of the advantages of using IRS.gov printable forms is that they are updated regularly to reflect any changes in tax laws or regulations. This ensures that you are using the most current and accurate forms when filing your taxes. Additionally, the forms come with instructions and guidelines to help you fill them out correctly.

By utilizing IRS.gov printable forms, you can streamline the tax-filing process and avoid costly mistakes. These forms are designed to make it easier for taxpayers to report their income, claim deductions, and calculate their tax liability. With the convenience of printable forms, filing your taxes can be a smooth and efficient experience.

In conclusion, IRS.gov printable forms offer a convenient and reliable way to file your taxes accurately. By accessing these forms online, you can save time and ensure that your tax return is submitted correctly. Whether you are an individual taxpayer or a business owner, IRS.gov has the resources you need to meet your tax obligations.