When it comes to filing taxes for trusts and estates, IRS Form 1041 is an essential document that must be filled out accurately. This form is used to report the income, deductions, and credits of estates and trusts, and it is crucial for ensuring compliance with tax laws.

For the year 2024, the IRS has made available a printable version of Form 1041 that can be easily accessed and filled out by taxpayers. This printable form provides a convenient way for individuals to report their financial information and fulfill their tax obligations.

Irs Form 1041 For 2024 Printable

Irs Form 1041 For 2024 Printable

Download and Print Irs Form 1041 For 2024 Printable

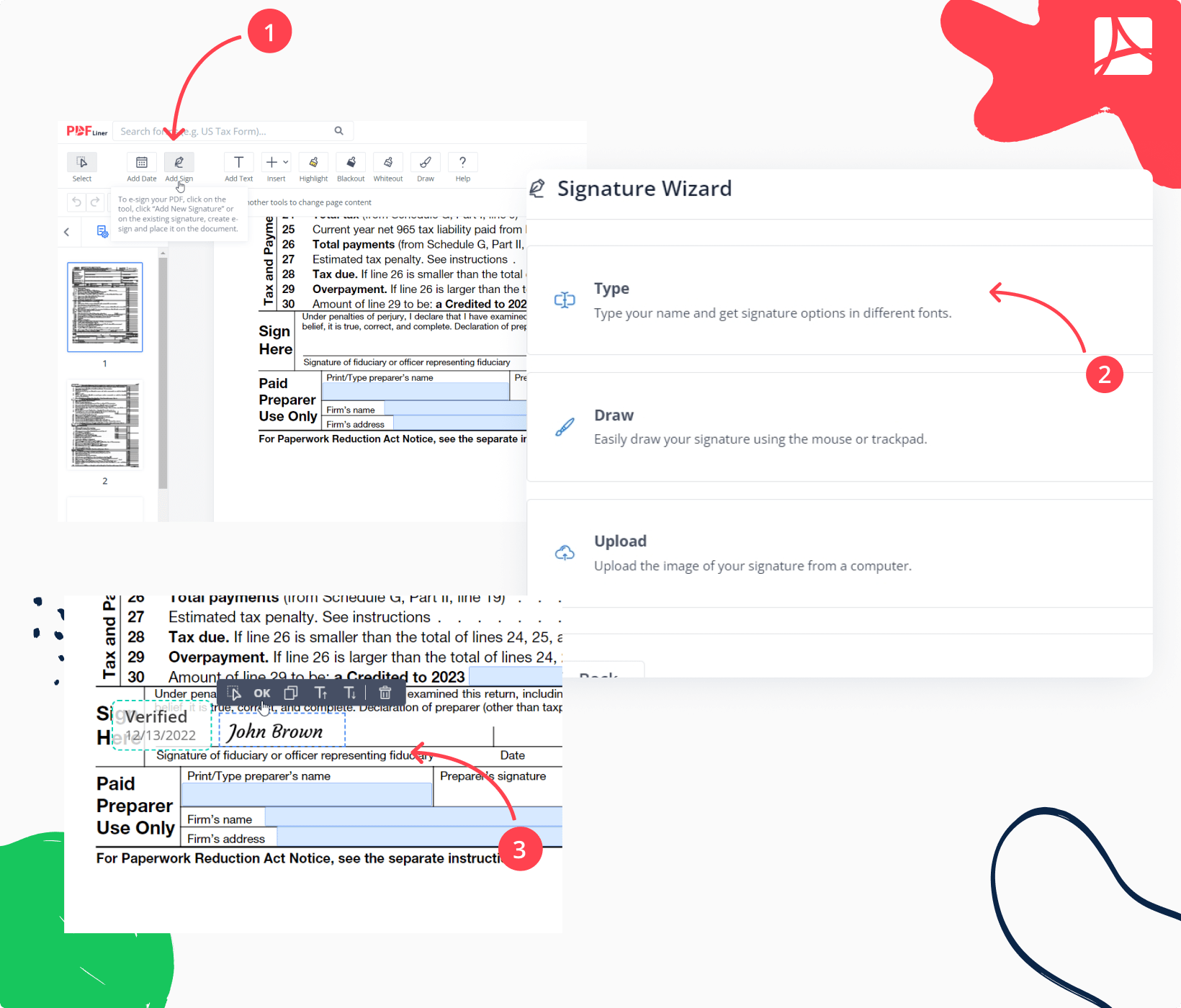

Fill Form 1041 2024 2025 Create Edit Forms Online

Fill Form 1041 2024 2025 Create Edit Forms Online

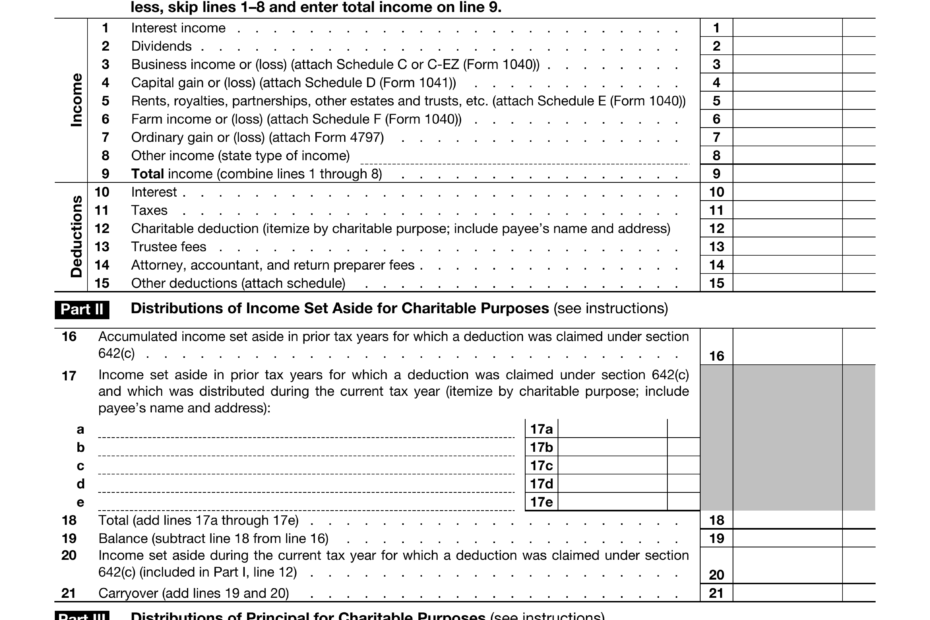

When completing Form 1041 for 2024, taxpayers must ensure that all relevant income, deductions, and credits are accurately reported. This includes information such as interest, dividends, capital gains, and other sources of income for the trust or estate. It is important to carefully review the instructions provided by the IRS to ensure that the form is completed correctly.

In addition to reporting income, Form 1041 also requires taxpayers to report any deductions or credits that may apply to the trust or estate. This could include expenses such as administrative costs, legal fees, and charitable contributions. By accurately reporting these deductions, taxpayers can minimize their tax liability and maximize their tax savings.

Once Form 1041 for 2024 has been completed, taxpayers must submit it to the IRS by the appropriate deadline. Failure to file this form on time could result in penalties and fines, so it is important to adhere to the IRS’s guidelines and deadlines. By staying organized and keeping accurate records, taxpayers can ensure that their tax obligations are met in a timely manner.

In conclusion, IRS Form 1041 for 2024 is an important document that must be filled out accurately by taxpayers with trusts and estates. By utilizing the printable version of this form provided by the IRS, taxpayers can easily report their financial information and fulfill their tax obligations. It is essential to carefully review the instructions and guidelines provided by the IRS to ensure compliance with tax laws and avoid any potential penalties or fines.