When starting a new job, one of the first tasks you will likely need to complete is filling out an IRS W4 form. This form is crucial for ensuring that your employer withholds the correct amount of federal income tax from your paychecks. Failure to complete this form accurately could result in owing taxes at the end of the year or receiving a smaller refund than expected.

It is important to keep in mind that the IRS W4 form is not a one-time task. You may need to update your form whenever you have a significant life change, such as getting married, having children, or taking on a second job. By keeping your W4 form up to date, you can ensure that you are not hit with any surprises come tax time.

Download and Print Irs W4 Printable Form

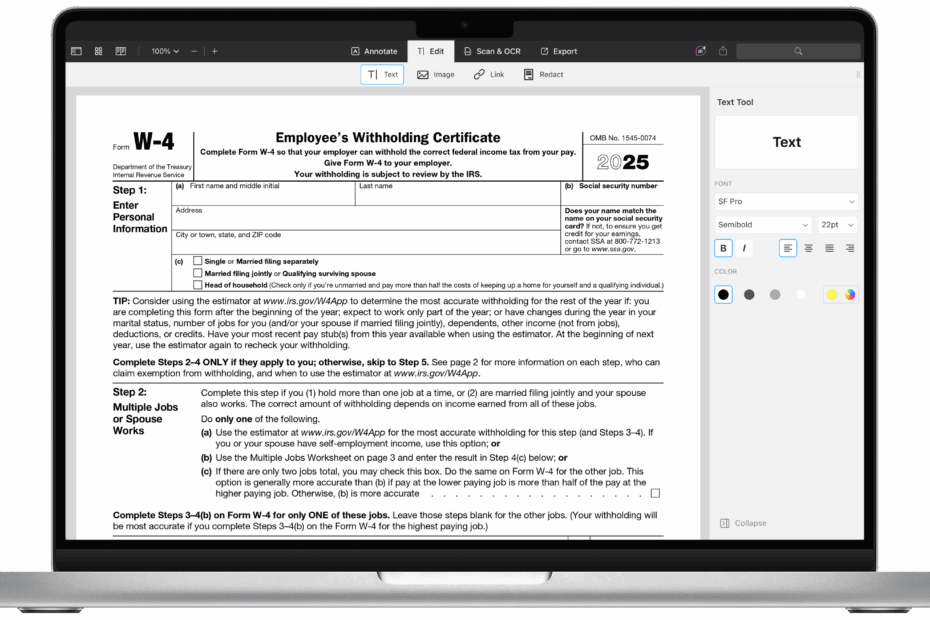

Irs W4 Printable Form

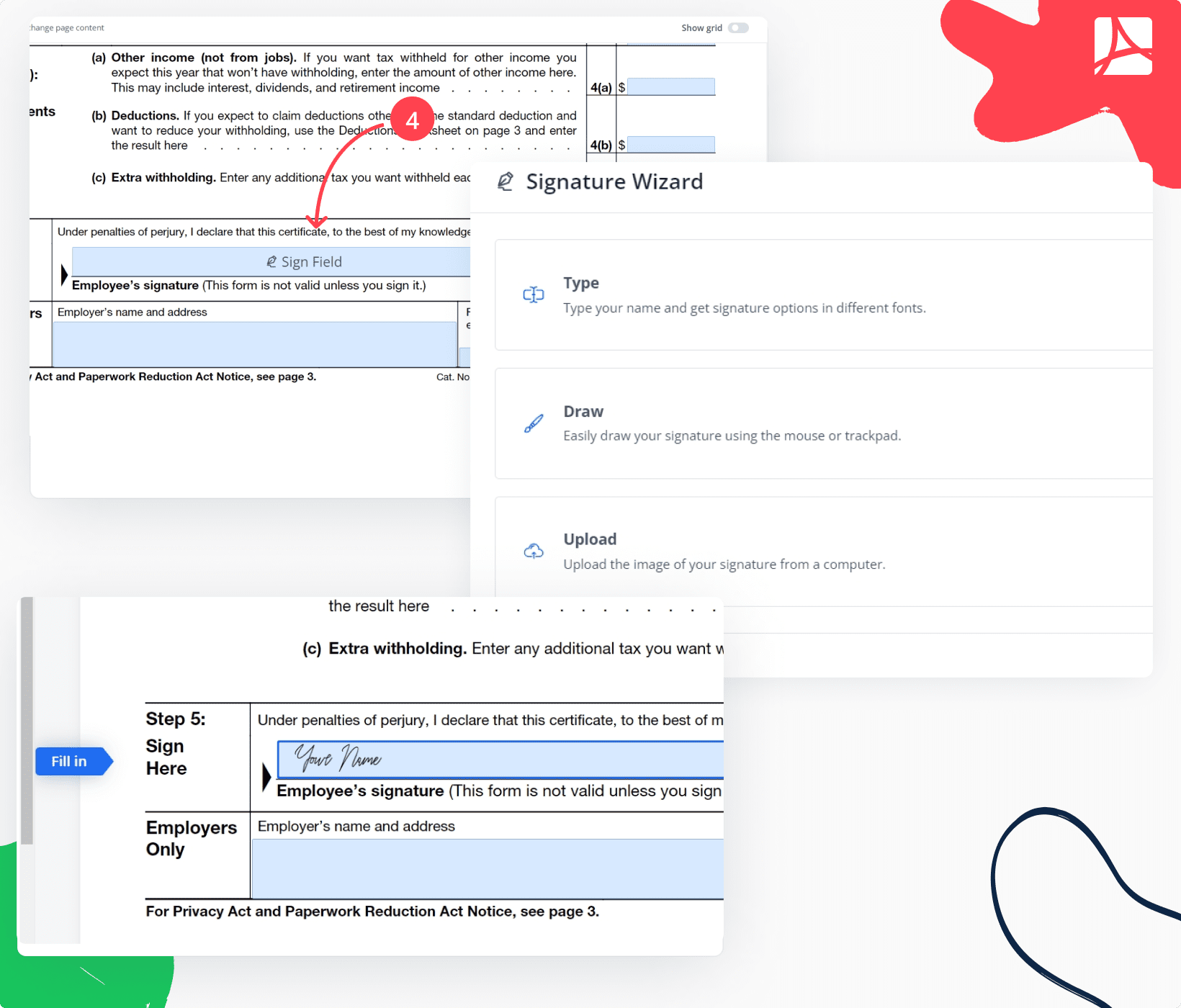

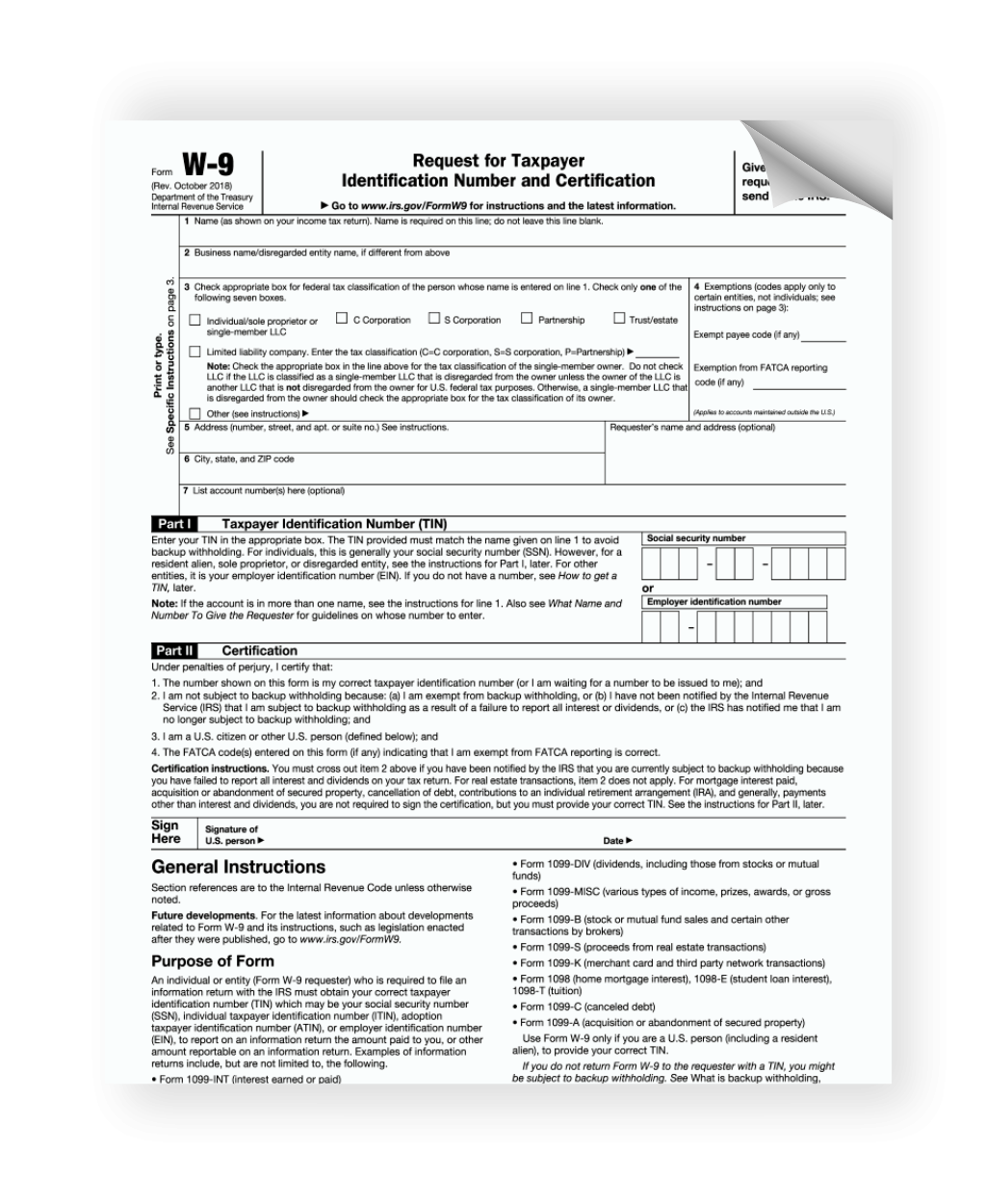

One of the easiest ways to access and complete an IRS W4 form is by using the printable version available on the IRS website. This form can be downloaded, filled out, and submitted to your employer in a matter of minutes. The printable form provides clear instructions on how to complete each section, making the process as straightforward as possible.

When filling out your IRS W4 form, be sure to provide accurate information about your filing status, number of dependents, and any additional income you may have. This information will help your employer accurately calculate the amount of federal income tax to withhold from your paychecks. It is also important to review your form periodically to ensure that it reflects your current financial situation.

By taking the time to fill out an IRS W4 form accurately, you can avoid any potential tax issues and ensure that you are not caught off guard by unexpected tax bills. Remember, it is always better to be proactive and stay on top of your tax obligations to avoid any unnecessary stress or financial hardship.

In conclusion, filling out an IRS W4 form is a crucial step in managing your tax obligations as an employee. By using the printable form provided by the IRS, you can easily ensure that your employer withholds the correct amount of federal income tax from your paychecks. Stay informed and up to date on any changes that may affect your tax situation to avoid any surprises at tax time.