As tax season approaches, it’s important for seniors to be aware of the IRS 1040 SR form. This form is specifically designed for individuals who are 65 and older, offering a simplified way to file their taxes. The IRS 1040 SR form takes into account the unique tax situations that seniors may face, such as retirement income, investment earnings, and medical expenses.

Seniors can use the IRS 1040 SR form to claim deductions and credits that are tailored to their needs, making the tax filing process easier and more efficient. By using this form, seniors can ensure that they are taking advantage of all available tax benefits and avoid any potential errors that could result in penalties or fines.

Irs 1040 Sr Form 2024 Printable

Irs 1040 Sr Form 2024 Printable

Download and Print Irs 1040 Sr Form 2024 Printable

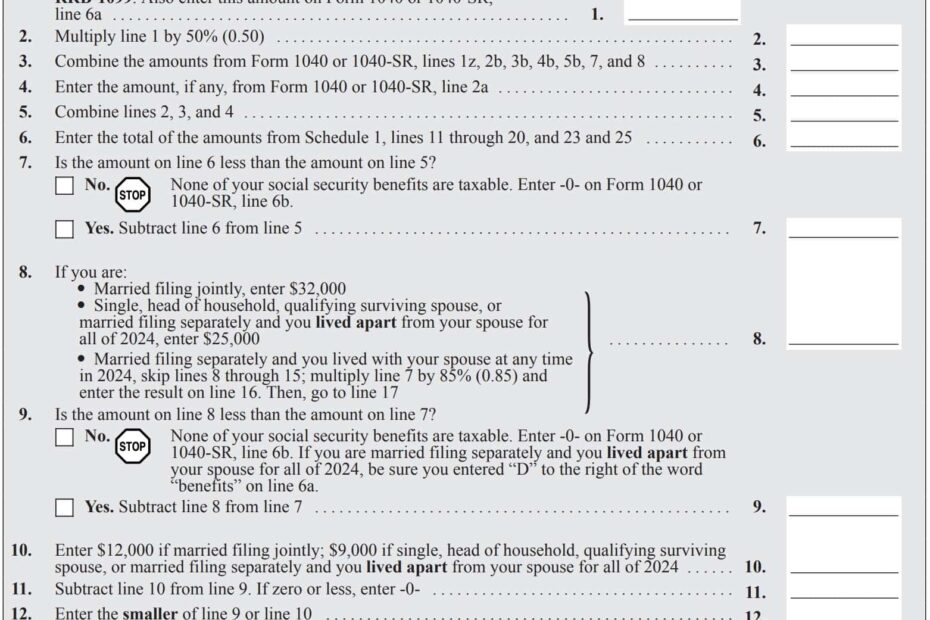

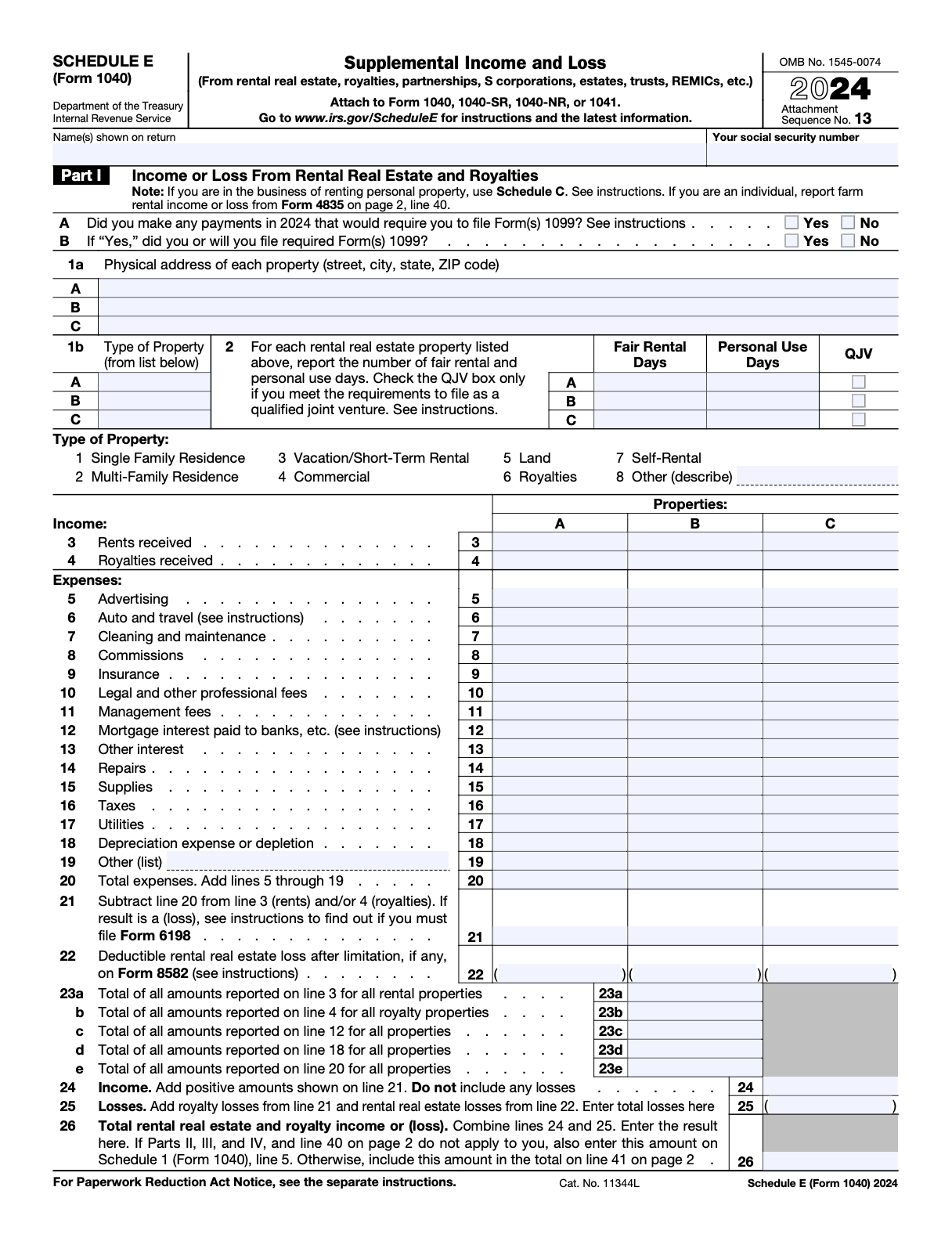

When filling out the IRS 1040 SR form, seniors will need to provide information about their income, deductions, and credits for the tax year. This form is available as a printable document on the IRS website, making it easy for seniors to access and complete at their convenience. Seniors can also seek assistance from tax professionals or volunteers if they need help with filling out the form.

It’s important for seniors to file their taxes accurately and on time to avoid any potential issues with the IRS. The IRS 1040 SR form provides seniors with a simple and straightforward way to report their income and claim any applicable tax deductions. By using this form, seniors can ensure that they are in compliance with tax laws and regulations.

Overall, the IRS 1040 SR form is a valuable resource for seniors who are looking to streamline the tax filing process. By utilizing this form, seniors can take advantage of tax benefits that are specifically designed for their age group and financial situation. With the IRS 1040 SR form, seniors can file their taxes with confidence and peace of mind.