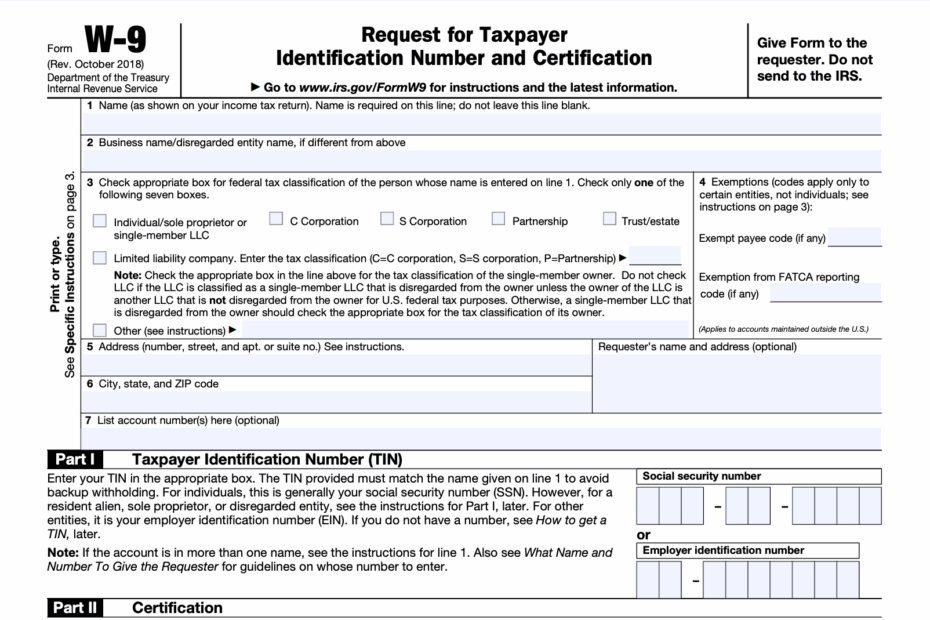

When it comes to tax documentation, the IRS Form W9 is an essential document that is often used for freelancers, contractors, and vendors. This form is used to request the taxpayer identification number (TIN) of individuals or entities for tax purposes. It is important to have a W9 on file for each vendor or contractor you work with to ensure compliance with tax laws.

Obtaining a W9 form is crucial for businesses to accurately report payments made to vendors and contractors. This form helps in preventing any potential issues with the IRS and ensures that all tax obligations are met. By having a completed W9 form on file, businesses can avoid penalties for failing to report payments made to vendors.

