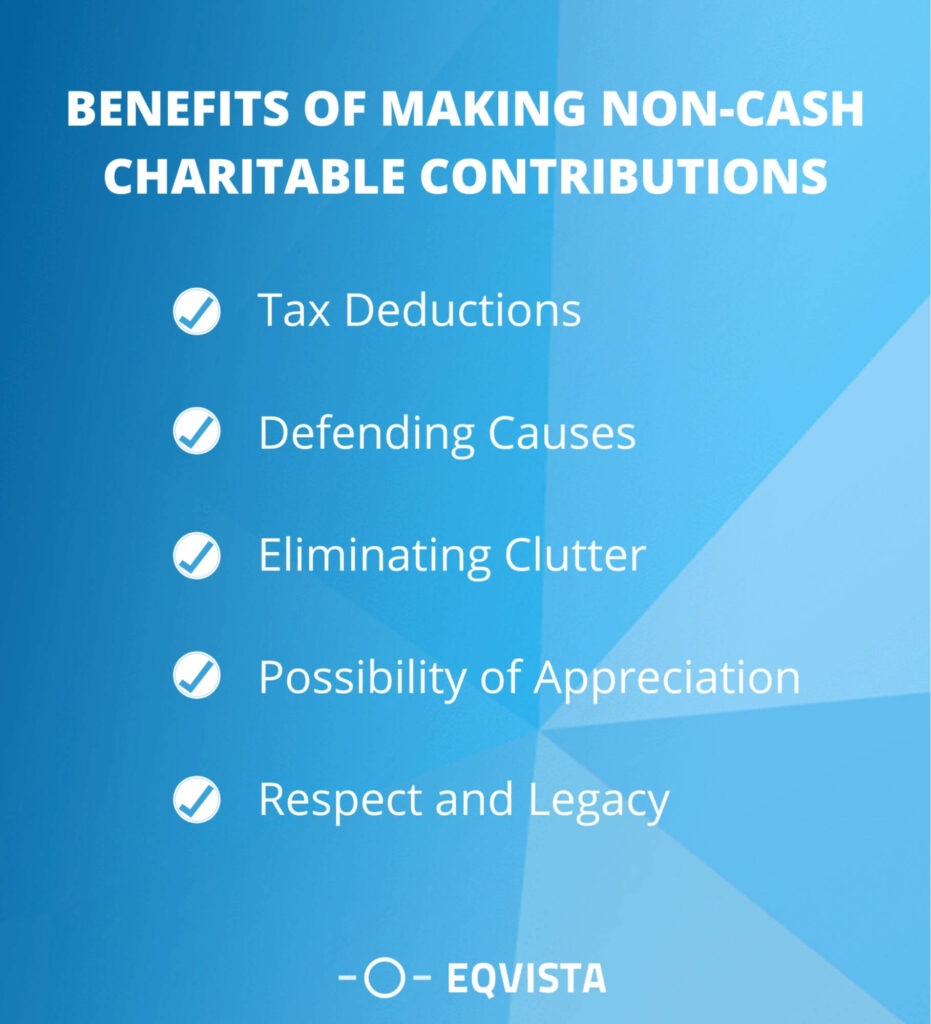

When it comes to claiming charitable donations on your taxes, Form 8283 is a crucial document to have. This form is used to report noncash charitable contributions that exceed $500 in value. It helps the IRS track donations and ensure that taxpayers are accurately reporting their contributions.

For the year 2024, the IRS has updated Form 8283 to reflect any changes in tax laws or regulations. It is important to use the most recent version of the form to avoid any discrepancies or delays in processing your tax return.

