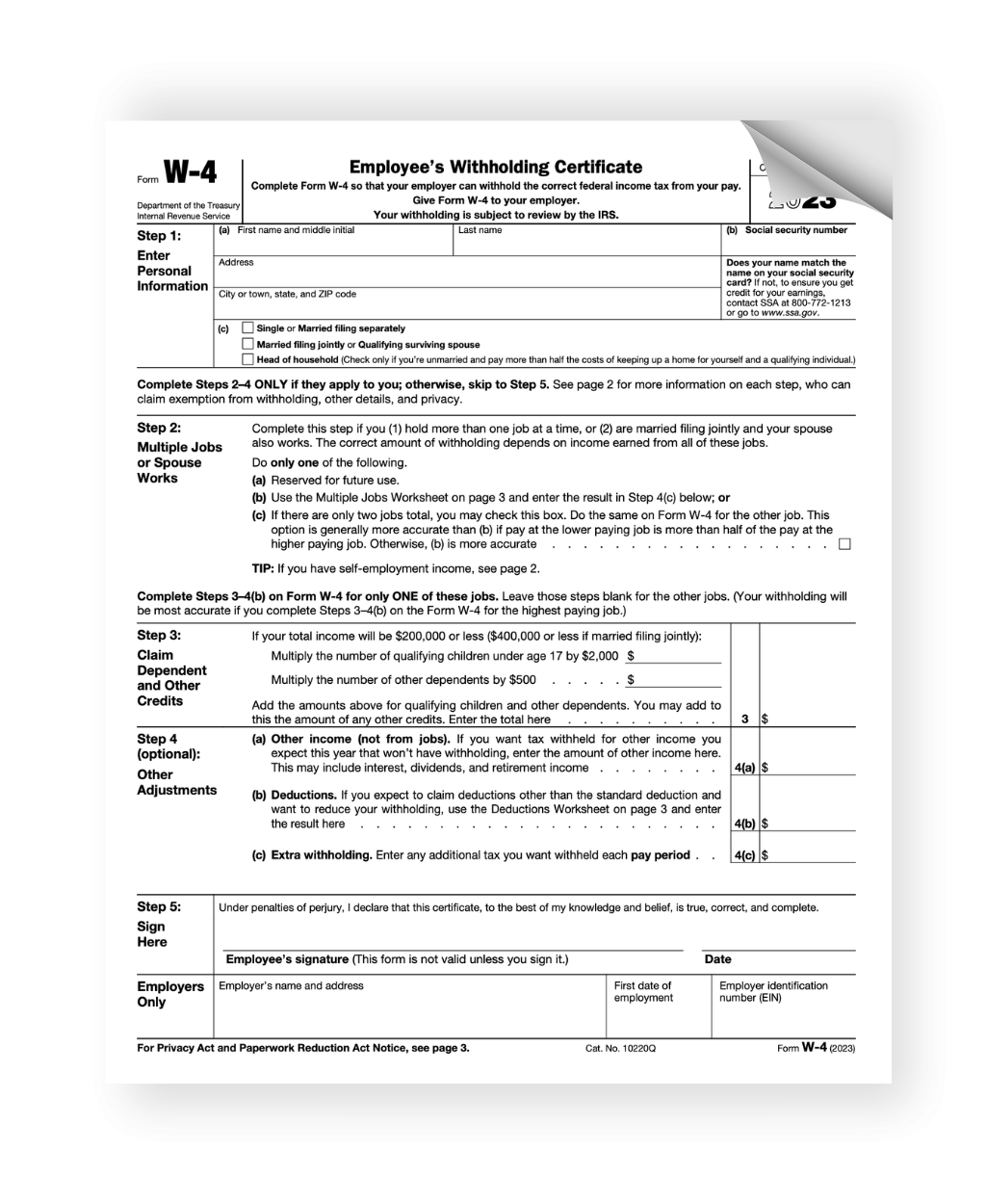

When starting a new job or experiencing a major life event like getting married or having a child, it’s important to update your tax withholding information with your employer. This is where the IRS W-4 form comes in. The W-4 form is used to determine how much federal income tax should be withheld from your paycheck based on your filing status and dependents.

Having a printable version of the IRS W-4 form at your disposal makes it easy to update your tax withholding information quickly and efficiently. This can help ensure that you are not overpaying or underpaying your taxes throughout the year, which can have a significant impact on your financial situation come tax time.

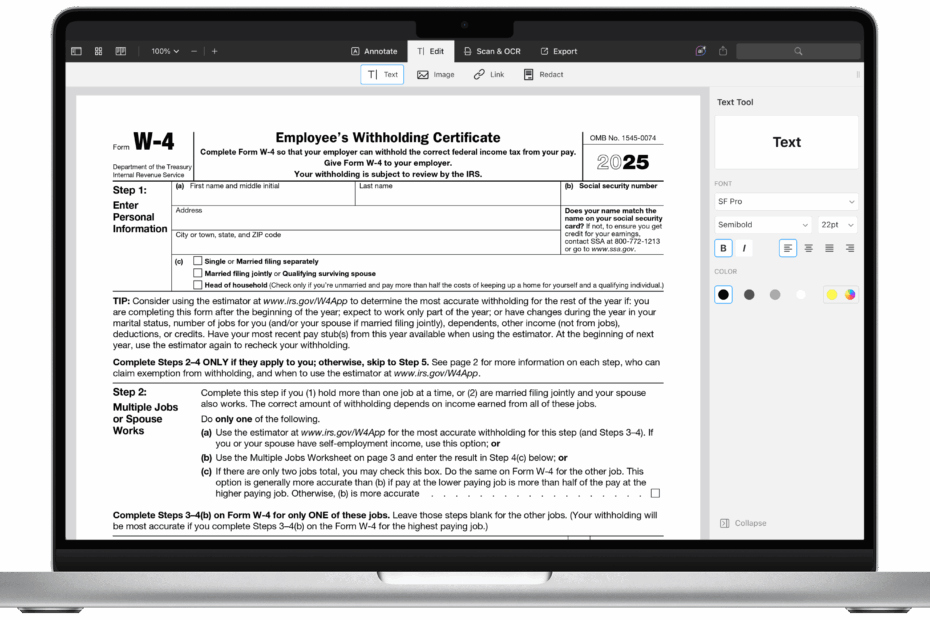

Get and Print Irs W 4 Form Printable

IRS W-4 Form Printable

The IRS W-4 form printable allows you to easily fill out the necessary information, such as your filing status, number of dependents, and any additional withholding amounts. By having this form readily available, you can make any necessary adjustments to your tax withholding without delay.

It’s important to review and update your W-4 form regularly, especially when experiencing major life changes. Failing to do so could result in unexpected tax bills or refunds at the end of the year. By using the IRS W-4 form printable, you can stay on top of your tax withholding and avoid any surprises when it comes time to file your taxes.

Additionally, having a printable version of the W-4 form allows you to keep a copy for your records and easily make changes as needed. This can be particularly helpful if you have multiple jobs or sources of income, as you may need to adjust your withholding amounts accordingly.

In conclusion, the IRS W-4 form printable is a valuable tool for managing your tax withholding and ensuring that you are not overpaying or underpaying your taxes. By keeping this form handy and regularly updating it as needed, you can stay on top of your tax obligations and avoid any surprises when it comes time to file your taxes.