As we approach tax season in 2025, it’s important for individuals to be aware of the various forms they may need to fill out. One such form is the IRS Form 1041, which is used for reporting income earned by estates and trusts. This form is crucial for ensuring that the proper taxes are paid on any income generated by these entities.

For those who need to file IRS Form 1041 for the tax year 2025, it’s important to have access to a printable version of the form. This can make the process of filling out the form much easier and more convenient. Luckily, the IRS provides a printable version of Form 1041 on their website, making it easy for individuals to access and complete.

Irs Form 1041 For 2025 Printable

Irs Form 1041 For 2025 Printable

Save and Print Irs Form 1041 For 2025 Printable

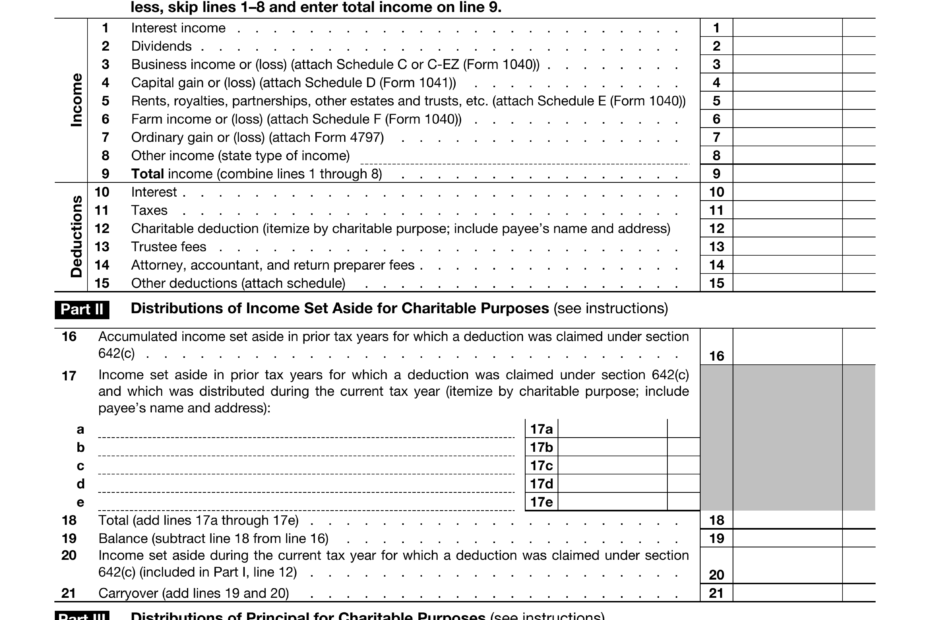

Form 1041 A U S Information Return 2024 2025 Fill PDF Guru

Form 1041 A U S Information Return 2024 2025 Fill PDF Guru

When filling out IRS Form 1041 for 2025, individuals will need to provide detailed information about the estate or trust, as well as any income earned during the tax year. This form also requires information about deductions, credits, and distributions made to beneficiaries. Having a printable version of the form can help ensure that all necessary information is accurately reported.

It’s important to note that IRS Form 1041 for 2025 must be filed by the due date, which is typically April 15th of the following year. Failure to file this form on time can result in penalties and interest being assessed. By using the printable version of the form, individuals can ensure that they meet the deadline and avoid any potential issues with the IRS.

In conclusion, IRS Form 1041 for 2025 is a crucial document for reporting income earned by estates and trusts. Having access to a printable version of the form can make the process of filling it out much easier and more convenient. By ensuring that all necessary information is accurately reported and filed on time, individuals can avoid potential penalties and ensure compliance with tax laws.