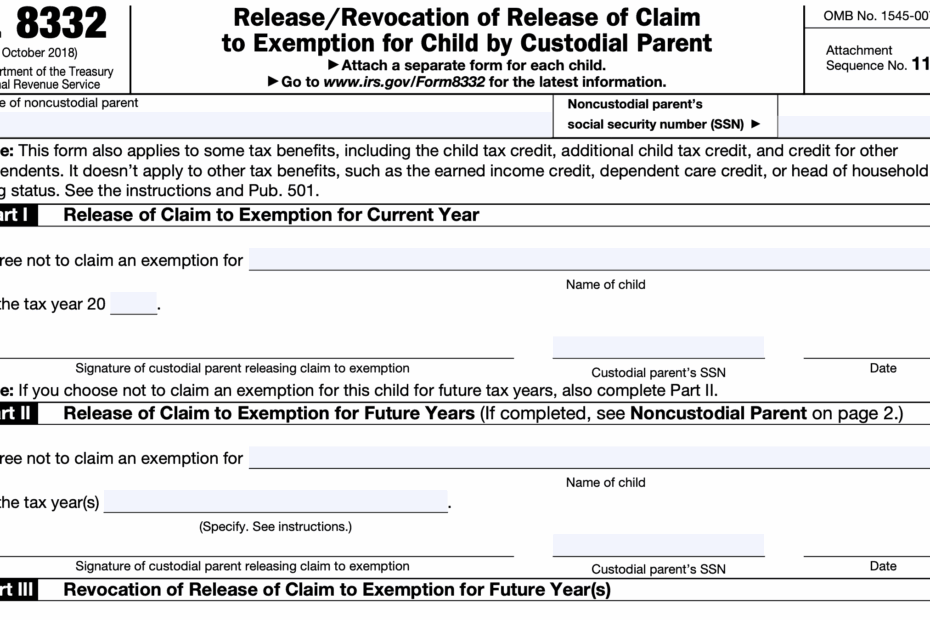

IRS Form 8332, also known as the Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent, is a crucial document for divorced or separated parents who wish to claim their child as a dependent for tax purposes. This form allows the custodial parent to release their claim to the child’s exemption, allowing the non-custodial parent to claim it instead.

It is important to note that Form 8332 must be completed and signed by the custodial parent in order for the non-custodial parent to claim the child as a dependent on their tax return. Without this form, the non-custodial parent will not be able to claim the child’s exemption.

Download and Print Irs Form 8332 Printable

Form For Non Custodial Parent Shop

Form For Non Custodial Parent Shop

When completing Form 8332, the custodial parent must provide their name, social security number, and the name of the child for whom they are releasing the claim to exemption. The form must be signed and dated by the custodial parent in order to be valid.

Once the form has been completed and signed, it should be kept for your records and submitted with your tax return when claiming the child as a dependent. The IRS may request a copy of Form 8332 as proof that the non-custodial parent is eligible to claim the child’s exemption.

It is important to follow the instructions provided on Form 8332 carefully to ensure that it is completed correctly. Failure to do so may result in delays or complications when filing your taxes. If you have any questions or concerns about Form 8332, it is recommended that you consult with a tax professional for guidance.

In conclusion, IRS Form 8332 is a valuable tool for divorced or separated parents who need to release their claim to a child’s exemption for tax purposes. By completing and submitting this form correctly, both parents can ensure that they are in compliance with IRS regulations and can avoid any potential issues when filing their taxes.