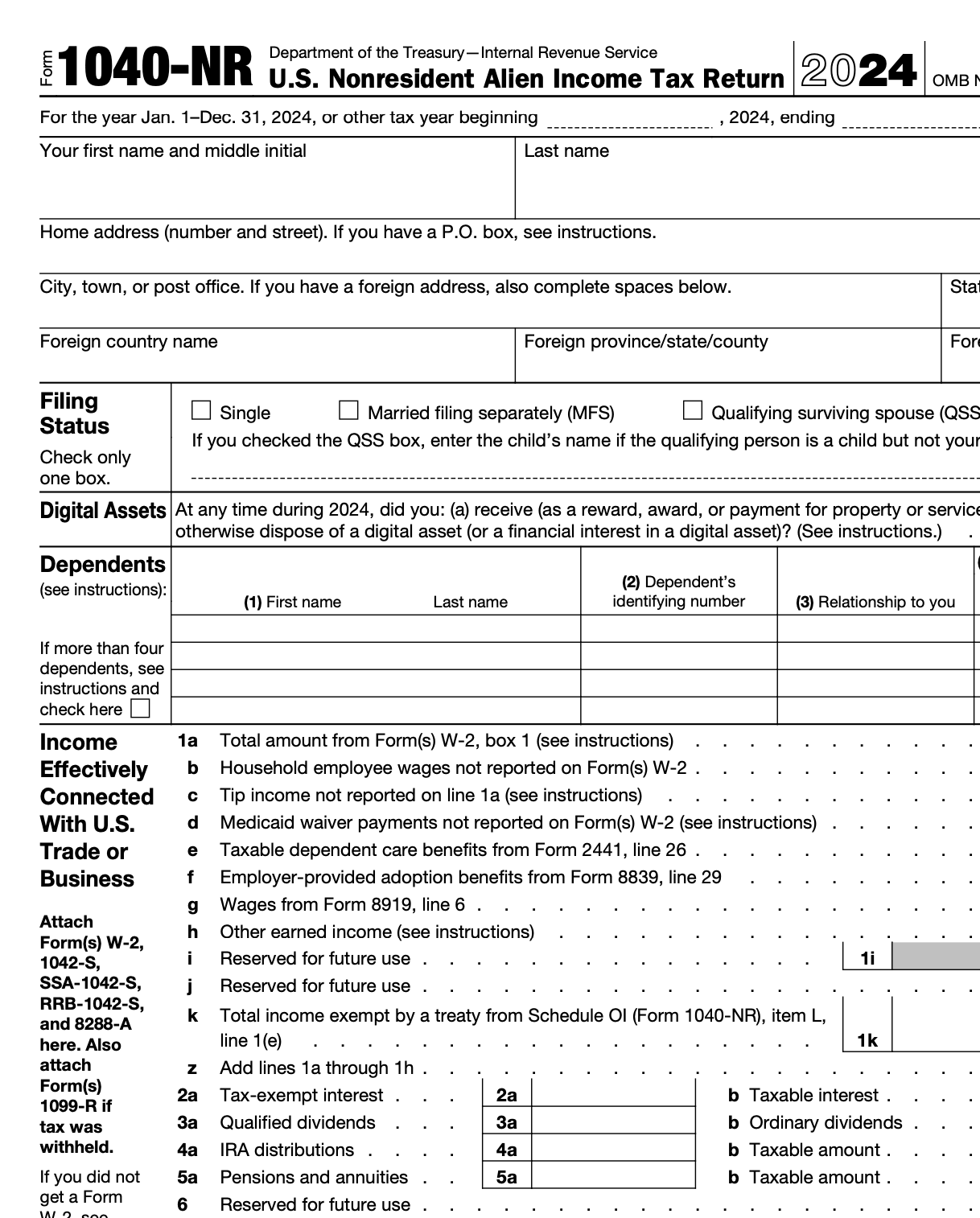

The Tax Form 1040 is one of the most commonly used forms by individuals to file their annual income tax returns with the IRS. This form is used to report various sources of income, deductions, and credits to calculate the tax liability or refund owed to the taxpayer.