Download and Print Irs Form W9 Printable

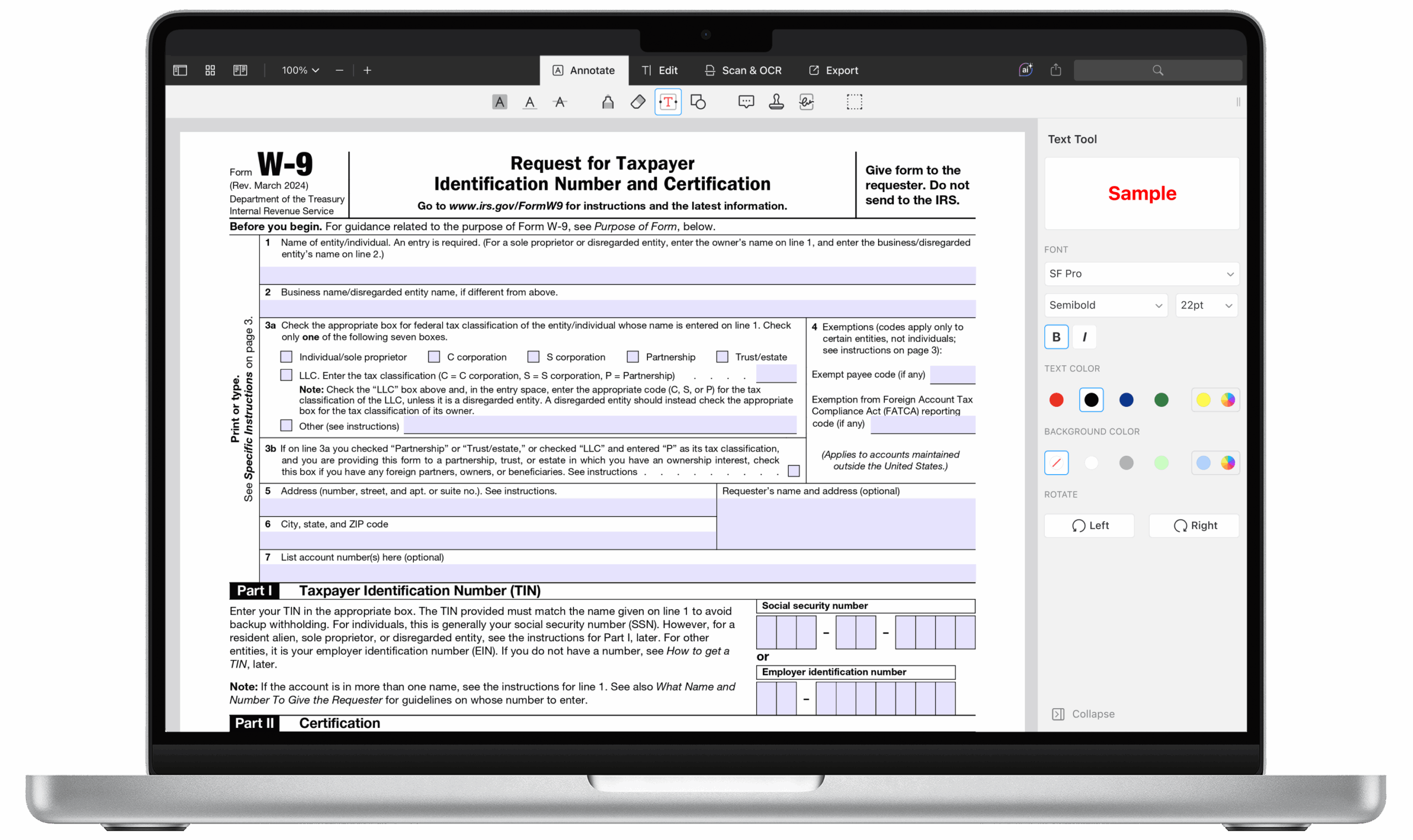

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

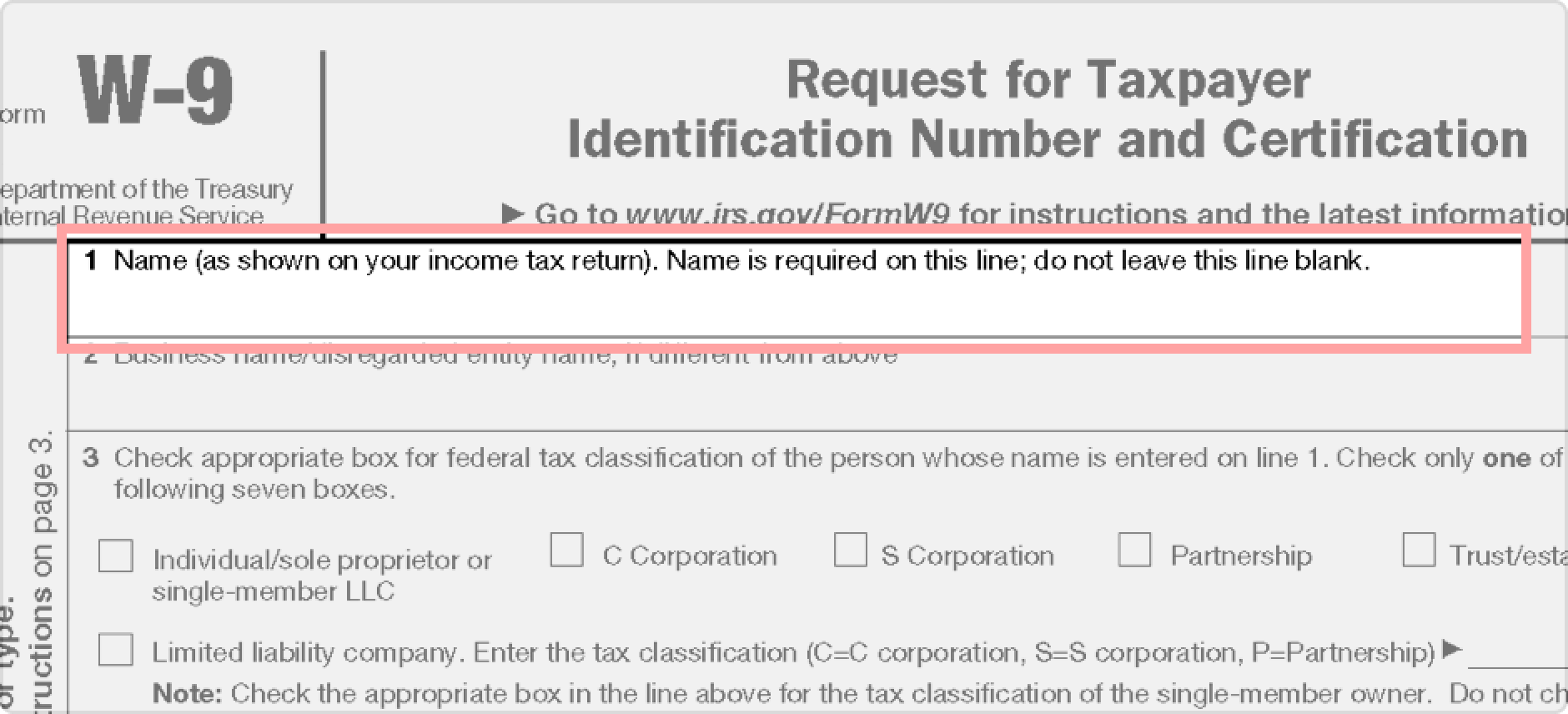

When it comes to filling out the IRS Form W9, it is important to provide accurate information to avoid any discrepancies. The form requires basic information such as the name, address, and taxpayer identification number of the individual or entity. It is important to carefully review the information provided and ensure that it is accurate before submitting the form.

One of the benefits of the IRS Form W9 is that it is available in a printable format, making it easy to access and distribute as needed. This printable form can be easily downloaded from the IRS website or other authorized sources. Having a printable version of the form allows businesses to quickly obtain the necessary information from vendors and contractors.

In conclusion, the IRS Form W9 is a critical document for businesses that work with vendors and contractors. By obtaining and maintaining accurate W9 forms, businesses can ensure compliance with tax laws and avoid potential penalties. The printable version of the form makes it easy to access and distribute, making it a convenient tool for businesses to use in their tax reporting processes.