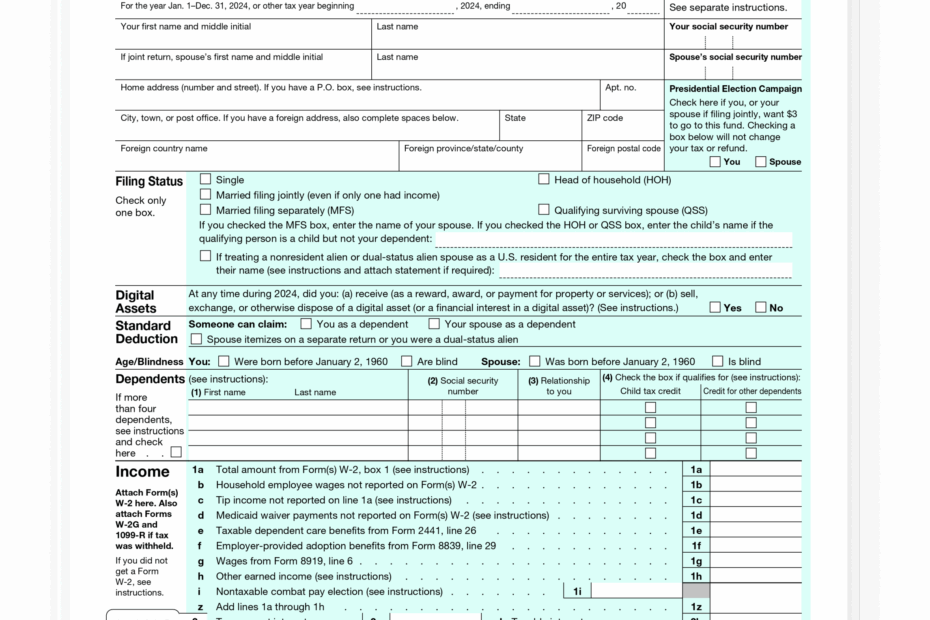

Printable Form 1040 is a standard form issued by the Internal Revenue Service (IRS) in the United States for taxpayers to report their annual income and calculate their tax liability. This form is used by individuals to file their federal income tax returns and is one of the most commonly used forms for this purpose.

It is essential for taxpayers to accurately complete Form 1040 to ensure compliance with tax laws and regulations. This form allows taxpayers to report various types of income, deductions, and credits, which ultimately determine the amount of tax they owe or the refund they are entitled to receive.

