When it comes to tax season, one of the most important forms that you may need to fill out is the IRS Printable 1099 form. This form is used to report various types of income that you have received throughout the year, such as freelance work, rental income, or interest earned on investments. It is crucial to accurately fill out this form to avoid any penalties or fines from the IRS.

Understanding the IRS Printable 1099 form is essential for individuals who receive income outside of traditional employment. This form ensures that all sources of income are properly reported to the IRS, allowing for accurate tax calculations and compliance with tax laws.

Easily Download and Print Irs Printable 1099 Form

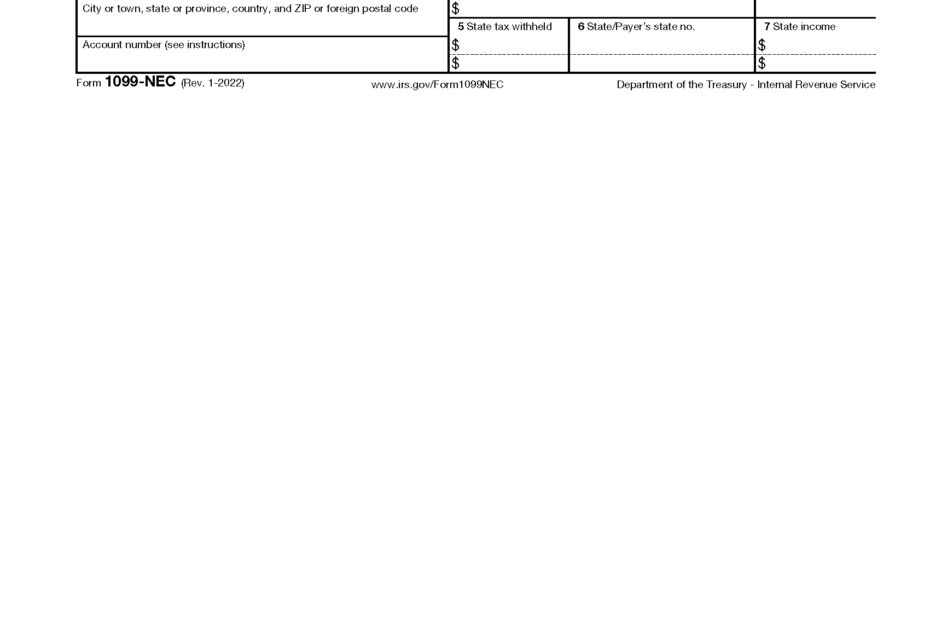

2021 Nec 1099 Forms 2024 1099 MISC Tax Forms Kit 25 Pack IRS Approved QuickBooks Compatible Tax Forms 1099

2021 Nec 1099 Forms 2024 1099 MISC Tax Forms Kit 25 Pack IRS Approved QuickBooks Compatible Tax Forms 1099

IRS Printable 1099 Form

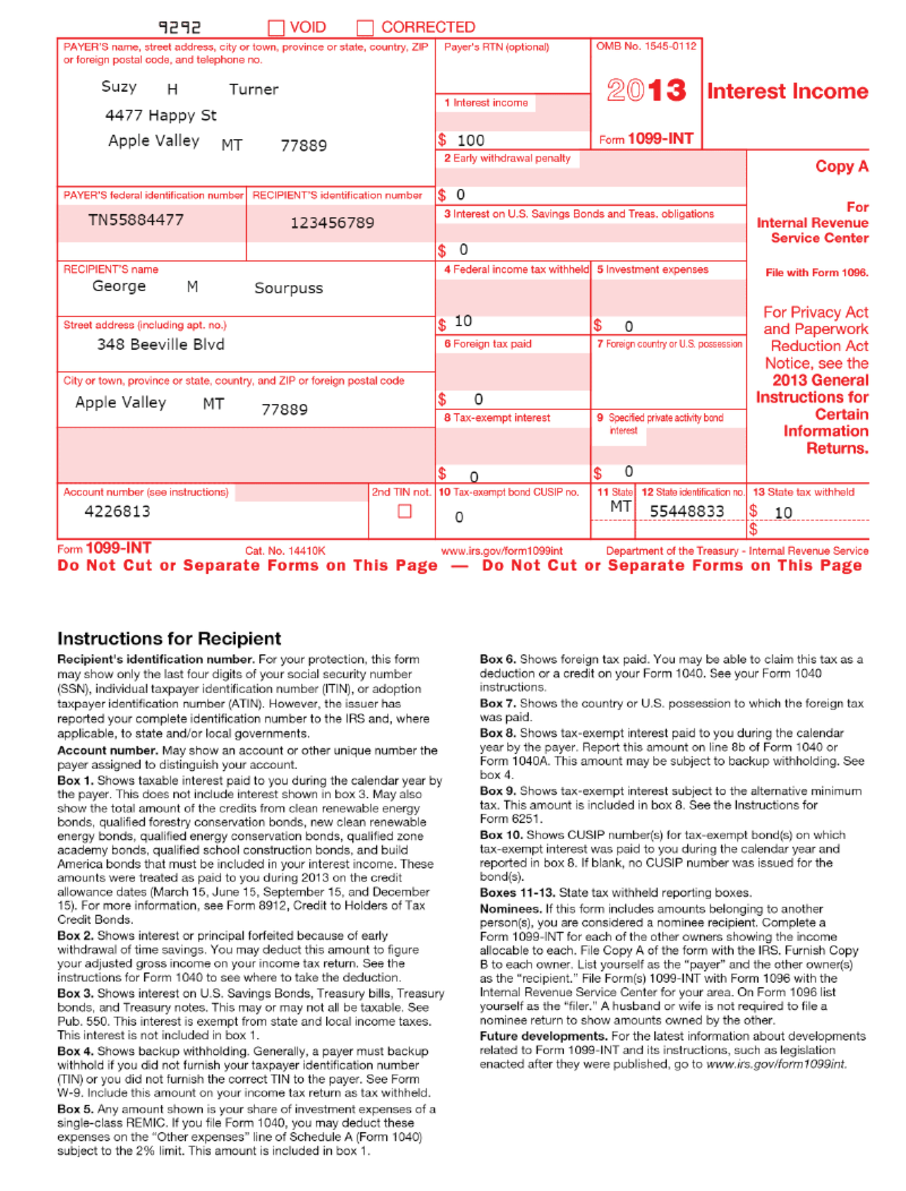

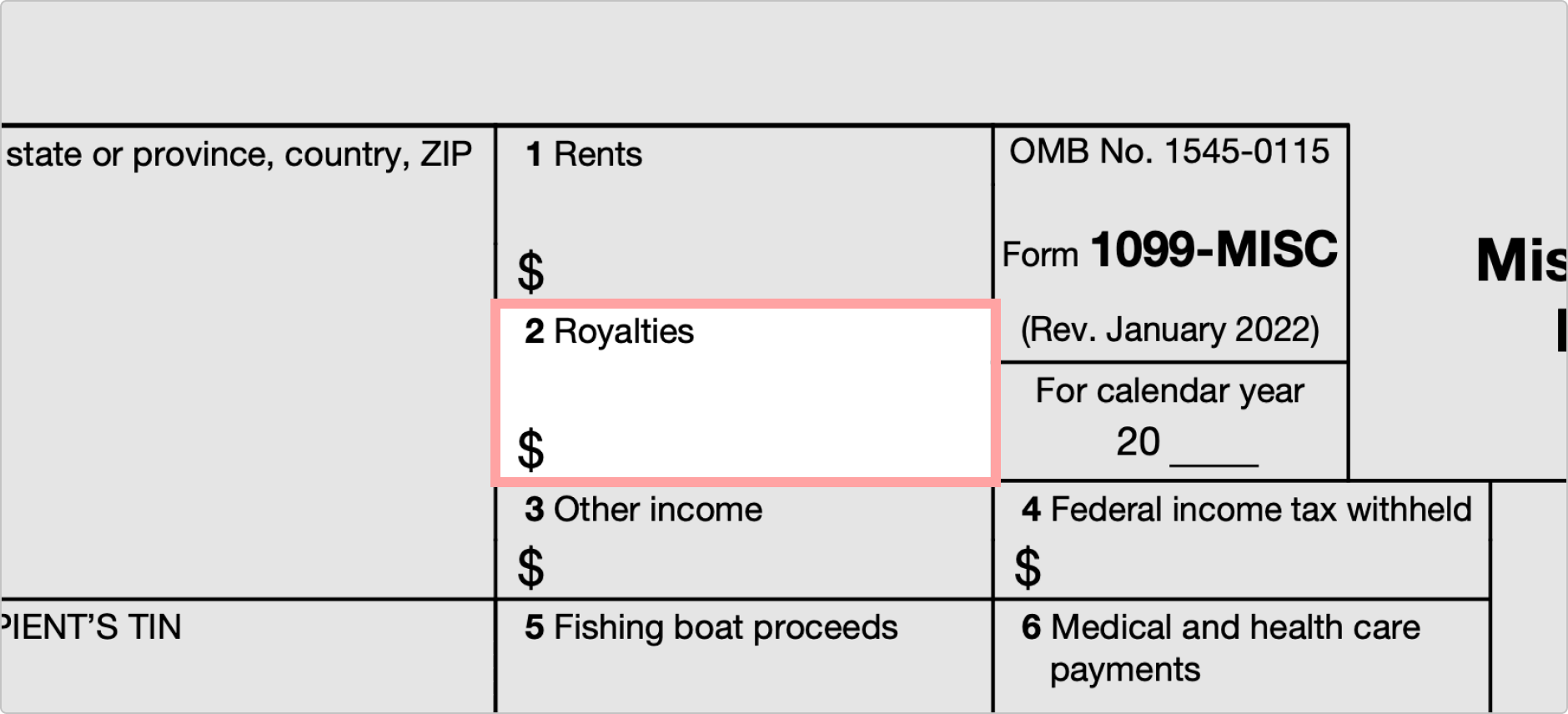

The IRS Printable 1099 form comes in several different variations, depending on the type of income that you need to report. Some common types of 1099 forms include 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income. Each form has specific instructions on how to fill it out, so it is essential to carefully read and follow these instructions to avoid any errors.

When filling out the IRS Printable 1099 form, you will need to provide information such as your name, address, social security number, and the amount of income that you received. You will also need to provide the name, address, and taxpayer identification number of the individual or business that paid you the income. Once you have completed the form, you can either file it electronically or mail it to the IRS.

It is essential to keep accurate records of all income that you receive throughout the year to ensure that you can accurately fill out the IRS Printable 1099 form. Keep track of all sources of income, including any freelance work, rental income, or investment earnings. By staying organized and keeping detailed records, you can make tax season much more manageable and less stressful.

In conclusion, the IRS Printable 1099 form is a crucial document that individuals who receive income outside of traditional employment must fill out accurately. By understanding the different types of 1099 forms and following the instructions carefully, you can ensure that all sources of income are properly reported to the IRS. Remember to keep accurate records of all income received throughout the year to make the tax filing process as smooth as possible.