When it comes to tax season, it’s important to have all the necessary forms ready to file your taxes accurately. One such form is the IRS 1096 Form, which is used to summarize and transmit information returns to the IRS. The 1096 Form is required when you are submitting forms such as 1099s, 1098s, or W-2Gs.

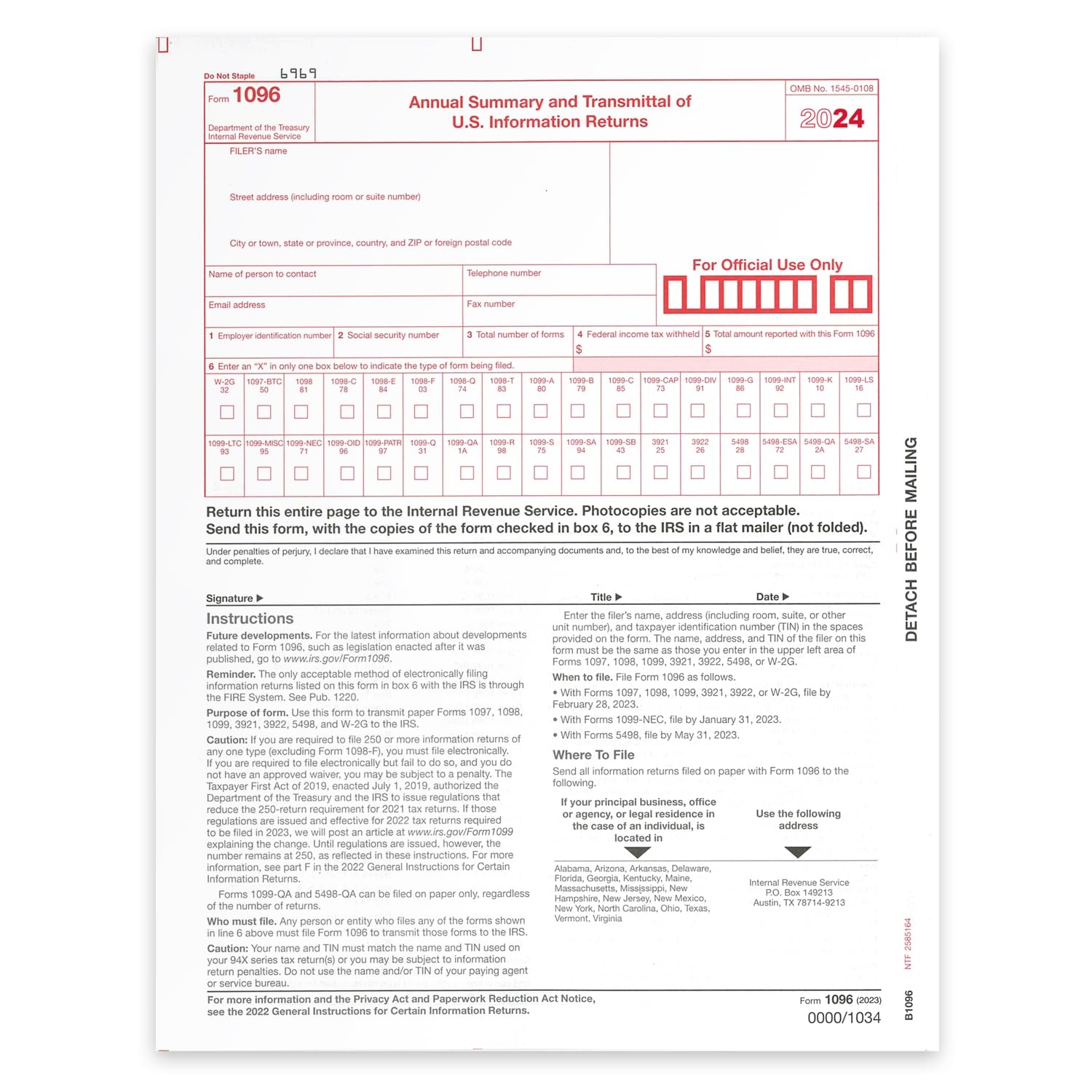

For the year 2024, the IRS has made the 1096 Form available for taxpayers to download and print for their convenience. Having the form in a printable format makes it easier for individuals and businesses to fill out the necessary information and submit it to the IRS in a timely manner.

