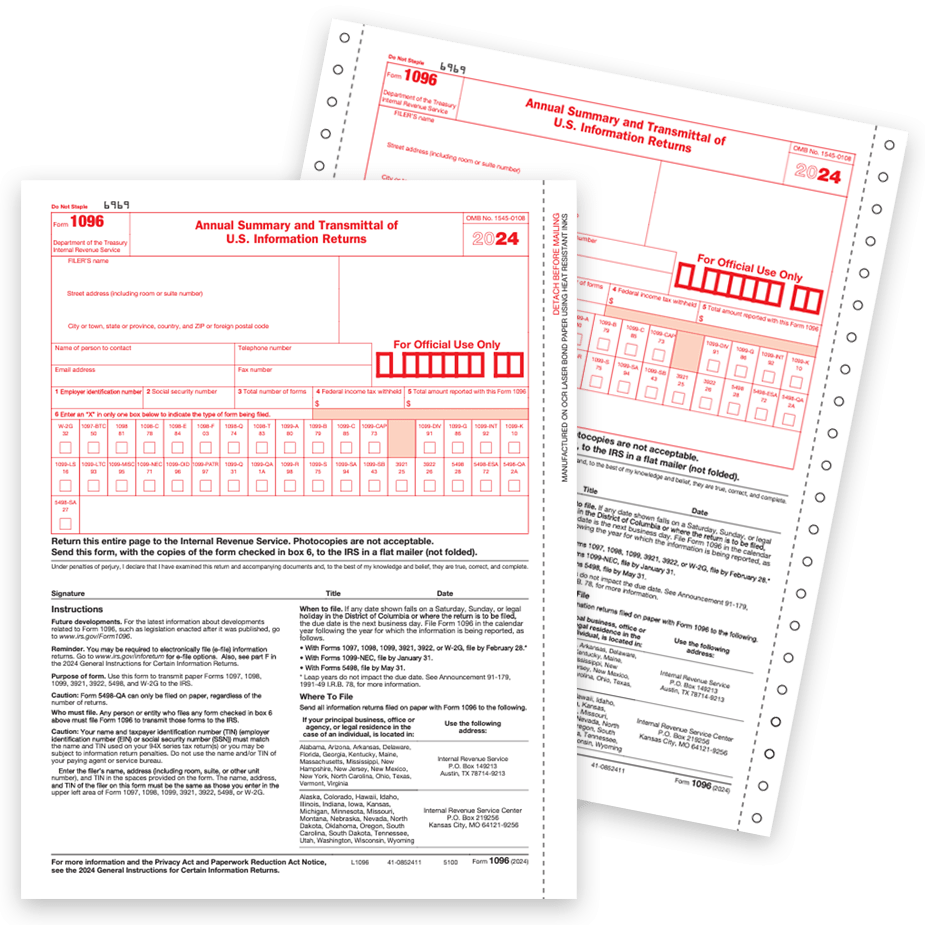

IRS Form 1096 is a summary or transmittal form that accompanies certain types of information returns sent to the Internal Revenue Service (IRS). It is used to summarize and transmit Forms 1099, 1098, 5498, and W-2G to the IRS. Form 1096 provides the IRS with information about the total number of forms being submitted, as well as the total amounts reported on those forms.

For the year 2025, the printable version of IRS Form 1096 is readily available on the IRS website. This form must be filled out accurately and submitted along with the corresponding information returns by the due date specified by the IRS. Failure to file Form 1096 or submitting inaccurate information may result in penalties imposed by the IRS.