Form 1040 is typically due by April 15th of each year for the previous tax year. However, there are instances where the deadline may be extended due to various circumstances, such as natural disasters or other emergencies.

Save and Print Tax Form 1040 Printable

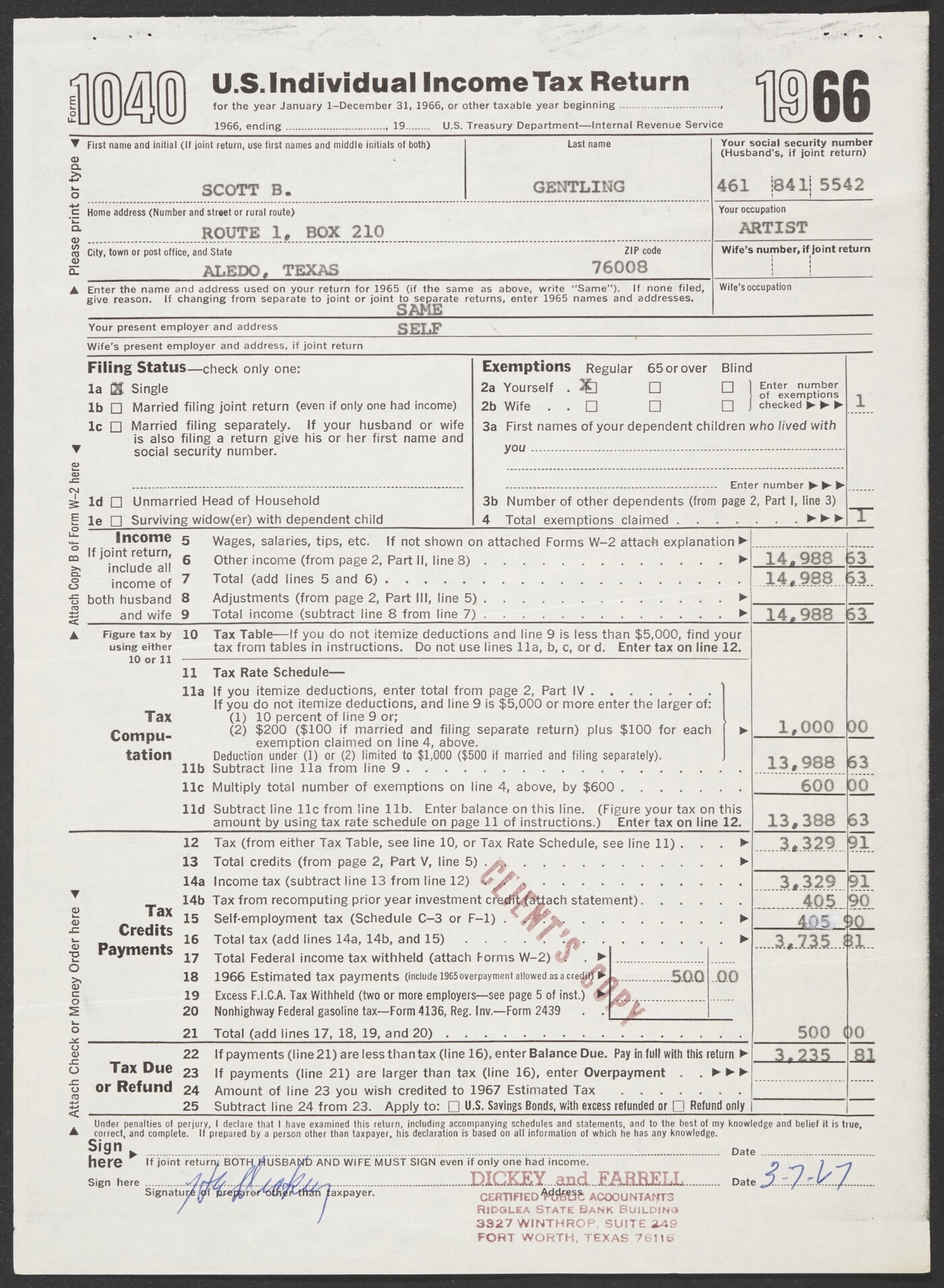

Form 1040 U S Individual Income Tax Return For Scott Gentling March 7 1967 Amon Carter Museum Of American Art

