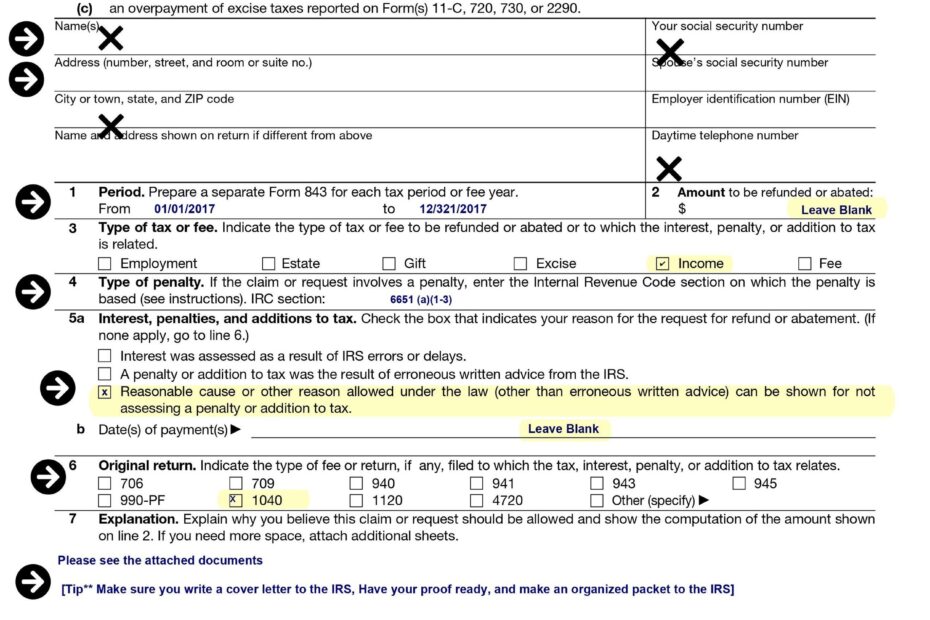

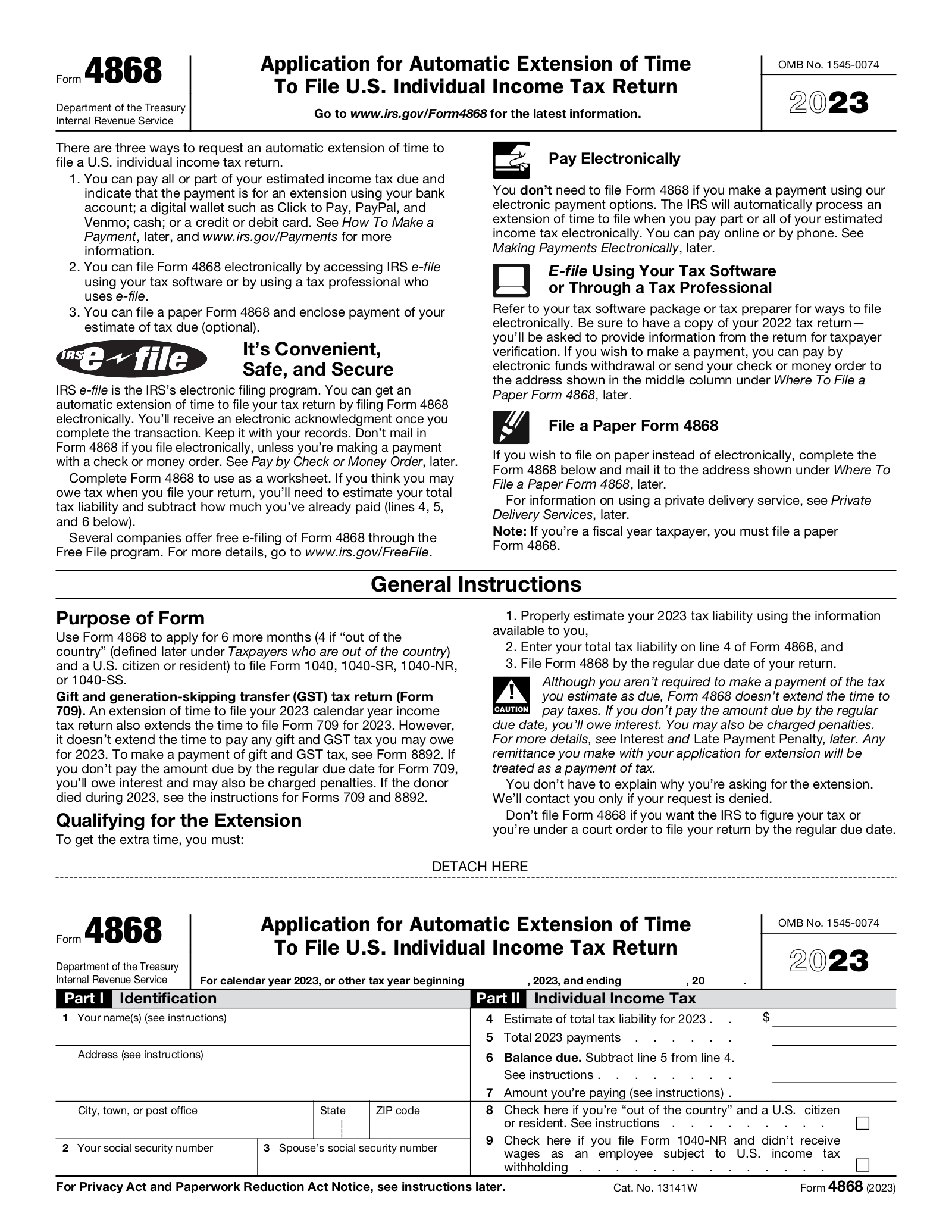

When it comes to dealing with tax issues, it’s important to have the right forms on hand. One such form that individuals may need to use is IRS Form 843. This form is used to request abatement or refund of certain types of taxes, penalties, and interest.

