As the tax season approaches, many individuals and businesses are starting to gather their financial documents in preparation for filing their taxes. One important aspect of this process is obtaining the necessary tax forms to accurately report income, deductions, and credits to the Internal Revenue Service (IRS).

For the year 2024, the IRS has released a variety of federal tax forms that can be easily accessed and printed from their official website. These forms are essential for taxpayers to fulfill their legal obligations and avoid penalties for non-compliance.

2024 Federal Tax Forms Printable

2024 Federal Tax Forms Printable

Easily Download and Print 2024 Federal Tax Forms Printable

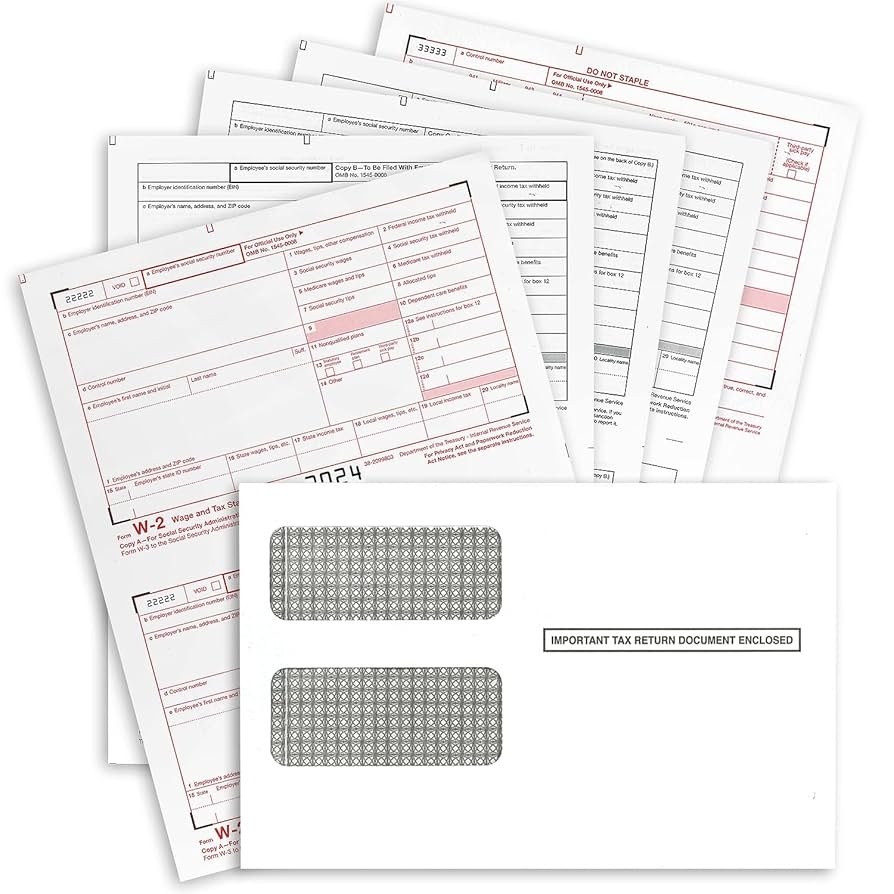

Amazon NextDayLables W2 Forms 2024 4 Part Tax Forms Set Of 50 With Self Seal Envelopes Laser Ink Jet Forms For QuickBooks And Accounting Software Office Products

Amazon NextDayLables W2 Forms 2024 4 Part Tax Forms Set Of 50 With Self Seal Envelopes Laser Ink Jet Forms For QuickBooks And Accounting Software Office Products

