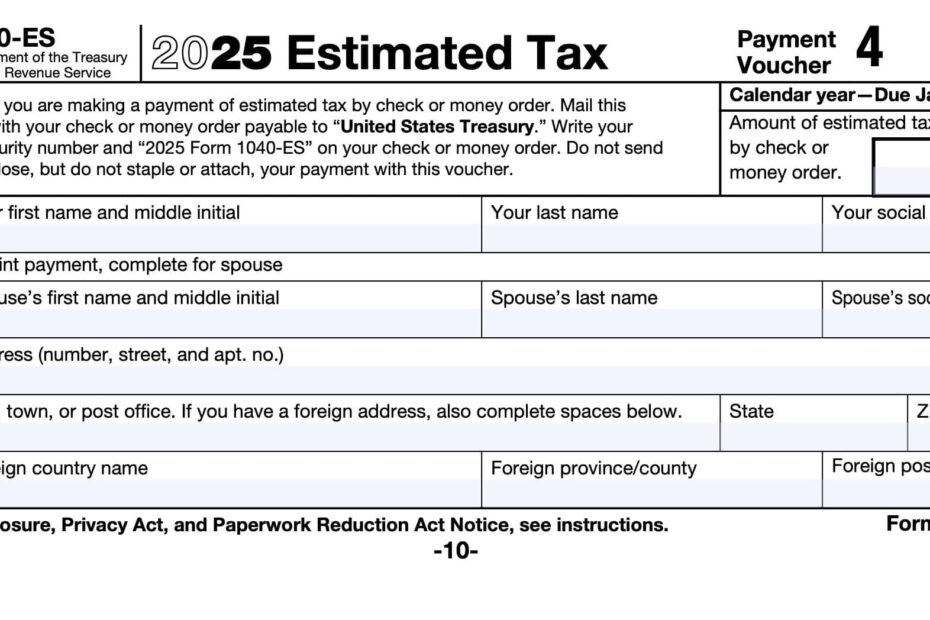

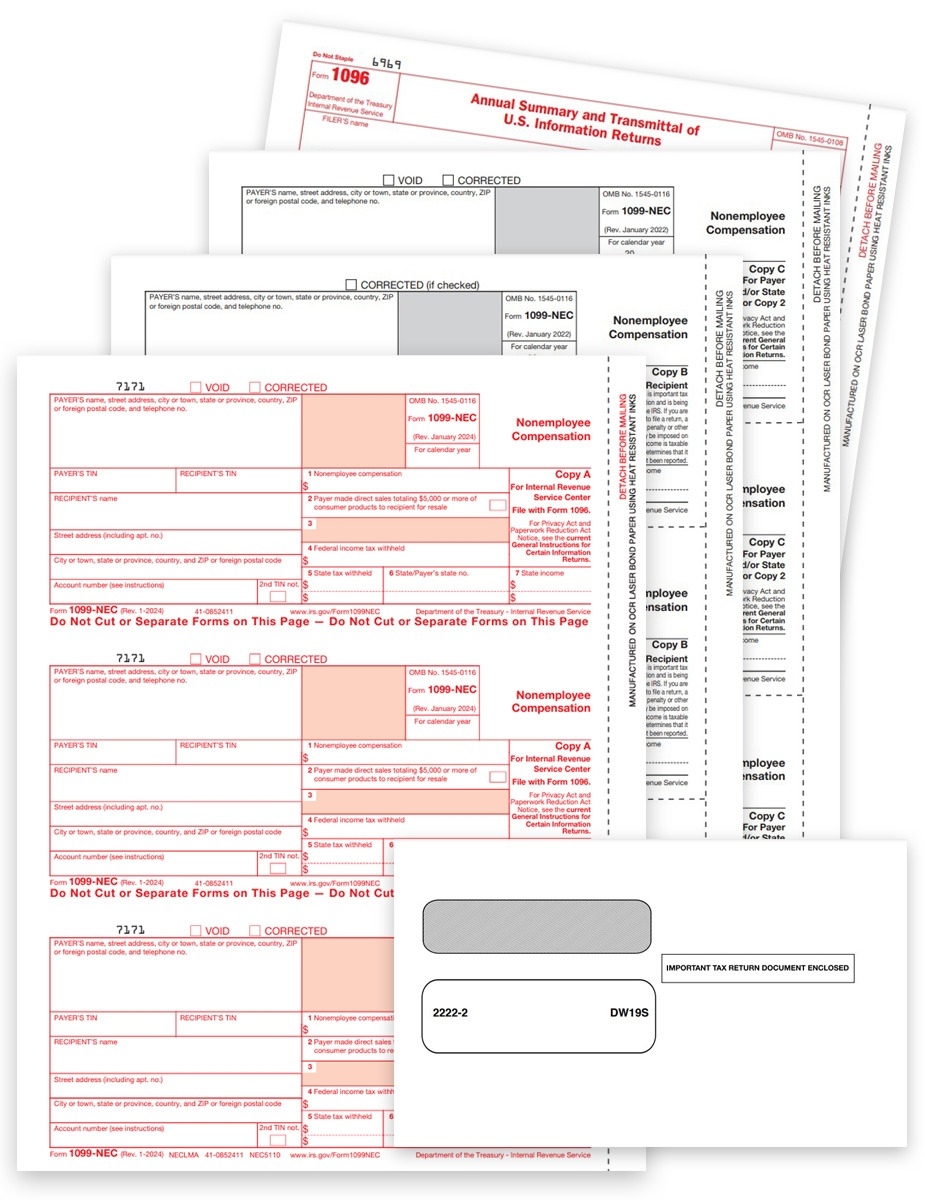

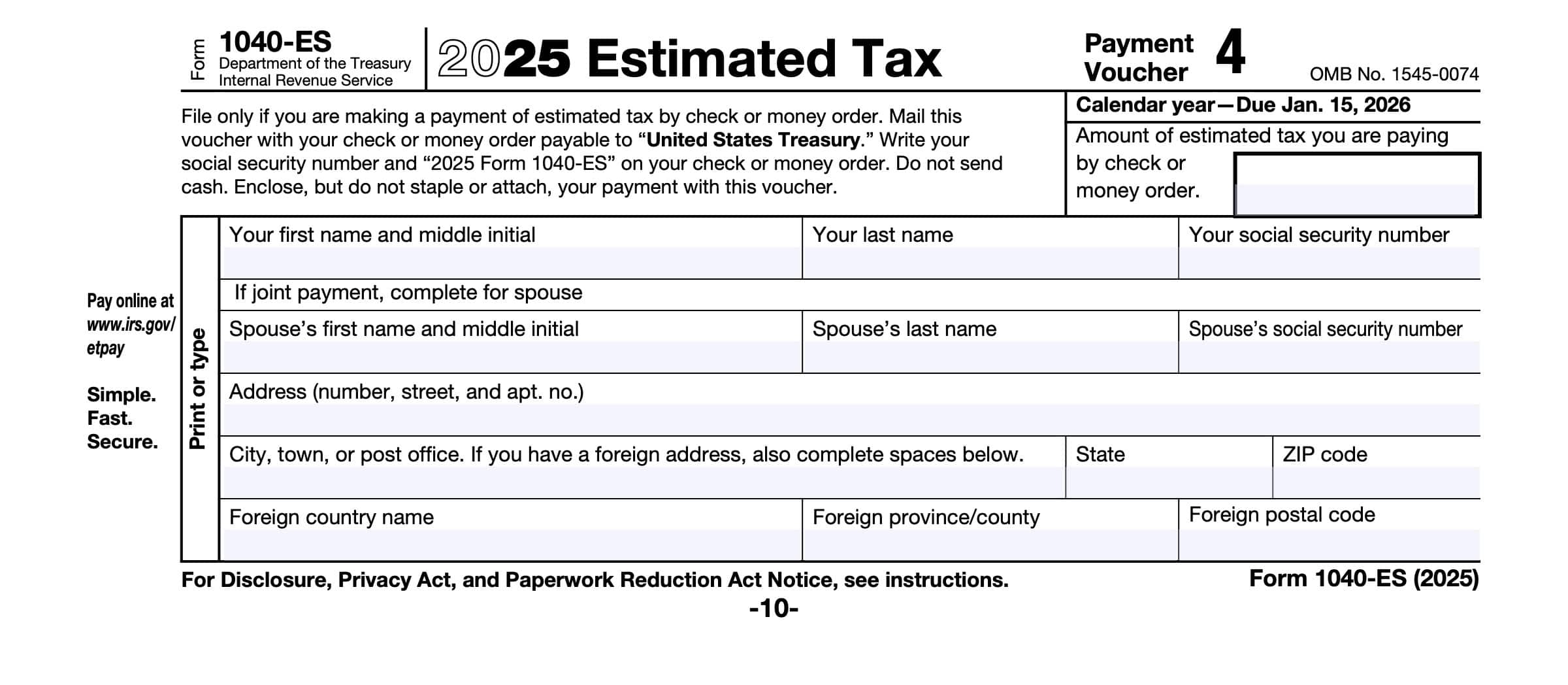

As tax season approaches, it’s important for individuals and businesses to start preparing their tax returns. One crucial document that taxpayers need to be aware of is the IRS 2025 Estimated Tax Forms. These forms are used to report and pay estimated taxes on income that is not subject to withholding, such as self-employment income, interest, dividends, and capital gains.

Printable versions of the IRS 2025 Estimated Tax Forms are readily available online, making it easy for taxpayers to access and fill out the necessary information. These forms provide a clear breakdown of the estimated tax due, as well as instructions on how to calculate and pay the correct amount. By using these printable forms, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential penalties or interest charges.

