When tax season rolls around, it’s important to have all the necessary forms ready to file your taxes accurately and on time. The IRS provides a wide range of printable tax forms that cater to different types of income, deductions, and credits. These forms are essential for individuals, businesses, and organizations to report their financial information to the government.

Whether you are a salaried employee, a freelancer, a business owner, or a nonprofit organization, the IRS has printable tax forms that suit your needs. These forms are available on the IRS website for free, making it convenient for taxpayers to access and fill them out at their own pace.

Get and Print Irs Gov Printable Tax Forms

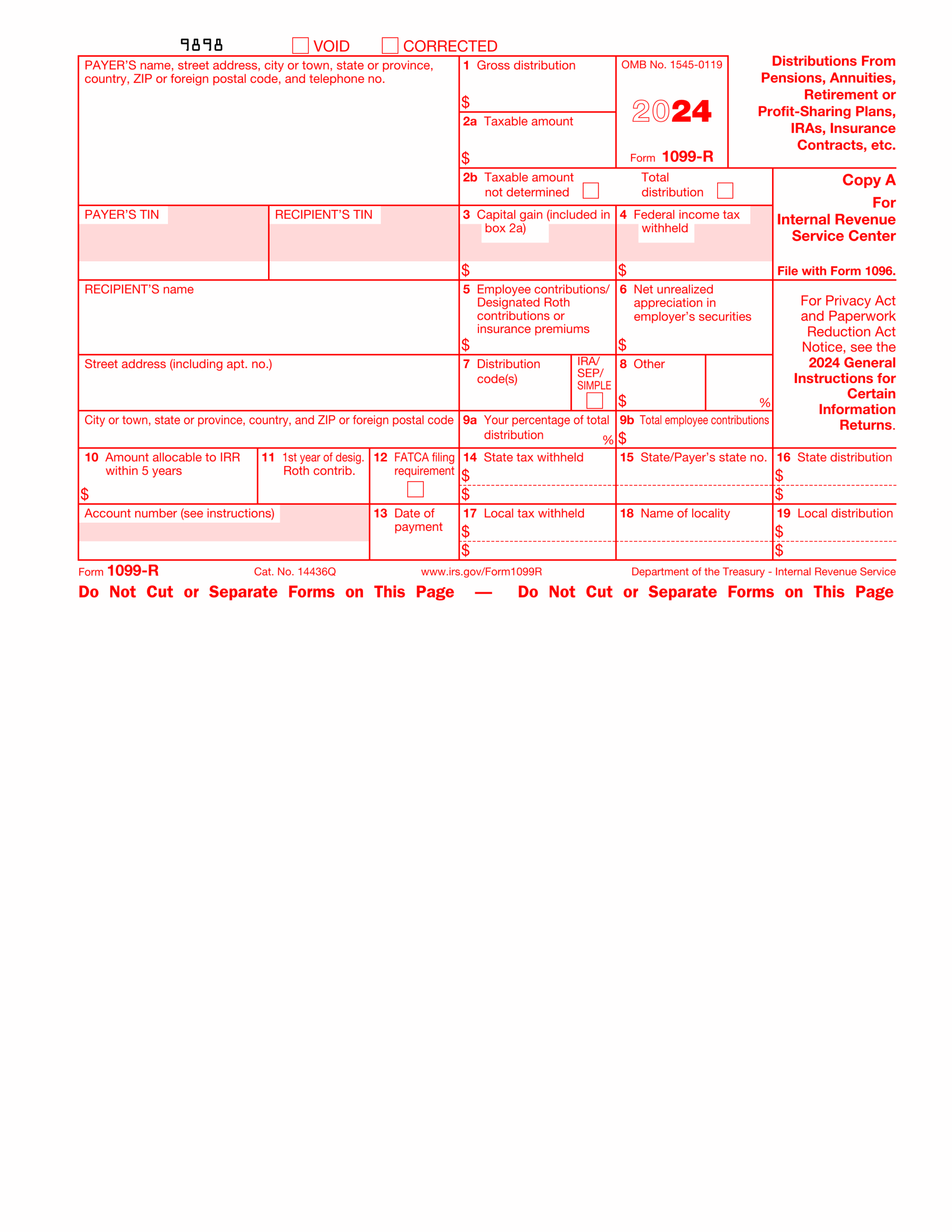

Fill Form 1099 R 2024 2025 Create Edit Forms Online

Fill Form 1099 R 2024 2025 Create Edit Forms Online

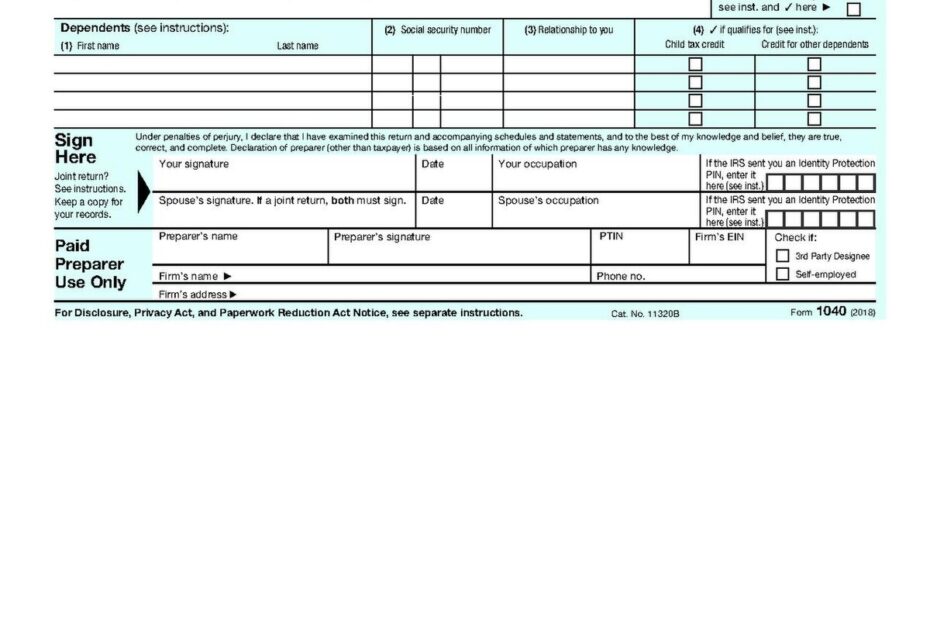

One of the most common IRS printable tax forms is the Form 1040, which is used by individuals to report their annual income and claim deductions and credits. This form is essential for filing both federal and state taxes, and it is important to fill it out accurately to avoid any penalties or audits.