Form 1040 U S Individual Income Tax Return For Scott Gentling March 7 1967 Amon Carter Museum Of American Art

Benefits of Using Tax Form 1040 Printable

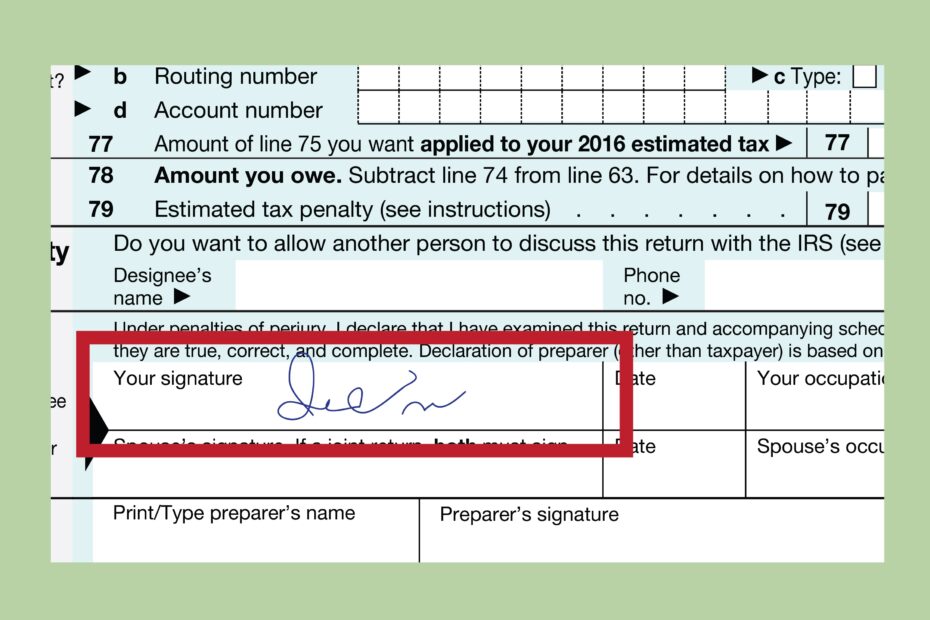

One of the key benefits of using the printable version of Form 1040 is convenience. Taxpayers can easily access and download the form from the IRS website, fill it out electronically, and then print and mail it to the IRS. This saves time and reduces the chances of errors that may occur when filling out the form by hand.

Another advantage of using the printable version is that it provides a clear and organized layout for taxpayers to input their financial information. The form is designed to guide taxpayers through the process of reporting income, deductions, and credits, making it easier to ensure that all necessary information is included.

Additionally, using the printable version of Form 1040 allows taxpayers to save a copy of their completed return for their records. This can be helpful in the future for reference or in the event of an audit by the IRS.

Overall, Tax Form 1040 Printable offers a user-friendly and efficient way for individuals to file their taxes accurately and on time. By utilizing this form, taxpayers can ensure compliance with IRS regulations and avoid potential penalties for late or incorrect filings.

In conclusion, Tax Form 1040 Printable is a valuable tool for individuals to fulfill their tax obligations and report their financial information to the IRS. By taking advantage of the benefits of using the printable version, taxpayers can streamline the filing process and minimize the risk of errors. It is important to ensure that all information is accurately reported on the form to avoid any issues with the IRS.