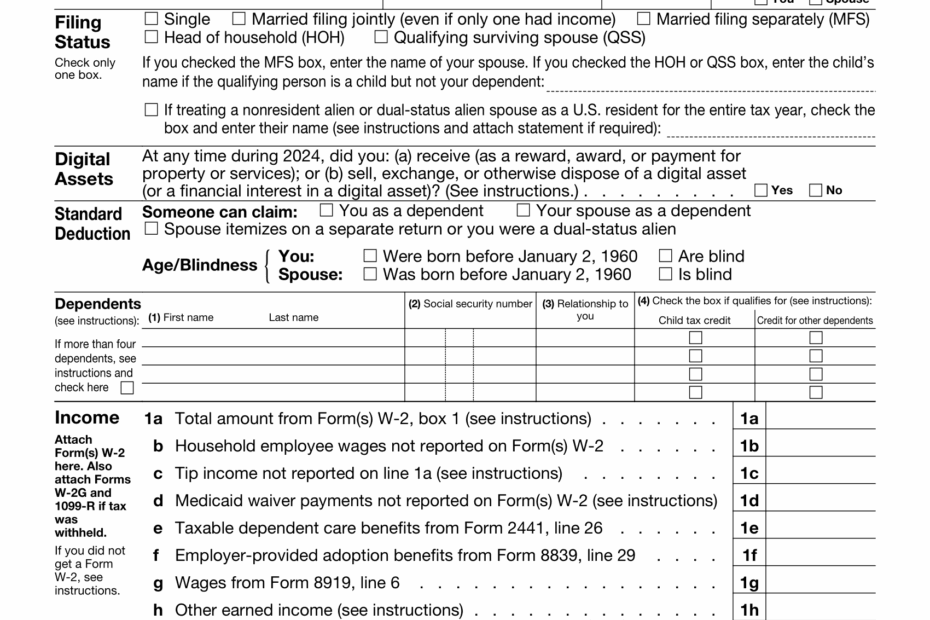

As the tax season approaches, it’s important for seniors to be aware of the changes in tax forms and instructions. The IRS Form 1040 SR is specifically designed for individuals aged 65 and older, making it easier for them to file their taxes. By understanding the instructions for this form, seniors can ensure that they are accurately reporting their income and claiming any deductions or credits they are eligible for.

One of the key features of the IRS Form 1040 SR is its simplicity. The form is streamlined and easier to read than the regular Form 1040, making it more user-friendly for seniors. The instructions for the form provide clear guidance on how to fill out each section, including how to report income from various sources such as pensions, social security, and investments.

Irs Form 1040 Sr Instructions 2025 Printable

Irs Form 1040 Sr Instructions 2025 Printable

Download and Print Irs Form 1040 Sr Instructions 2025 Printable

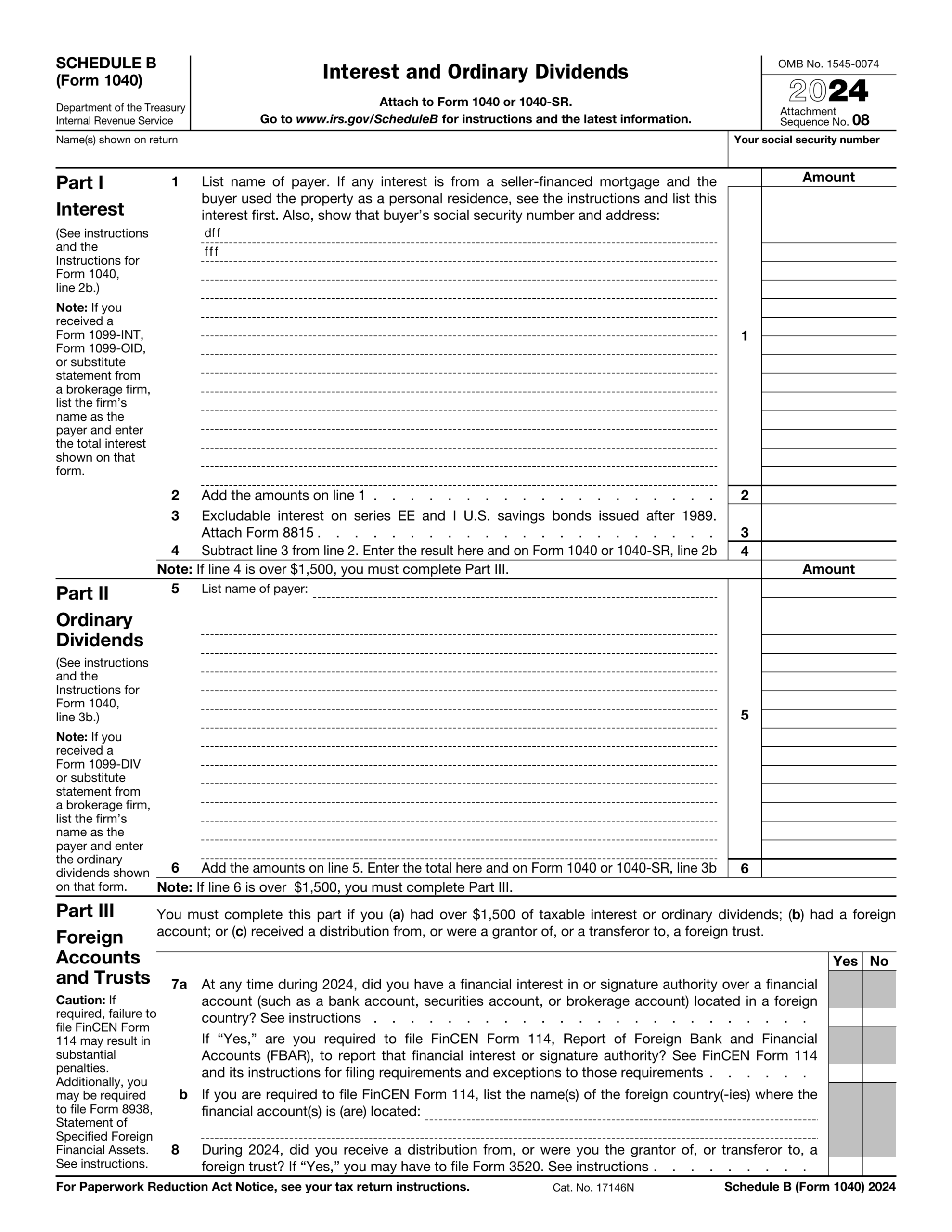

Schedule B Form 1040 2024 2025 Fill PDF Guru

Schedule B Form 1040 2024 2025 Fill PDF Guru

When filling out the Form 1040 SR, seniors should pay close attention to the instructions for reporting their income. This includes ensuring that all sources of income are accurately reported and that any deductions or credits are claimed correctly. The instructions also provide guidance on how to calculate taxable income and determine the amount of tax owed.

In addition to income reporting, the instructions for the Form 1040 SR also cover other important topics such as claiming the standard deduction, reporting capital gains and losses, and calculating any additional taxes owed. Seniors should carefully review these instructions to ensure that they are taking advantage of all available tax benefits and credits.

Overall, the IRS Form 1040 SR instructions for 2025 provide valuable guidance for seniors who are filing their taxes. By following these instructions carefully, seniors can ensure that they are accurately reporting their income and claiming all available deductions and credits. It’s important for seniors to take the time to review these instructions and seek help from a tax professional if needed to avoid any errors on their tax return.