As a self-employed individual or independent contractor, it’s important to stay on top of your tax obligations. One crucial form that you may need to file is the IRS 1099 NEC form. This form is used to report nonemployee compensation, such as freelance income, to the IRS.

For tax year 2024, the IRS has made changes to the 1099 NEC form, including updates to the filing deadline and instructions for reporting income. It’s essential to familiarize yourself with these changes to ensure compliance with tax laws.

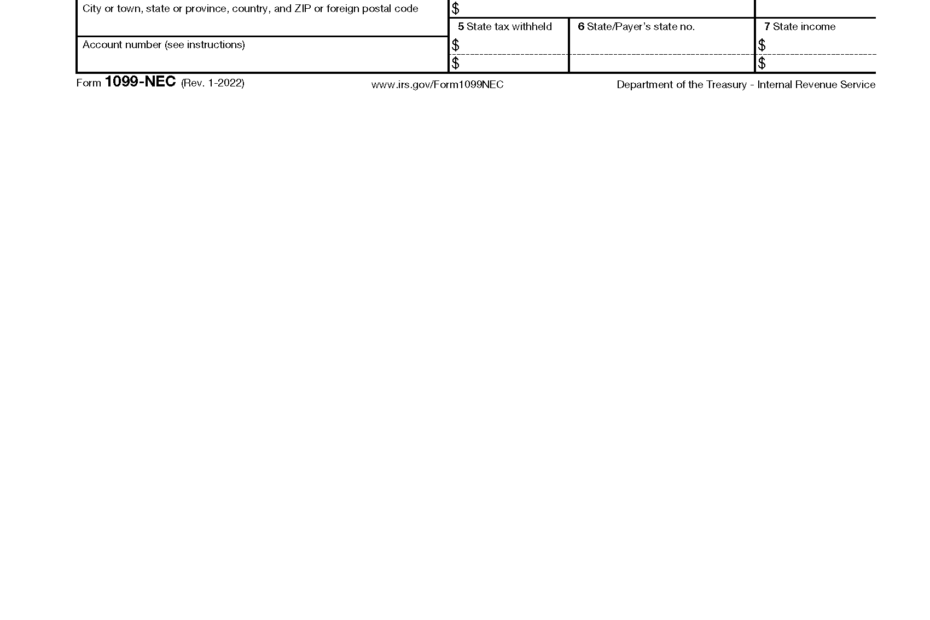

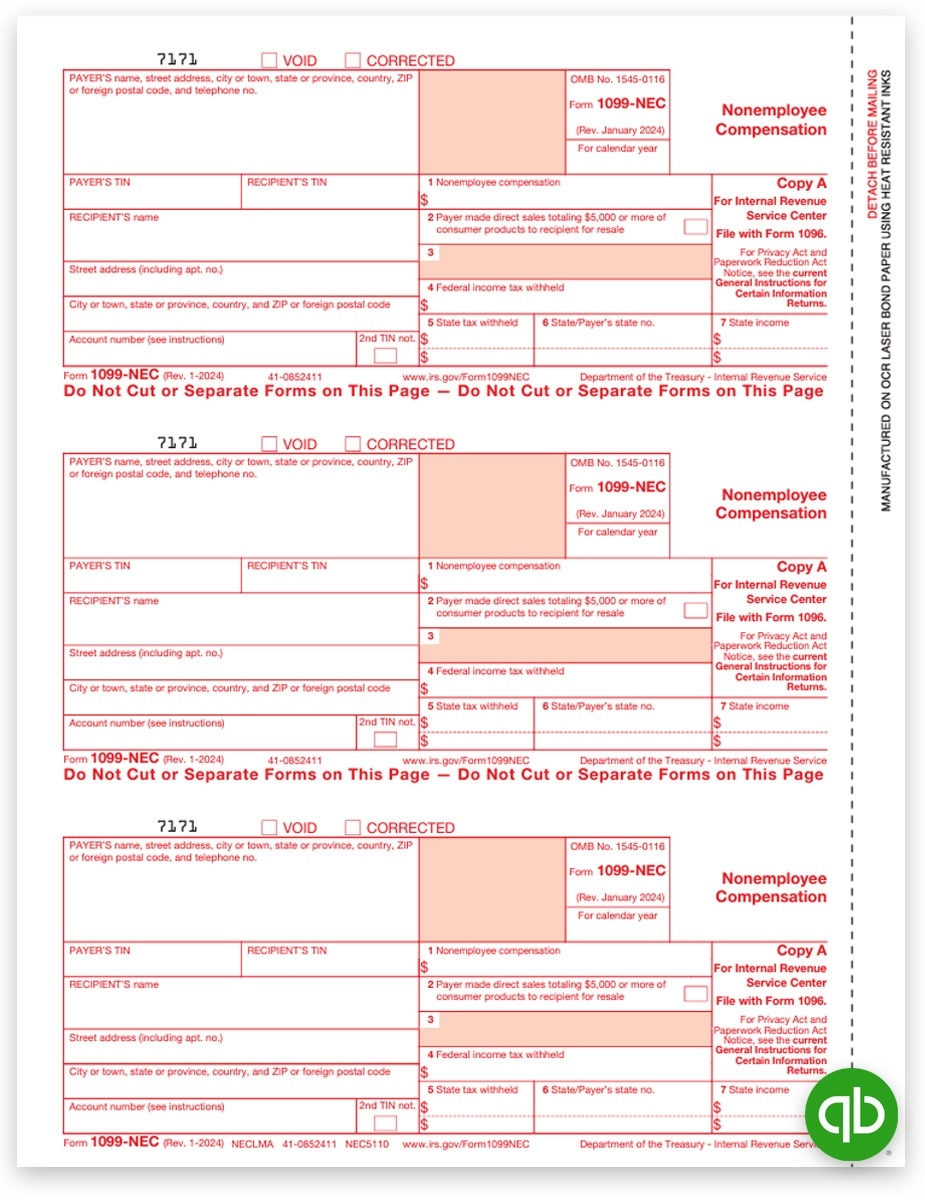

Irs 1099 Nec Form 2024 Printable

Irs 1099 Nec Form 2024 Printable

Save and Print Irs 1099 Nec Form 2024 Printable

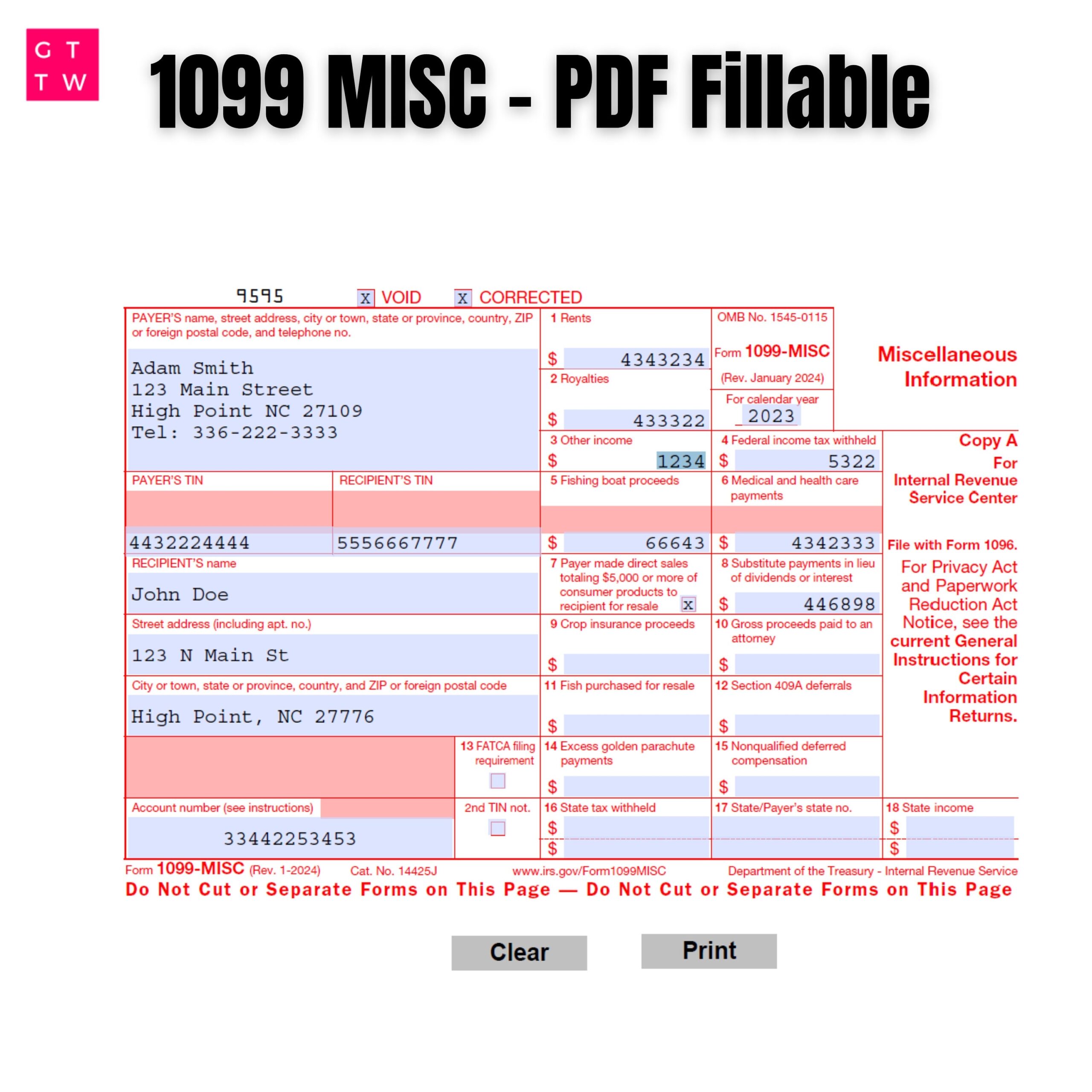

2024 1099 MISC Form Fillable Print Template Digital Download Etsy

2024 1099 MISC Form Fillable Print Template Digital Download Etsy

Irs 1099 NEC Form 2024 Printable

If you need to file the IRS 1099 NEC form for tax year 2024, you can easily find a printable version online. The form is available on the IRS website and can be downloaded and printed for your convenience. Make sure to fill out the form accurately and submit it to the IRS by the deadline to avoid any penalties.

When filling out the 1099 NEC form, you will need to provide information such as your name, address, taxpayer identification number, and the amount of nonemployee compensation you received. Double-check all the information before submitting the form to ensure there are no errors that could trigger an audit.

It’s important to note that if you paid nonemployee compensation of $600 or more during the tax year, you are required to file the 1099 NEC form. Failure to do so could result in penalties from the IRS. Be sure to keep accurate records of all payments made to independent contractors to simplify the filing process.

Overall, the IRS 1099 NEC form is a crucial document for self-employed individuals and independent contractors. By staying informed about the changes for tax year 2024 and completing the form accurately and on time, you can avoid potential issues with the IRS and ensure compliance with tax laws.

Make sure to consult with a tax professional if you have any questions or need assistance with filing the 1099 NEC form. They can provide guidance and ensure that you meet all your tax obligations as a self-employed individual.