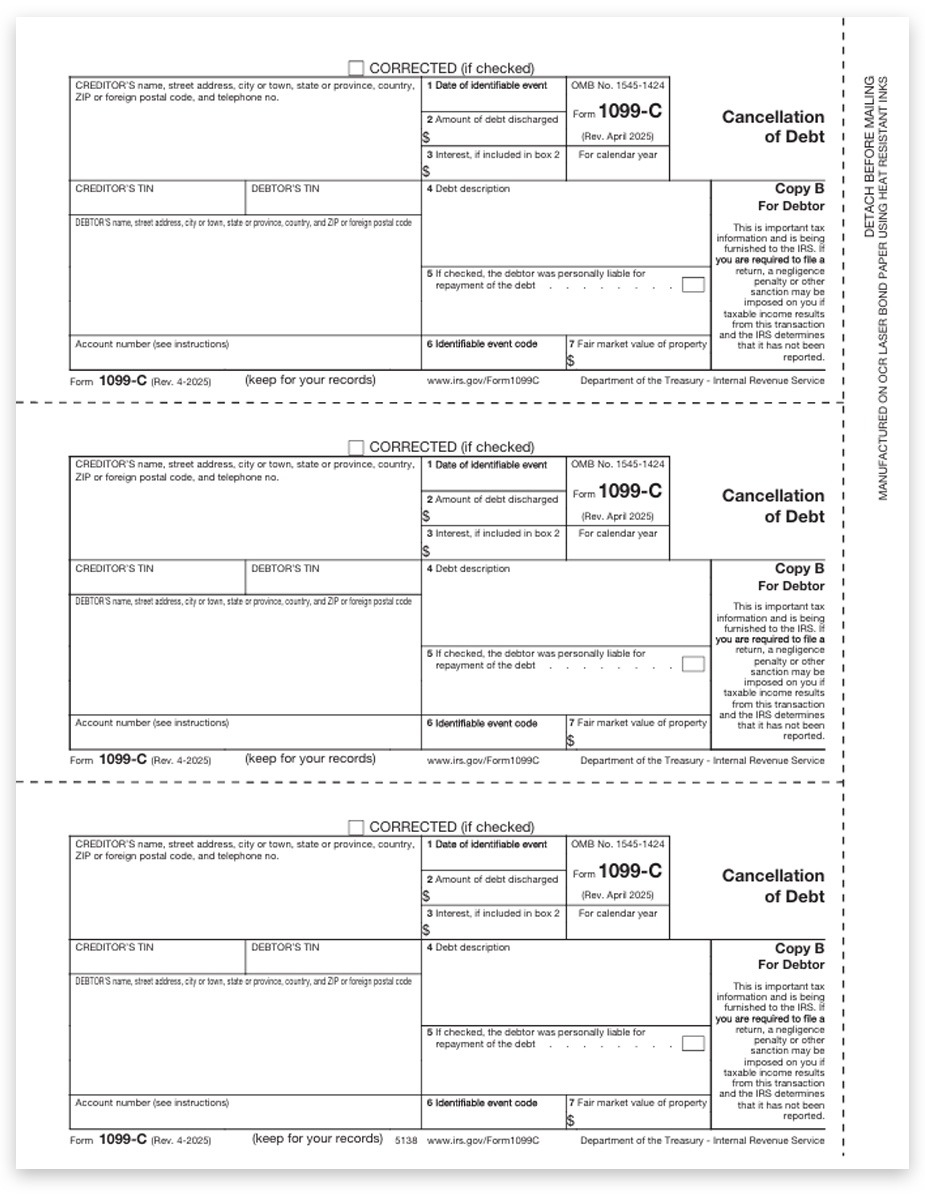

In addition to the Form 1040, there are also other printable tax forms such as the Form 1099 for reporting miscellaneous income, the Form 941 for employers to report payroll taxes, and the Form W-4 for employees to declare their withholding allowances. These forms play a crucial role in the tax filing process and help taxpayers comply with the IRS regulations.

It’s important to note that the IRS updates its tax forms and instructions every year, so it’s essential to download the latest versions from the IRS website to ensure compliance with the current tax laws. Taxpayers can also seek assistance from tax professionals or use tax software to help them accurately fill out their printable tax forms and file their taxes on time.

In conclusion, IRS printable tax forms are essential tools for individuals, businesses, and organizations to report their financial information and fulfill their tax obligations. By accessing these forms on the IRS website, taxpayers can easily download and fill them out to ensure compliance with the tax laws and avoid any penalties or audits. Remember to stay informed about the latest updates from the IRS to stay on top of your tax filing responsibilities.