IRS Form 9465 is used by taxpayers who are unable to pay their full tax bill to request a monthly installment plan. This form allows individuals to spread their tax payments over time, making it easier to manage their financial obligations to the IRS.

By filling out Form 9465, taxpayers can avoid potential penalties and interest charges for late payment of taxes. This form provides a structured way for individuals to communicate with the IRS about their payment plan options.

Get and Print Irs Form 9465 Printable

3 8 45 Manual Deposit Process Internal Revenue Service

3 8 45 Manual Deposit Process Internal Revenue Service

What is IRS Form 9465?

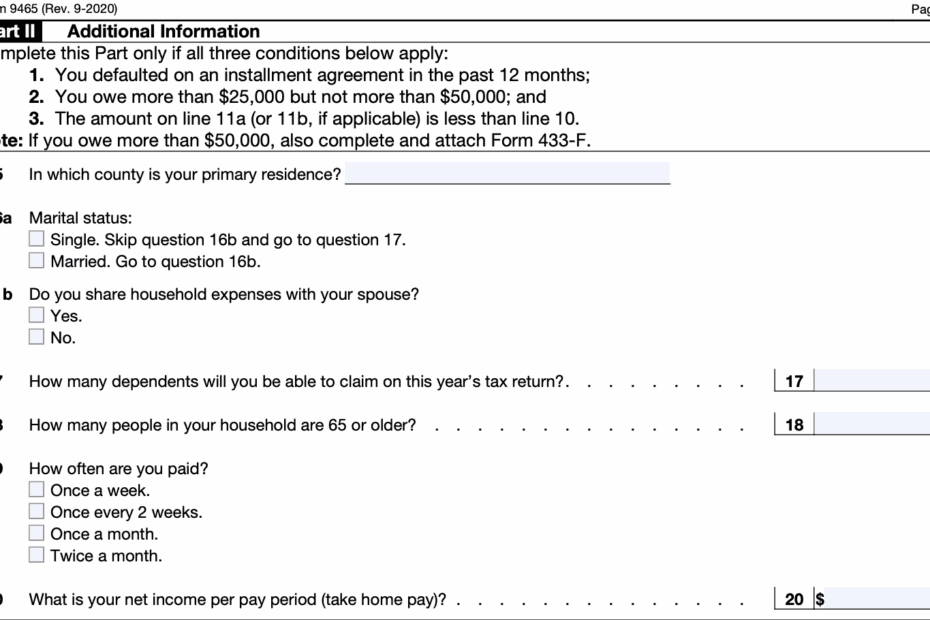

IRS Form 9465 is a request for installment agreement, which allows taxpayers to pay off their tax debt over time. The form requires individuals to provide information about their financial situation, including their income, expenses, and assets. By submitting this form, taxpayers can propose a monthly payment amount that fits within their budget.

When completing Form 9465, taxpayers should be honest and accurate in their financial disclosures. The IRS will review the information provided to determine the feasibility of the proposed payment plan. It is important to note that there may be fees associated with setting up an installment agreement.

Once Form 9465 is approved, taxpayers are required to make timely monthly payments until the full tax debt is paid off. It is essential to adhere to the terms of the installment agreement to avoid defaulting on the plan. Failure to comply with the agreement may result in additional penalties and interest charges.

Overall, IRS Form 9465 provides a valuable option for individuals who are unable to pay their tax bill in full. By requesting an installment agreement, taxpayers can effectively manage their tax obligations and avoid potential financial consequences. It is essential to carefully review and complete the form to ensure a successful payment plan with the IRS.

In conclusion, IRS Form 9465 is a helpful tool for taxpayers facing difficulty in paying their taxes. By submitting this form and proposing a monthly installment plan, individuals can effectively address their financial obligations to the IRS. It is important to be truthful and diligent when completing Form 9465 to avoid any potential issues with the installment agreement.