Irs Form 1096 For 2025 Printable

Irs Form 1096 For 2025 Printable

Easily Download and Print Irs Form 1096 For 2025 Printable

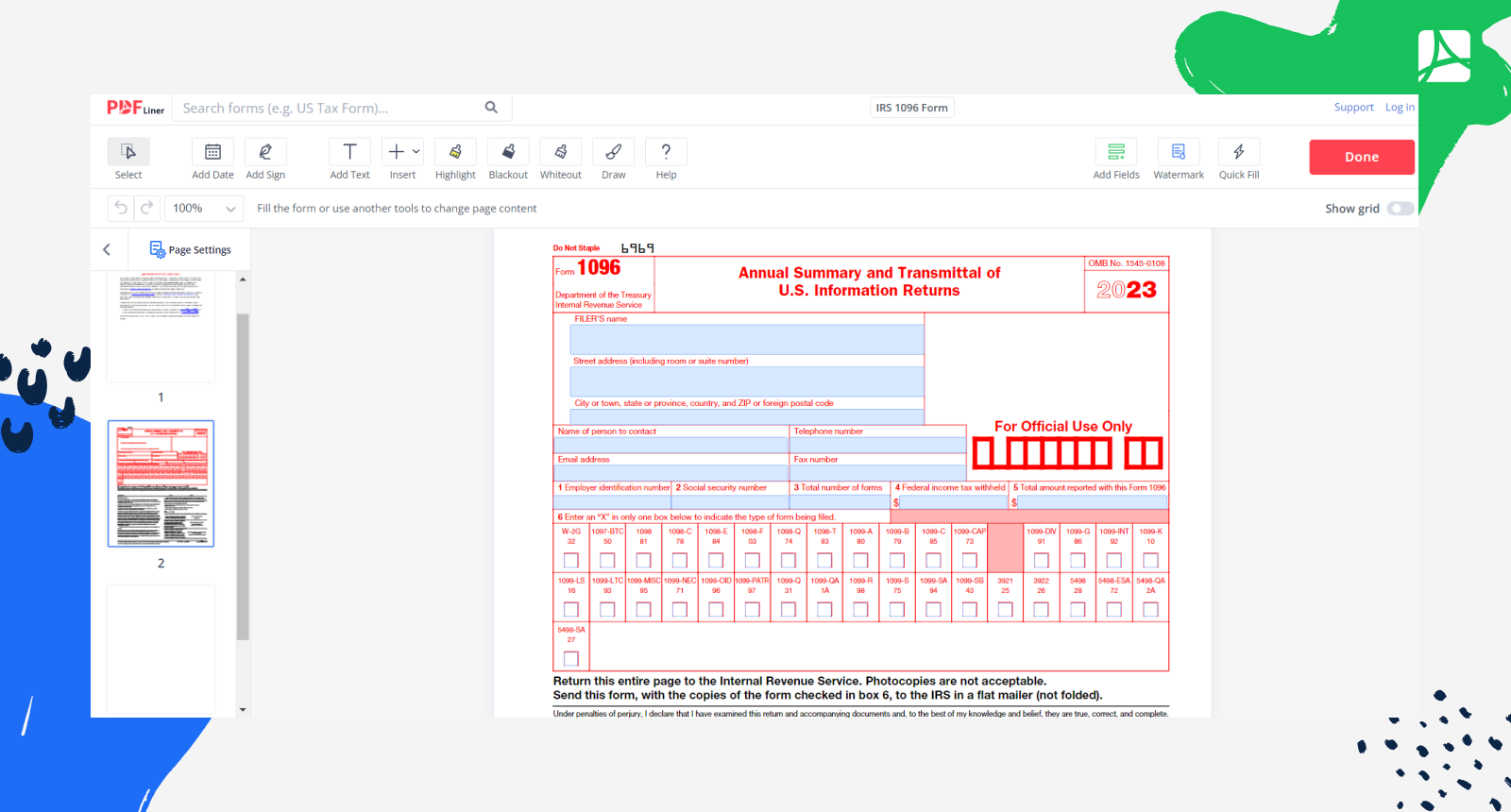

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

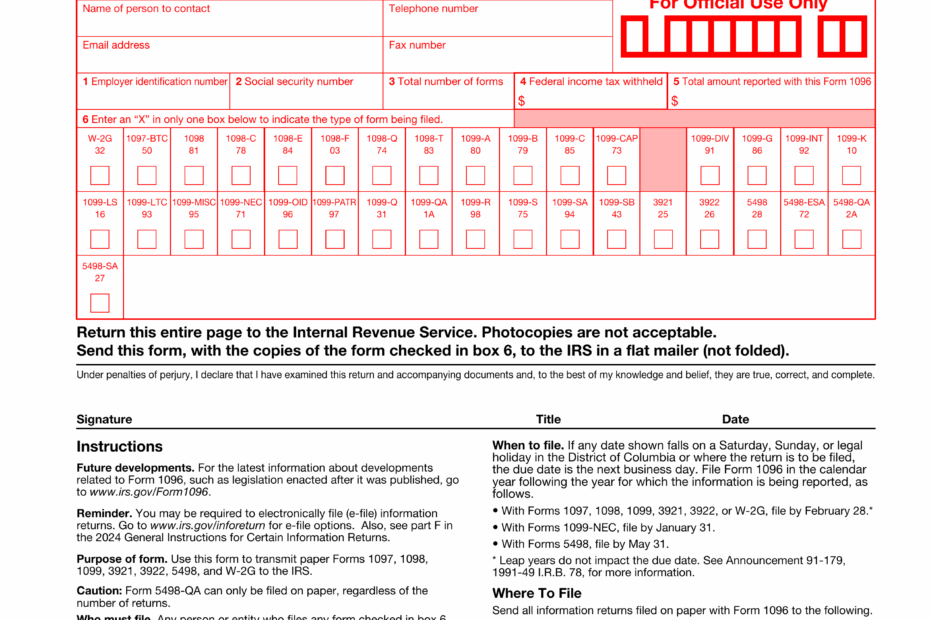

When completing Form 1096, it is important to ensure that all information is accurate and matches the information reported on the accompanying forms. This includes details such as the total number of forms being submitted, the total federal income tax withheld, and the total amount of payments made.

It is recommended to carefully review the instructions provided by the IRS for Form 1096 to ensure compliance with all requirements. Additionally, taxpayers should keep a copy of Form 1096 for their records and retain all supporting documentation related to the information returns submitted to the IRS.

As with any tax-related form, it is essential to file Form 1096 on time to avoid potential penalties and interest charges. By staying organized and keeping accurate records, taxpayers can ensure a smooth and hassle-free filing process with the IRS.

Overall, IRS Form 1096 for 2025 is an important document for summarizing and transmitting information returns to the IRS. By following the guidelines provided by the IRS and submitting the form accurately and on time, taxpayers can fulfill their reporting obligations and avoid potential penalties.