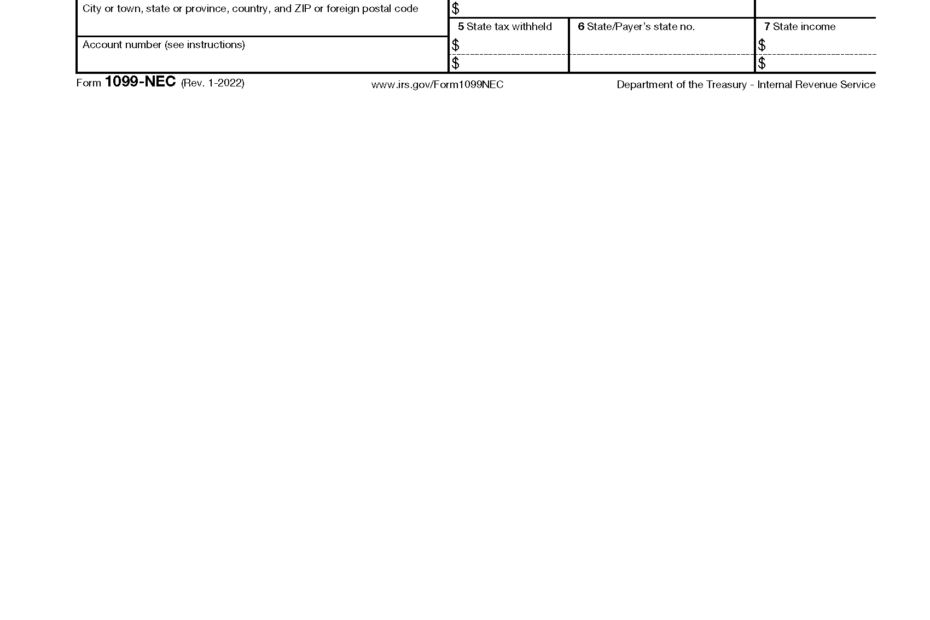

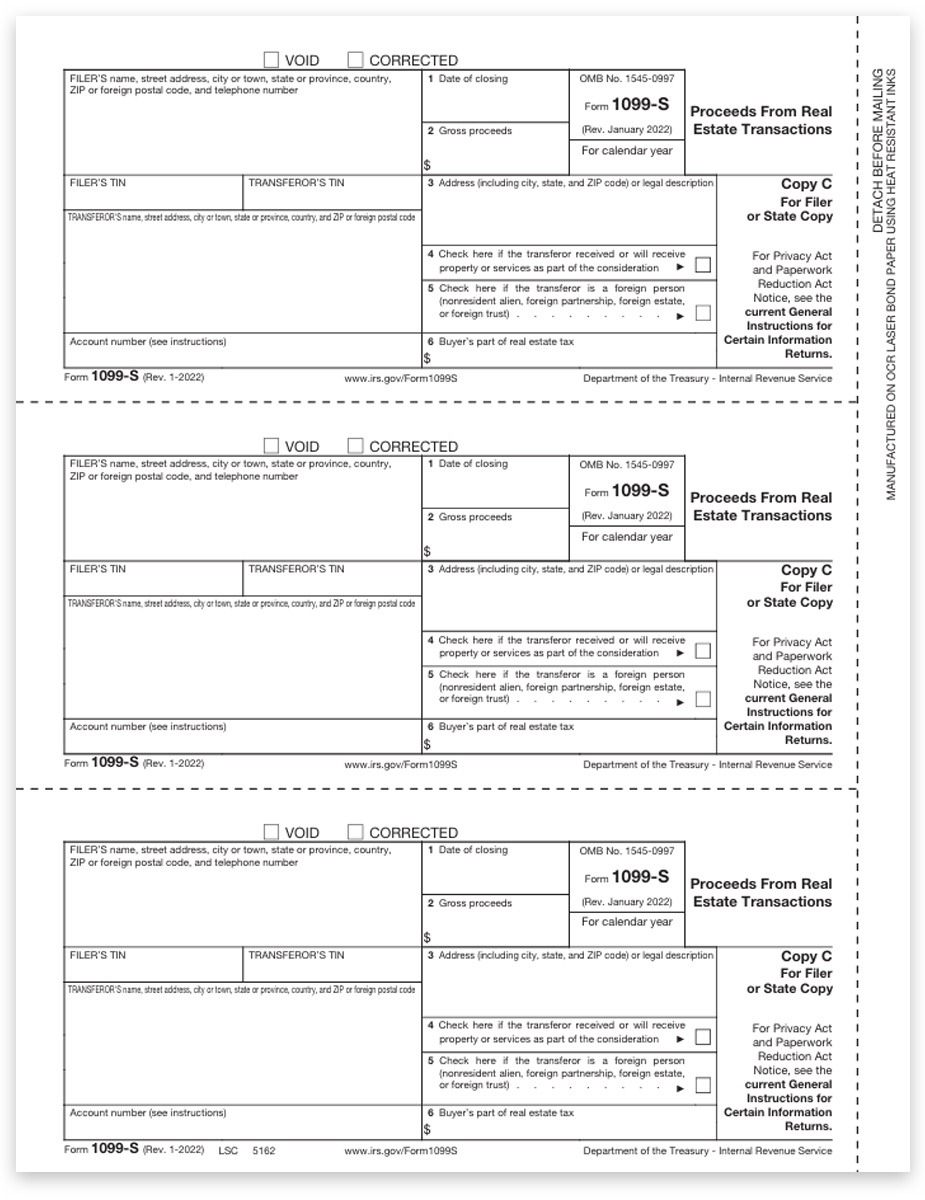

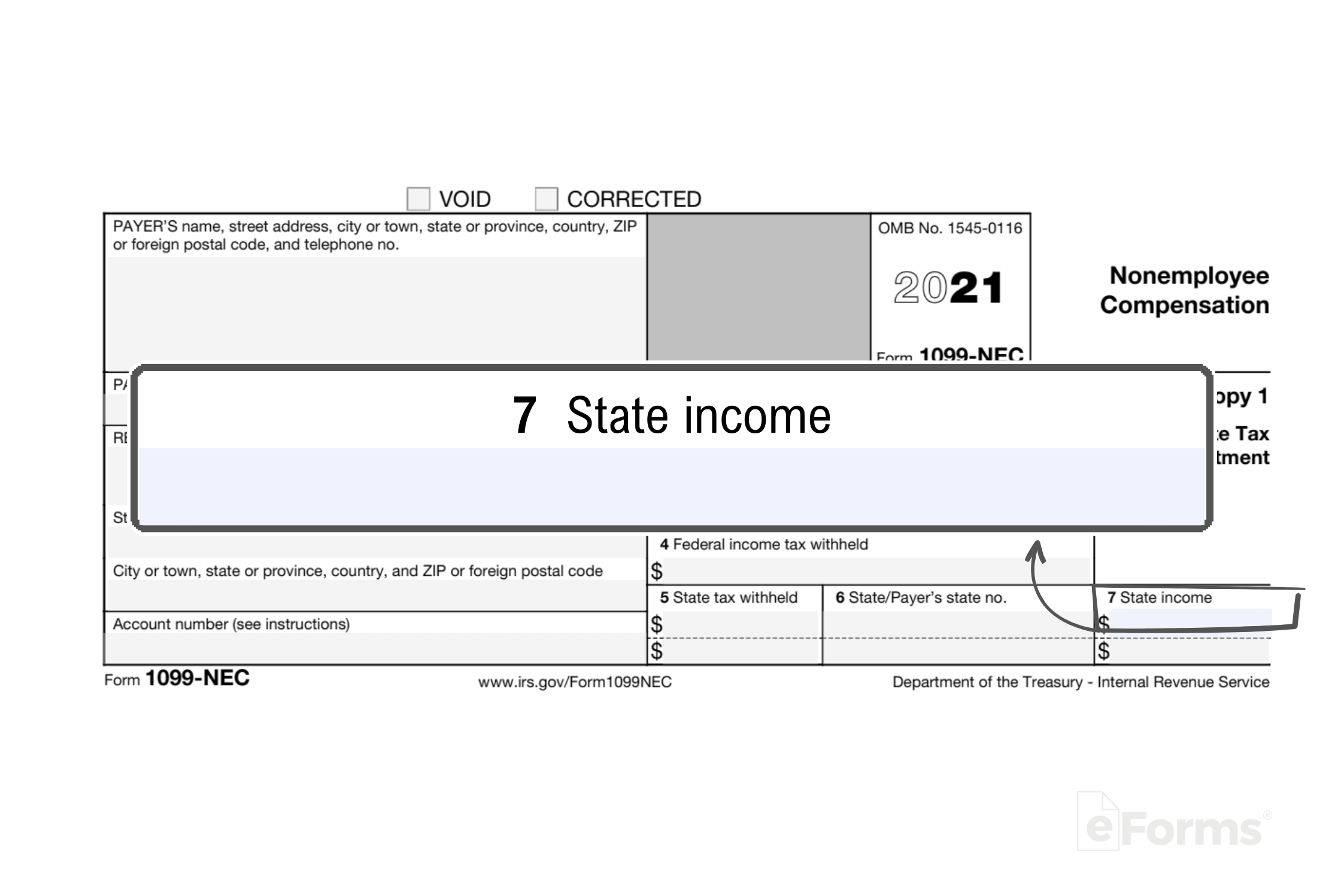

IRS Form 1099 is a tax form used for reporting various types of income other than wages, salaries, and tips. This form is essential for individuals and businesses who receive income that is not subject to withholding. It is important to accurately report this income to the IRS to avoid penalties and ensure compliance with tax laws.

Form 1099 comes in various types depending on the type of income being reported, such as interest, dividends, miscellaneous income, and more. It is crucial to use the correct form to report income accurately. The IRS provides printable versions of Form 1099 on their website for individuals and businesses to easily access and fill out.

Quickly Access and Print Irs Form 1099 Printable

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

When filling out Form 1099, it is important to include the payer’s information, recipient’s information, and the amount of income received. Make sure to double-check all information for accuracy before submitting the form to the IRS. Failure to report income accurately can result in fines and penalties.

Businesses that pay individuals or entities over a certain threshold are required to issue Form 1099 to report the income. This form is used by the recipient to report the income on their tax return. It is important for both the payer and recipient to keep a copy of the form for their records.

IRS Form 1099 serves as a vital tool for reporting non-wage income and ensuring compliance with tax laws. By using the printable version provided by the IRS, individuals and businesses can easily access and fill out the necessary information for accurate reporting. Remember to submit the form by the deadline to avoid penalties and ensure smooth tax filing.

Closing Paragraph

In conclusion, IRS Form 1099 Printable is a crucial document for reporting non-wage income to the IRS. It is important to use the correct form and accurately report all income to avoid penalties and ensure compliance with tax laws. By utilizing the printable version provided by the IRS, individuals and businesses can easily access and fill out Form 1099 for tax reporting purposes.