It’s essential to know how to properly fill out this form to ensure that your request is processed correctly. Fortunately, the IRS provides a printable version of Form 843 on their website, making it easy for individuals to access and complete.

Download and Print Irs Form 843 Printable

How To Remove IRS Tax Penalties Semper Tax Relief IRS Tax Problems Business Bookkeeping

How To Remove IRS Tax Penalties Semper Tax Relief IRS Tax Problems Business Bookkeeping

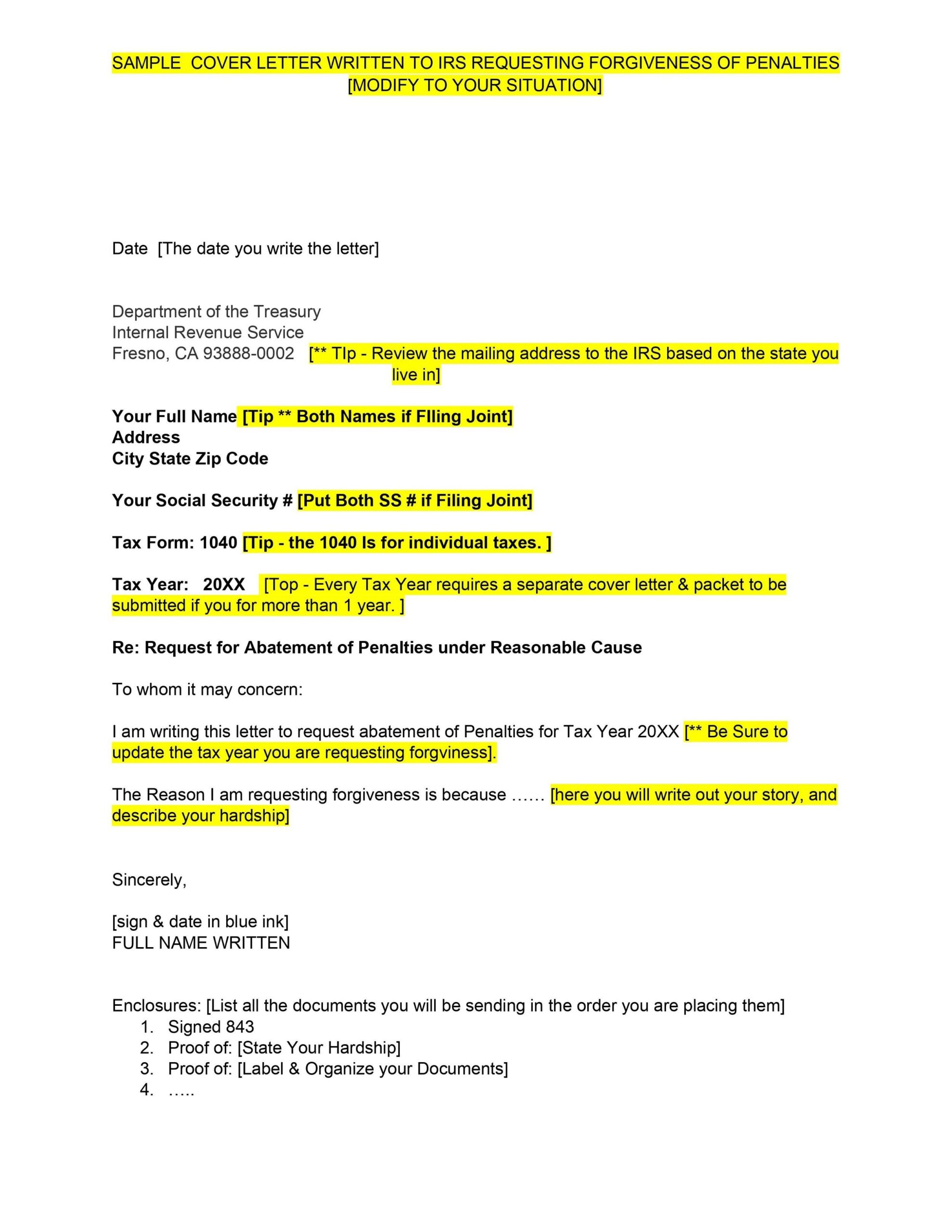

Form 843 consists of several sections where you will need to provide detailed information about the taxes, penalties, or interest you are requesting abatement or refund for. You will also need to explain the reason for your request and provide any supporting documentation that may be required.

It’s important to note that not all requests for abatement or refund will be granted by the IRS. However, by filling out Form 843 accurately and providing all necessary information, you can increase your chances of having your request approved.

Before submitting Form 843, be sure to double-check all information and make sure that you have included all required documentation. Once you have completed the form, you can mail it to the appropriate IRS address listed on the form instructions.

In conclusion, IRS Form 843 is a valuable tool for individuals who need to request abatement or refund of certain taxes, penalties, or interest. By utilizing the printable version of this form provided by the IRS and following the instructions carefully, you can navigate the process with ease and hopefully achieve a favorable outcome.