Irs 2025 Estimated Tax Forms Printable

Irs 2025 Estimated Tax Forms Printable

Easily Download and Print Irs 2025 Estimated Tax Forms Printable

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

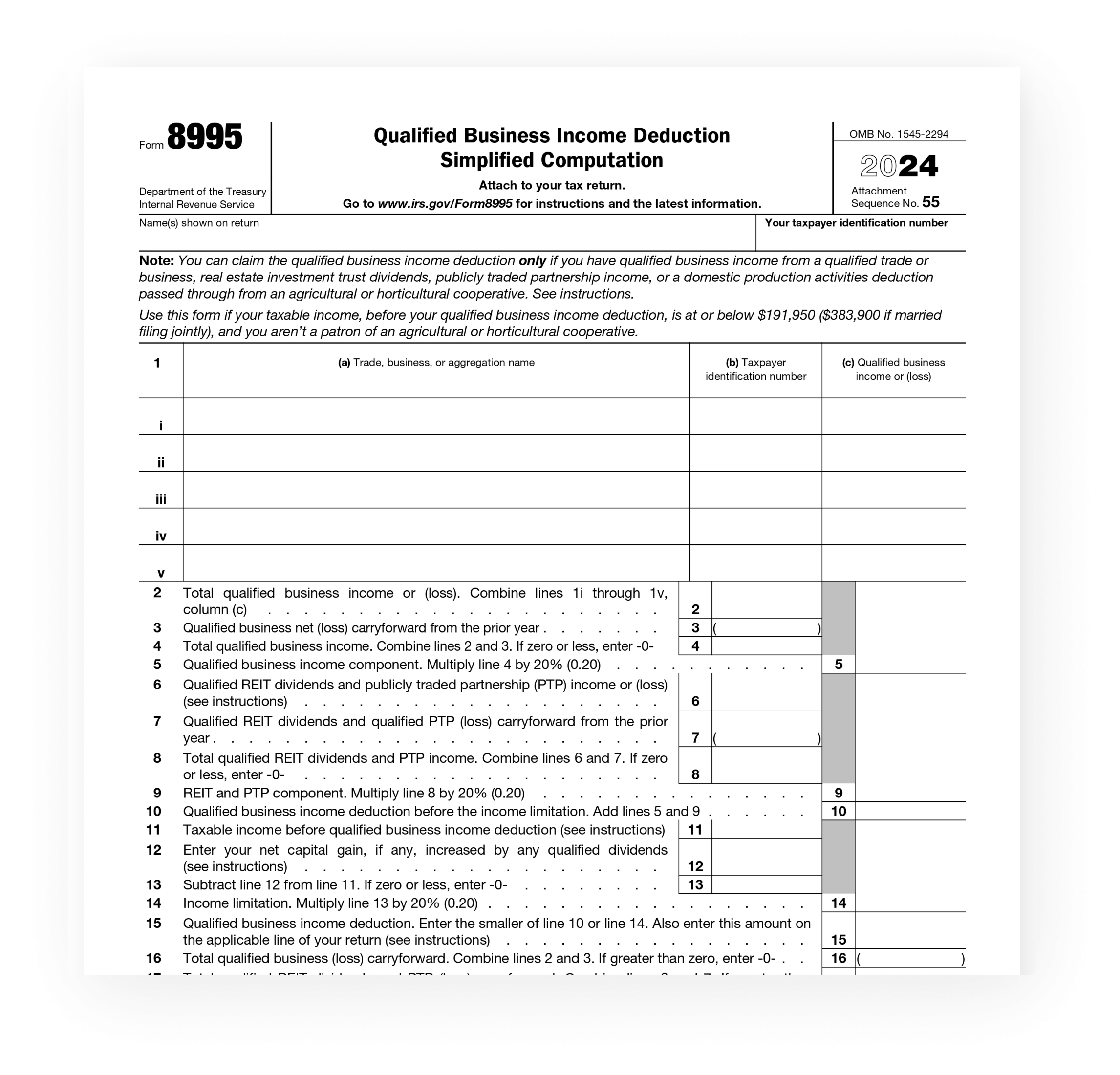

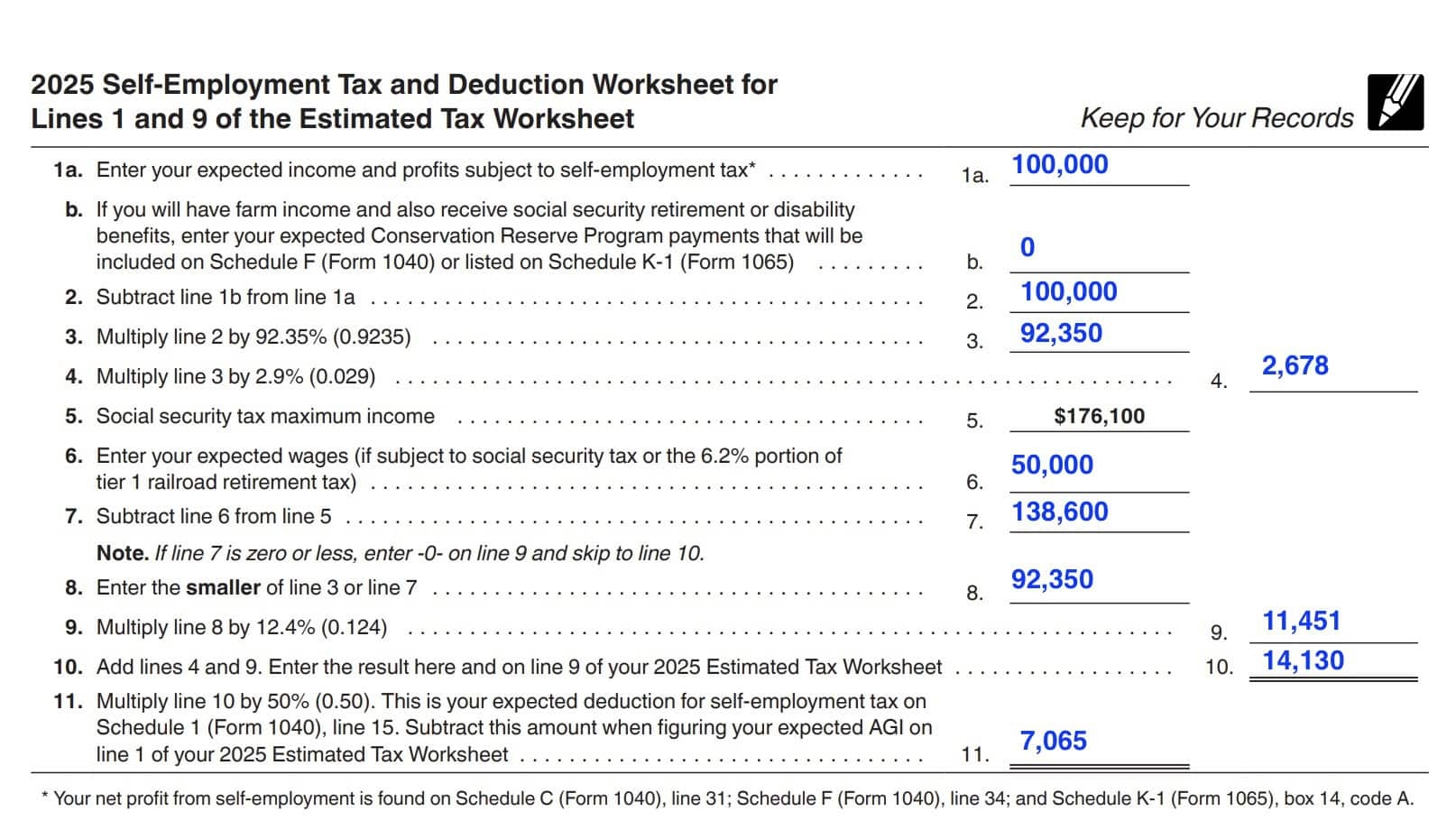

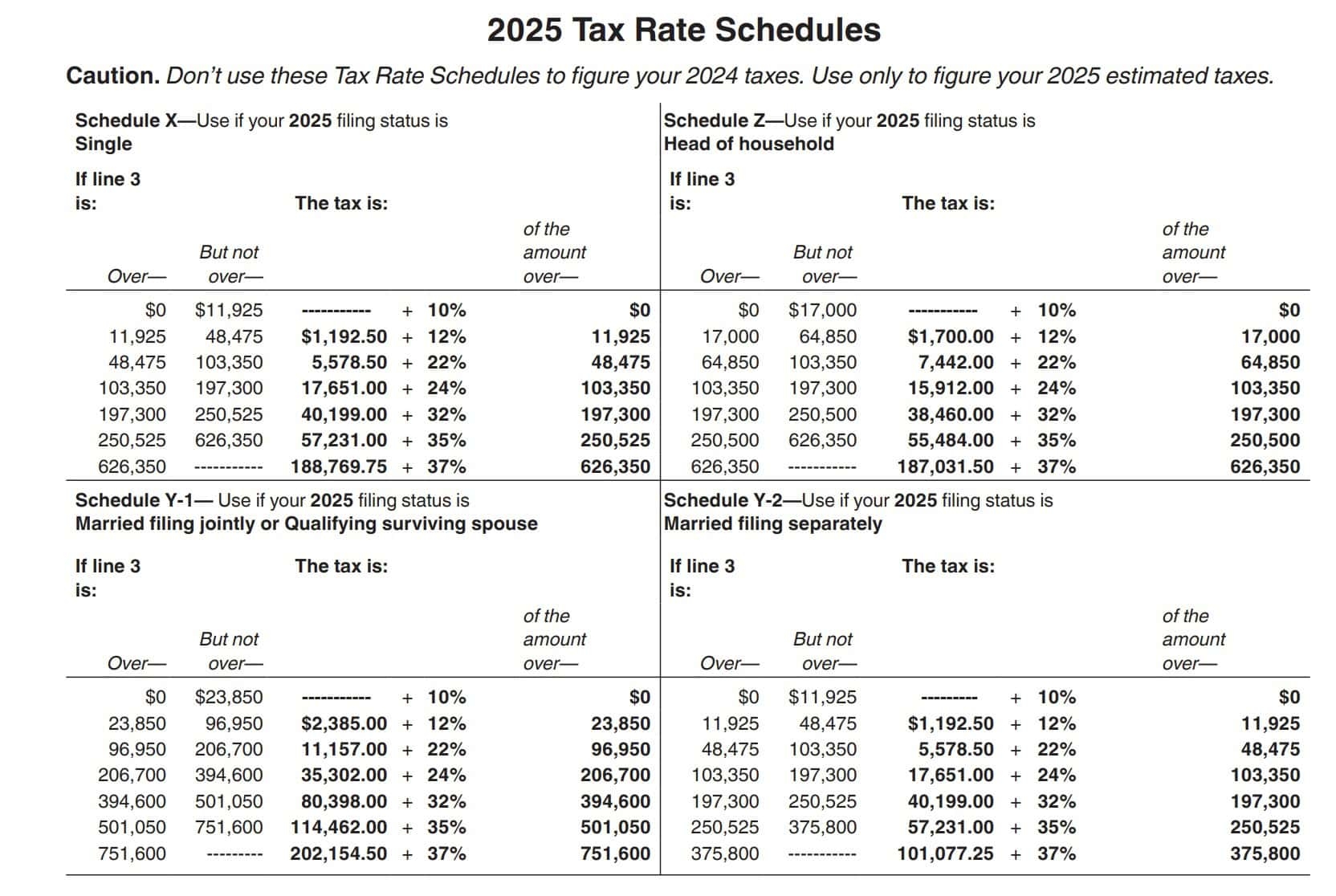

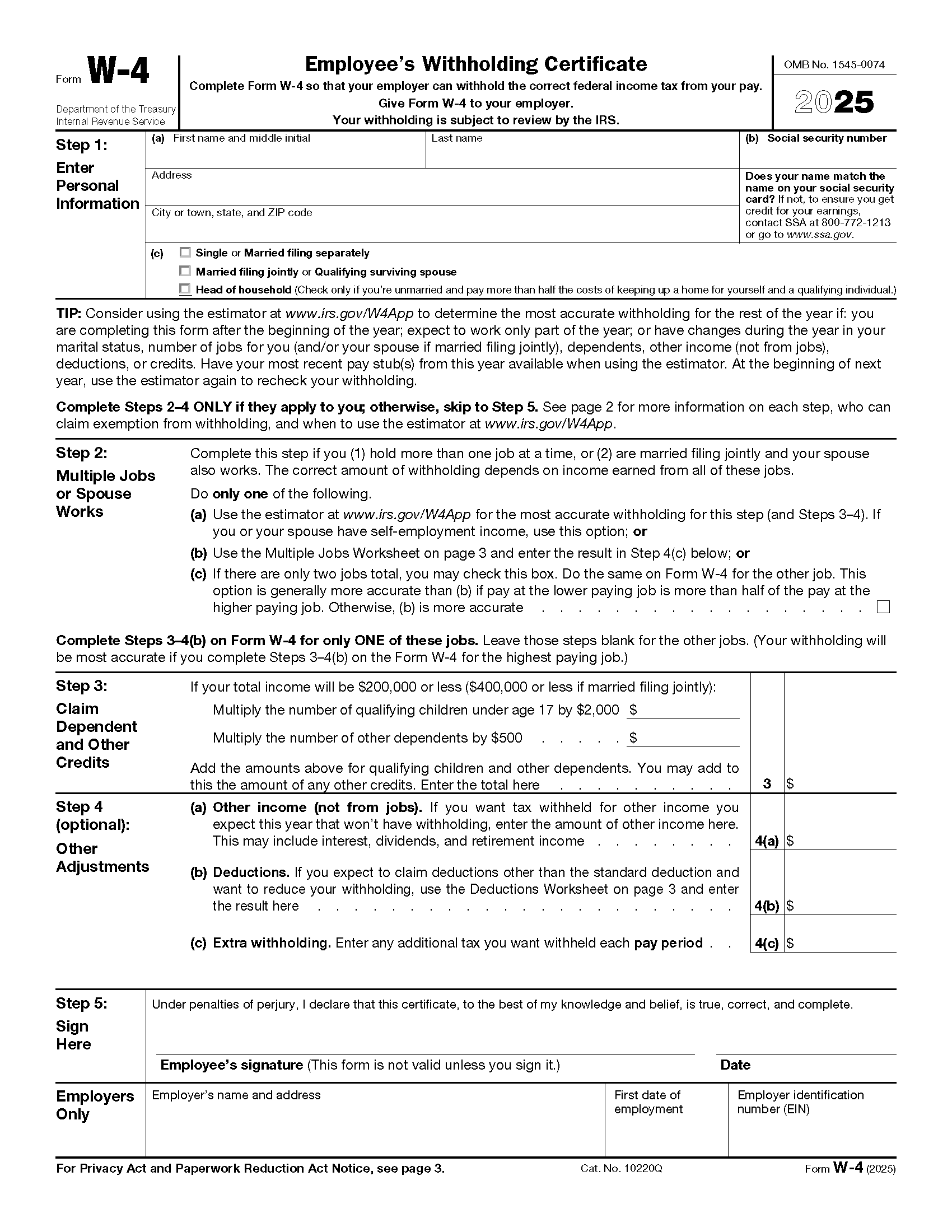

When filling out the IRS 2025 Estimated Tax Forms, taxpayers will need to provide information such as their total income, deductions, credits, and any estimated tax payments made throughout the year. It’s important to accurately calculate these figures to avoid underpayment