Irs Form 8283 For 2024 Printable

Irs Form 8283 For 2024 Printable

Get and Print Irs Form 8283 For 2024 Printable

Form 8283 And Non Cash Charitable Contribution Eqvista

Form 8283 And Non Cash Charitable Contribution Eqvista

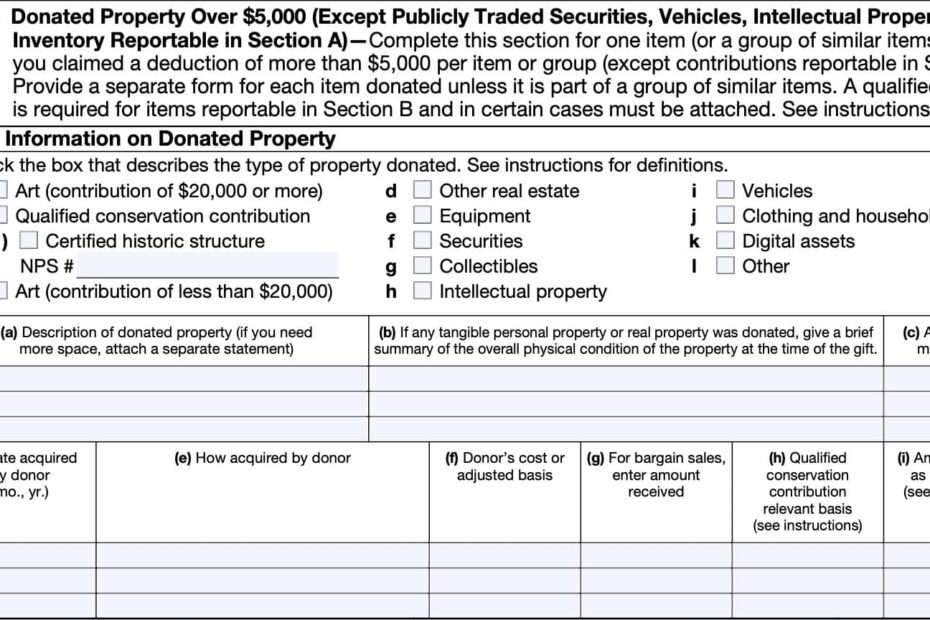

When filling out Form 8283 for 2024, you will need to provide detailed information about the donated property, including its description, fair market value, and how it was acquired. You will also need to include the name and address of the charitable organization receiving the donation.

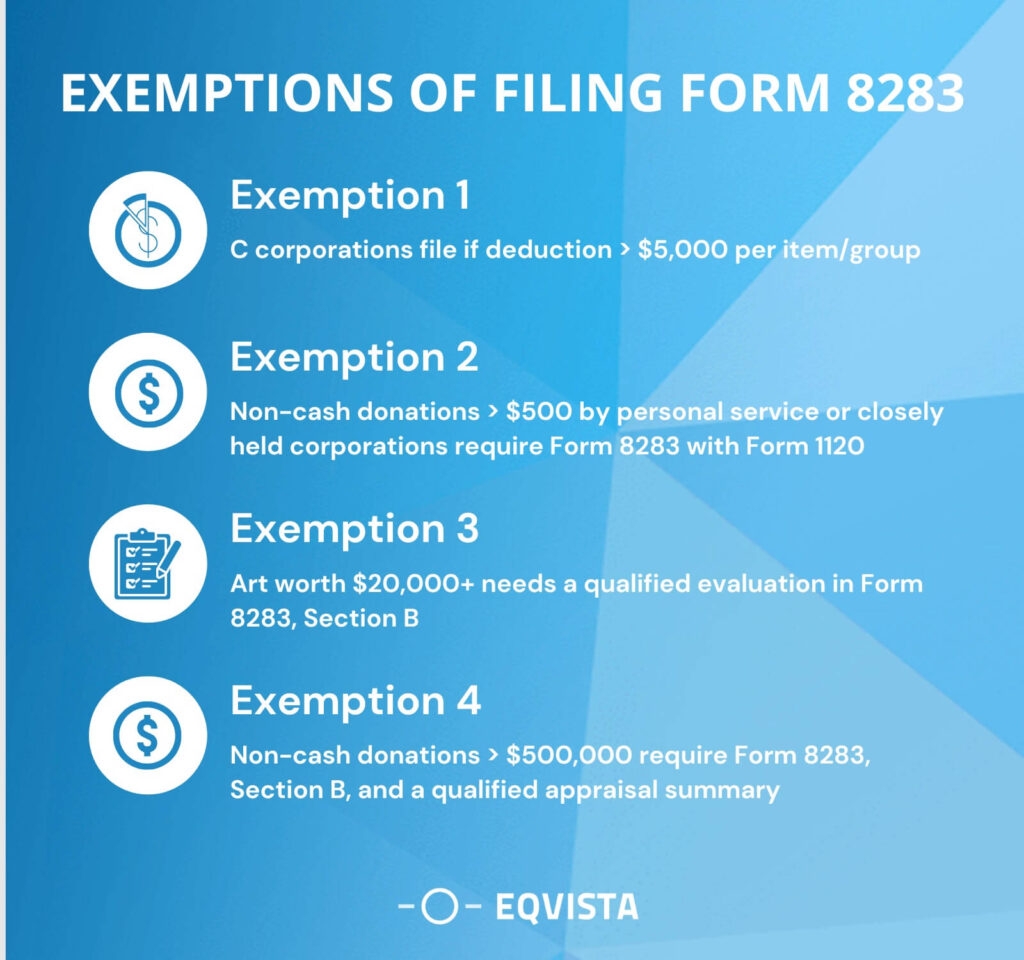

Additionally, if you are claiming a deduction of $5,000 or more for a single item or group of similar items, you will need to obtain an appraisal from a qualified appraiser. This appraisal must be attached to your tax return along with Form 8283.

It is important to keep accurate records of all charitable donations and receipts, as the IRS may request documentation to support your deductions. By properly completing Form 8283 and providing all necessary information, you can ensure that your charitable contributions are properly reported on your tax return.

Overall, Form 8283 for 2024 is an essential document for anyone claiming noncash charitable contributions on their taxes. By following the instructions and providing accurate information, you can avoid any issues with the IRS and ensure that your deductions are properly recorded.