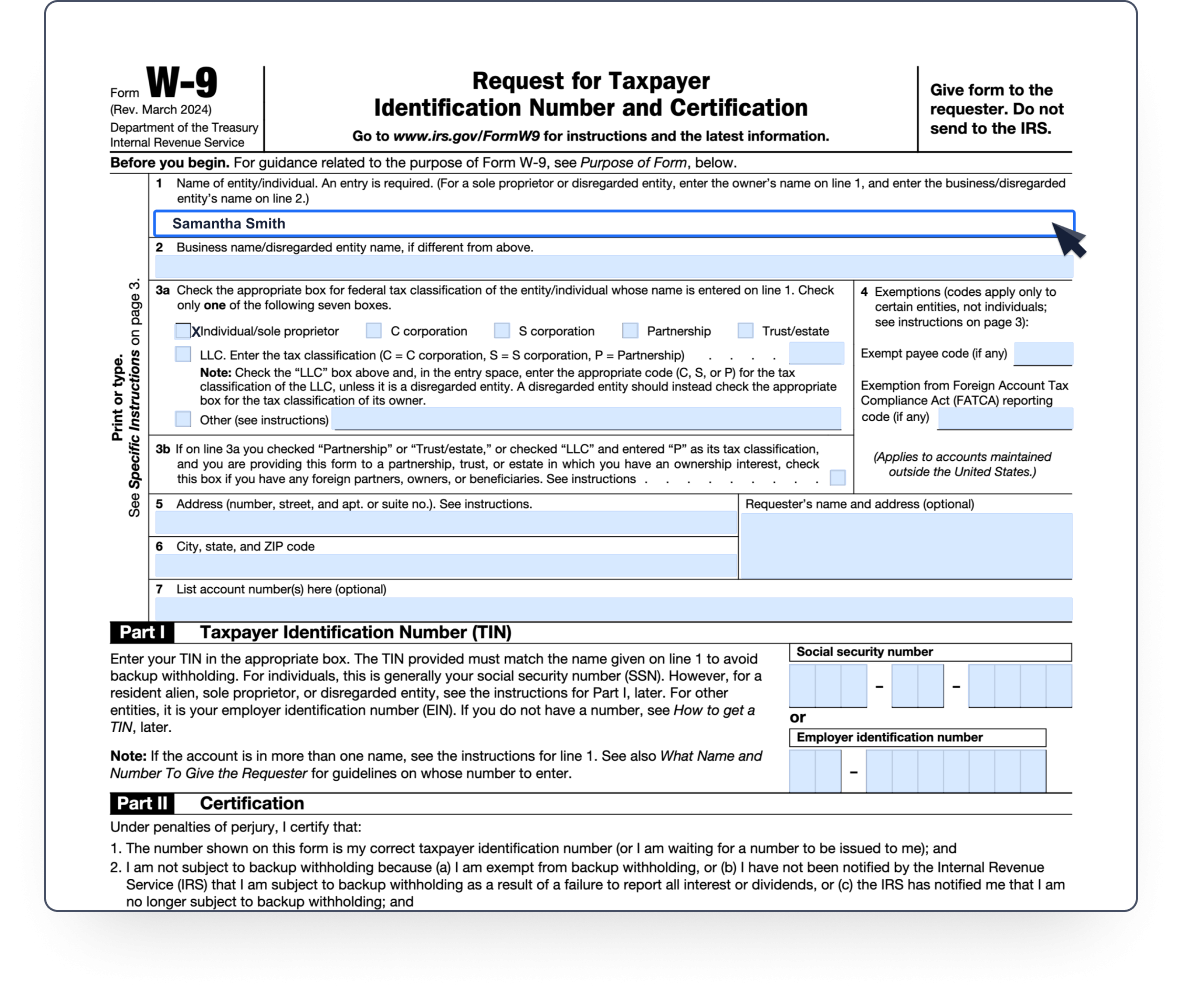

One of the most commonly used forms is the 1040 form, which is used by individuals to report their annual income and calculate their tax liability. In addition to the 1040 form, there are also other forms such as the 1099 form for reporting miscellaneous income, the W-2 form for reporting wages from employers, and various schedules for claiming deductions and credits.

It is important for taxpayers to carefully review the instructions provided with each form to ensure accurate reporting of financial information. Inaccurate or incomplete information can result in delays in processing tax returns and potential audits by the IRS.

By utilizing the 2024 federal tax forms that are available for printing, taxpayers can streamline the tax filing process and ensure compliance with federal tax laws. These forms are designed to capture all relevant financial information and facilitate the calculation of tax liabilities in a systematic manner.

In conclusion, obtaining and printing the necessary federal tax forms for the year 2024 is an essential step in the tax filing process. By carefully reviewing and completing these forms accurately, taxpayers can fulfill their legal obligations and avoid potential penalties for non-compliance. For easy access to these forms, individuals and businesses can visit the IRS website and download the forms that are relevant to their specific tax situation.