or overpayment of taxes. Additionally, taxpayers should keep detailed records of their income and expenses to support the information provided on the forms.

Once the IRS 2025 Estimated Tax Forms have been completed, taxpayers can submit them along with any payment due by the quarterly deadlines. These deadlines typically fall on April 15, June 15, September 15, and January 15 of the following year. Failing to pay the correct amount of estimated tax by these deadlines can result in penalties and interest charges, so it’s essential to stay on top of these payments.

In conclusion, the IRS 2025 Estimated Tax Forms Printable are a valuable resource for taxpayers who need to report and pay estimated taxes on income that is not subject to withholding. By using these forms and following the instructions provided, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential penalties or interest charges. It’s important to stay organized and accurate when filling out these forms to avoid any issues with the IRS.

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

Free IRS Form W4 2024 PDF EForms

Free IRS Form W4 2024 PDF EForms

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

Need a hassle-free way to manage your money matters? The free printable checks provide a simple, secure, and personalizable option right from home. Be it for personal use, home businesses, or budgeting, printable checks help you save both time and cash without lowering security. Compatible with popular bookkeeping tools and easy to print, they’re a wise option to store-bought checks. Begin printing now and take full control of your check issuing—no waiting, zero charges. Browse our free templates and choose the one that matches your purpose. With our beginner-friendly features, managing your finances has never been this easy. Get your Irs 2025 Estimated Tax Forms Printable and streamline your check-writing process with security!.