As tax season approaches, many individuals and businesses are gearing up to file their taxes. One essential tool in this process is the IRS tax forms. These forms provide the necessary information for taxpayers to report their income, deductions, and credits to the government. For the year 2025, the IRS has made these forms available in printable format for easy access and convenience.

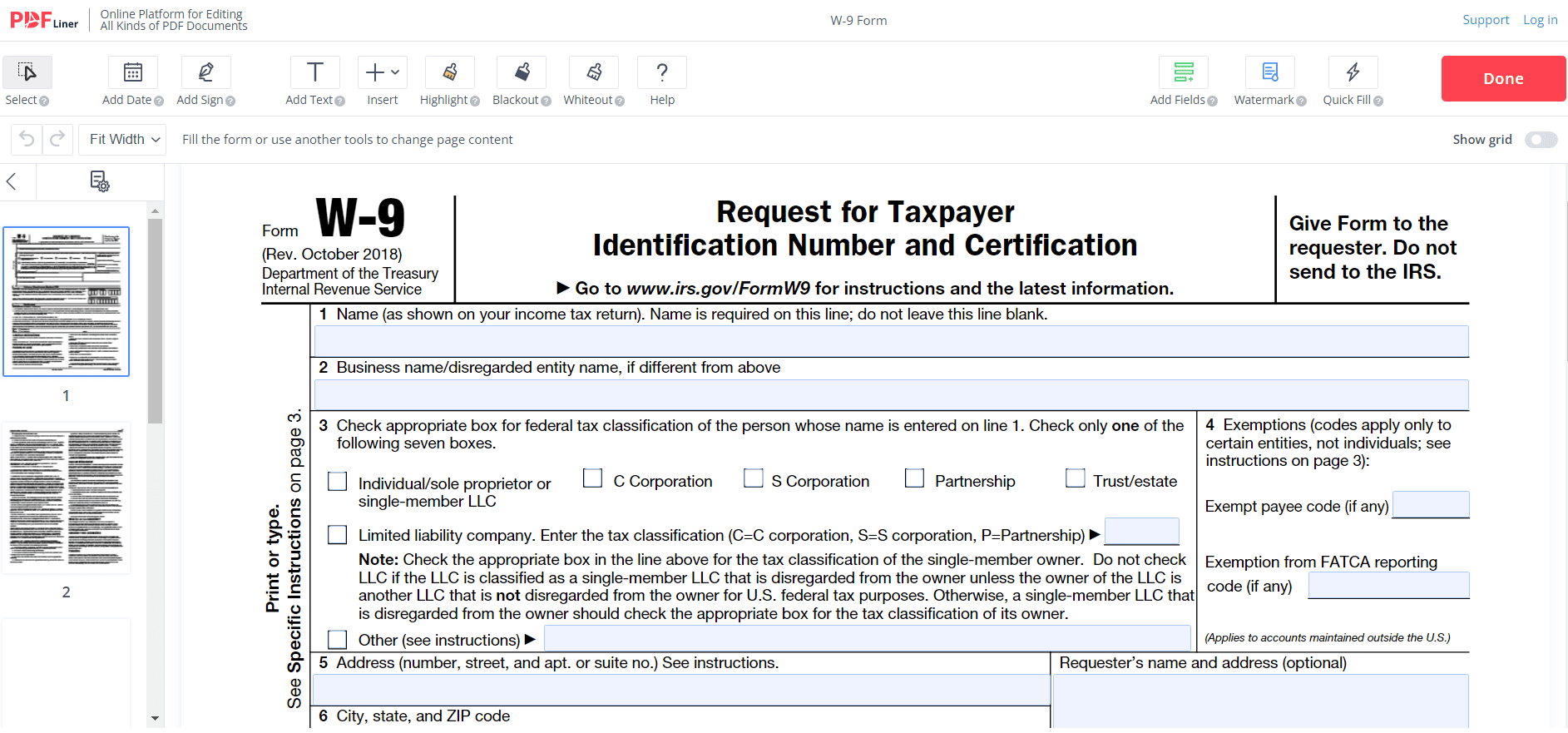

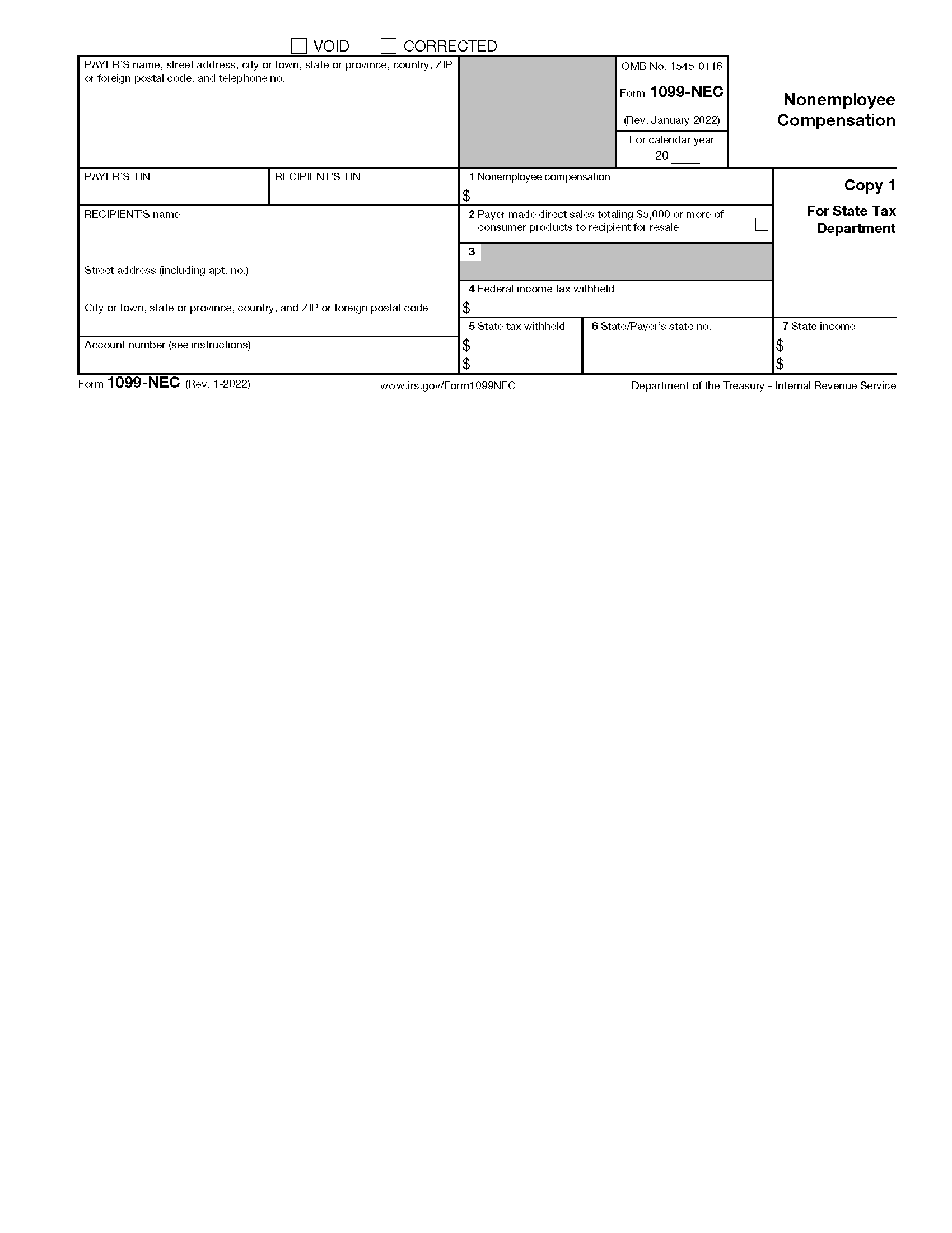

Whether you are a wage earner, a small business owner, or a freelancer, there are IRS tax forms that are tailored to your specific needs. By having these forms in printable format, taxpayers can easily fill them out at their own pace and convenience. This eliminates the need to visit an IRS office or wait for forms to arrive in the mail.

Save and Print Irs Tax Forms 2025 Printable

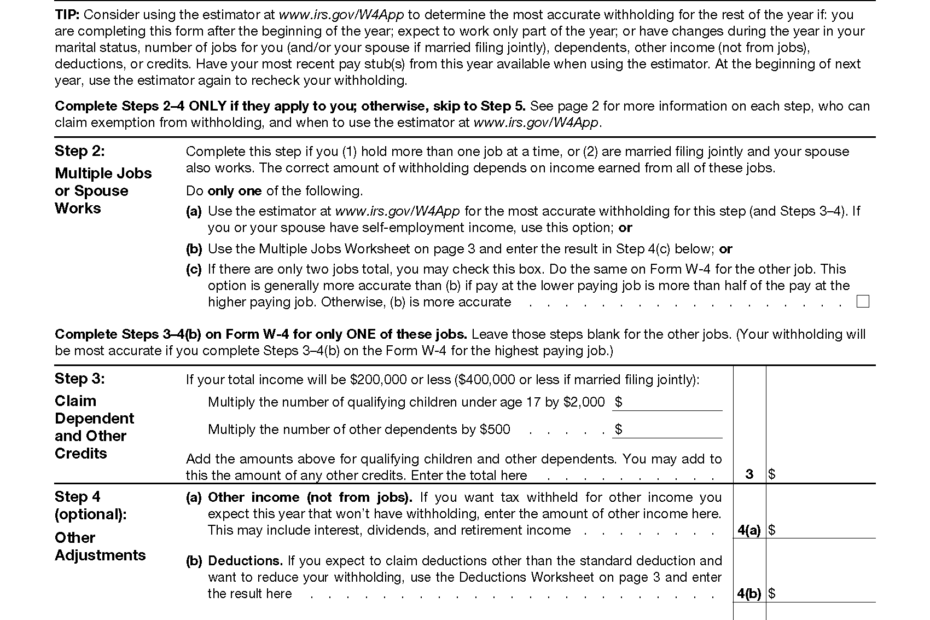

One of the most common tax forms that individuals use is the Form 1040. This form is used to report individual income tax returns and claim deductions and credits. Additionally, there are other forms such as the Schedule A for itemized deductions, Schedule C for self-employment income, and Form 8863 for education credits. Having these forms in printable format allows taxpayers to easily access and complete them without any hassle.

For businesses, forms such as the Form 1120 for corporations, Form 1065 for partnerships, and Form 941 for payroll taxes are essential for reporting income and taxes. By having these forms in printable format, businesses can efficiently file their taxes and ensure compliance with IRS regulations. This saves time and effort for both the business owners and the IRS.

In conclusion, the availability of IRS tax forms in printable format for the year 2025 is a convenient and efficient way for taxpayers to file their taxes. By having these forms easily accessible, individuals and businesses can accurately report their income, deductions, and credits to the government. This not only simplifies the tax filing process but also ensures compliance with IRS regulations.