Easily Download and Print Irs 1096 Form 2024 Printable

Amazon NextDayLabels 1096 Transmittal 2024 Tax Forms For Laser Or Inkjet Printers Quickbooks And Other Accounting Software Compatible Pack Of 10 For 2024 Office Products

Amazon NextDayLabels 1096 Transmittal 2024 Tax Forms For Laser Or Inkjet Printers Quickbooks And Other Accounting Software Compatible Pack Of 10 For 2024 Office Products

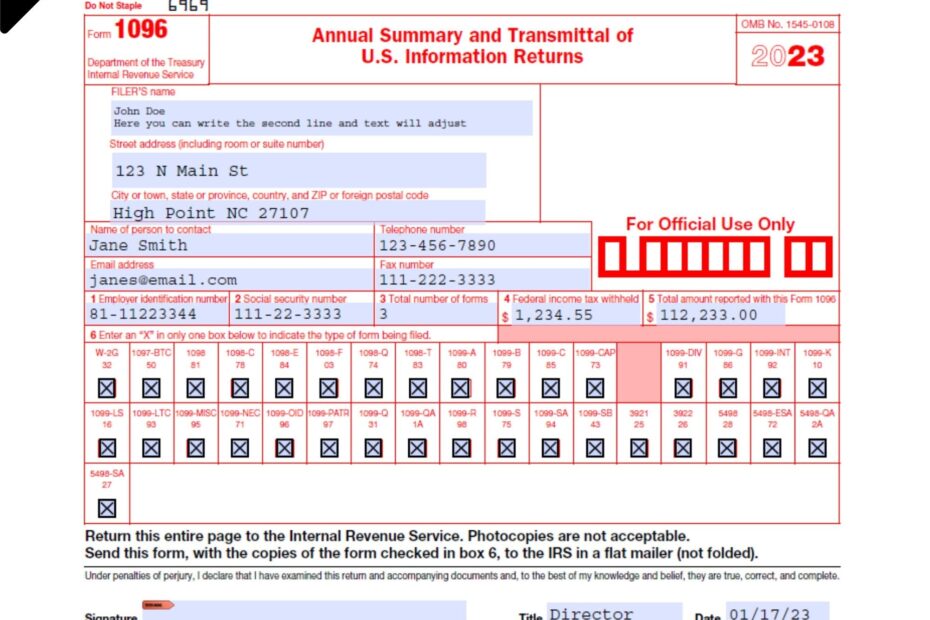

It’s important to ensure that all information on the 1096 Form is accurate and complete before submitting it to the IRS. Any errors or missing information could result in delays or penalties, so it’s crucial to double-check all details before sending it off.

When filling out the 1096 Form, be sure to include your name, address, and taxpayer identification number (TIN). You will also need to provide the total number of forms being submitted, as well as the total amount of federal income tax withheld. Once the form is completed, you can either mail it to the IRS or submit it electronically, depending on your preference.

By utilizing the IRS 1096 Form 2024 Printable, taxpayers can streamline the process of submitting information returns and ensure that they are in compliance with IRS regulations. It’s always a good idea to stay organized and keep track of all necessary forms and deadlines to avoid any issues during tax season.

Overall, the IRS 1096 Form 2024 Printable is a valuable tool for individuals and businesses who need to report information returns to the IRS. By downloading and printing the form, taxpayers can easily fill it out and submit it in a timely manner, helping to avoid any potential penalties or delays in processing. Be sure to take advantage of this resource to stay on top of your tax obligations!