Get and Print Printable Form 1040

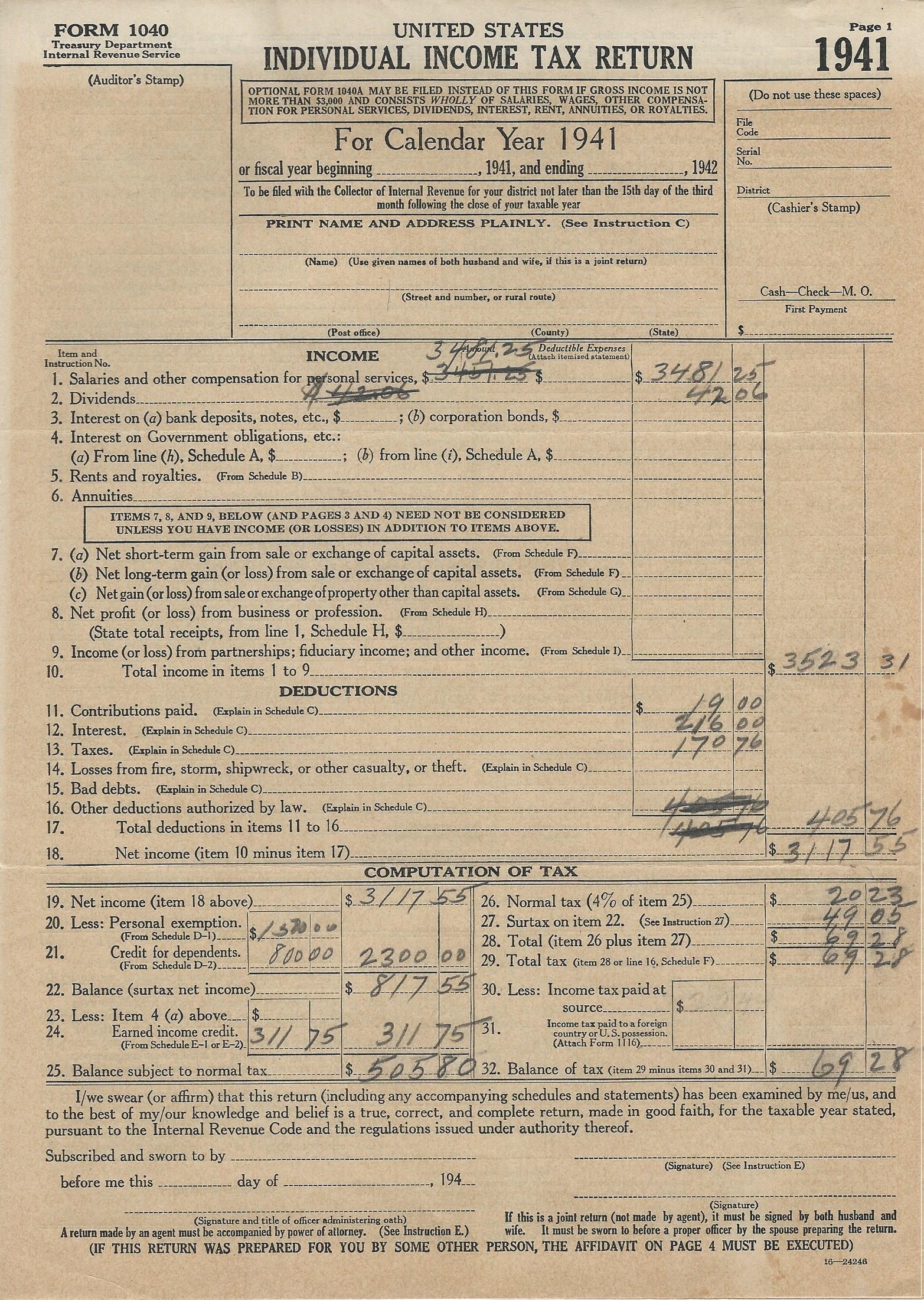

File Form 1040 1941 Jpg Wikimedia Commons

File Form 1040 1941 Jpg Wikimedia Commons

Printable Form 1040

Form 1040 consists of several sections that require taxpayers to provide detailed information about their income, deductions, and credits. Some of the key sections on this form include:

1. Personal Information: Taxpayers are required to provide their name, address, Social Security number, and filing status on Form 1040.

2. Income: Taxpayers must report all sources of income, including wages, salaries, dividends, and capital gains, on this form. They are also required to report any income from self-employment, rental properties, and other sources.

3. Deductions: Taxpayers can claim various deductions on Form 1040, such as mortgage interest, state and local taxes, and charitable contributions. These deductions help reduce the taxpayer’s taxable income.

4. Credits: Form 1040 also allows taxpayers to claim various tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. These credits directly reduce the amount of tax owed by the taxpayer.

5. Tax Calculation: Once all income, deductions, and credits have been reported, taxpayers can calculate their tax liability using the tax tables provided by the IRS. The final amount of tax owed or refund due is then entered on Form 1040.

In conclusion, Printable Form 1040 is a crucial document for taxpayers to accurately report their income and calculate their tax liability. By understanding the various sections of this form and providing the required information, taxpayers can ensure compliance with tax laws and regulations. It is important to carefully review Form 1040 before filing to avoid any errors or omissions that could result in penalties or additional taxes owed.