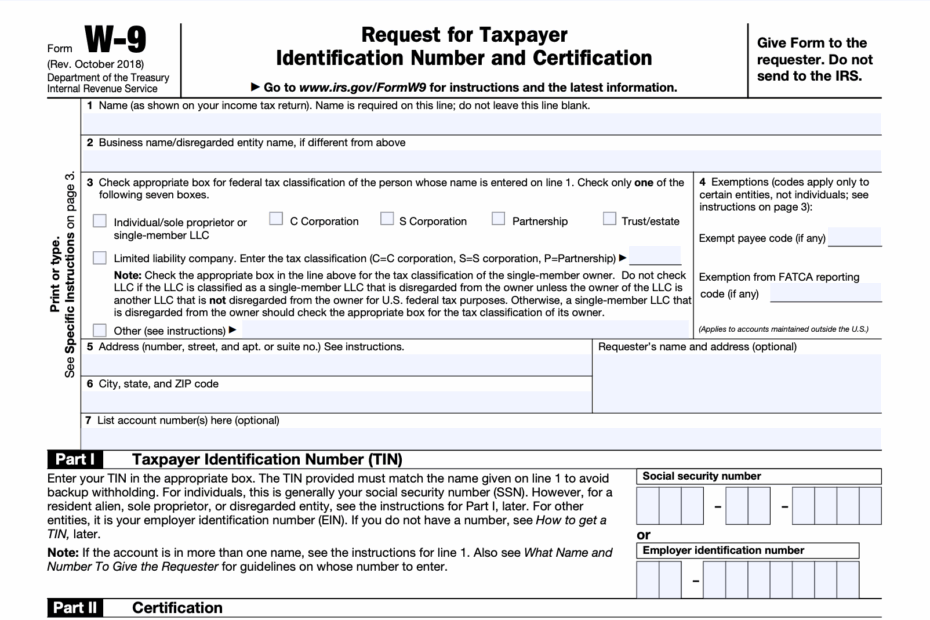

When it comes to tax season, one of the most important forms that individuals and businesses need to be familiar with is the W9 form. This form is used to gather information from independent contractors and vendors for tax-reporting purposes. It is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

Obtaining a W9 form from your vendors or contractors is crucial for accurate reporting of payments made to them throughout the year. This form provides the necessary information, such as the vendor’s name, address, and taxpayer identification number, which is used to prepare 1099 forms for the IRS.

Get and Print W9 Forms Printable

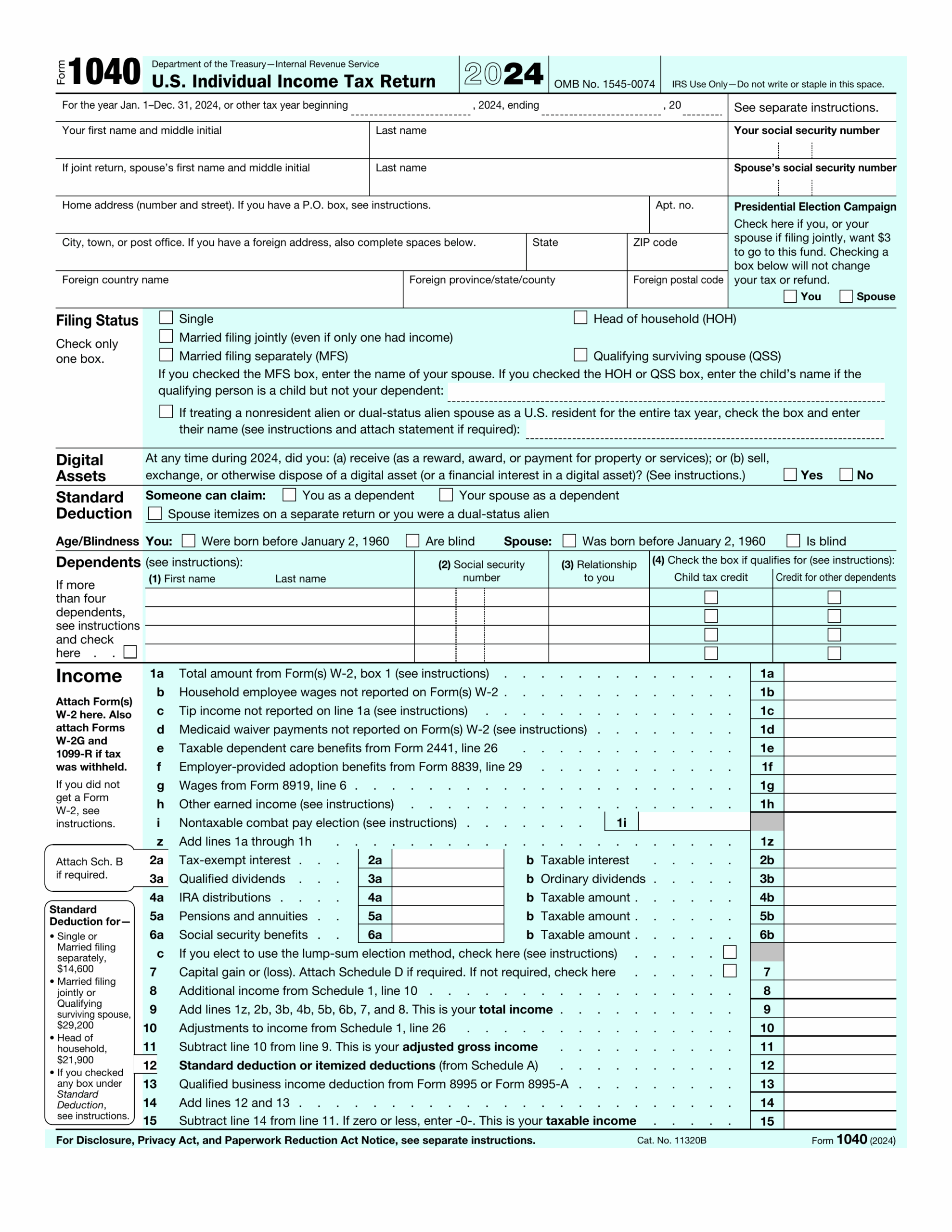

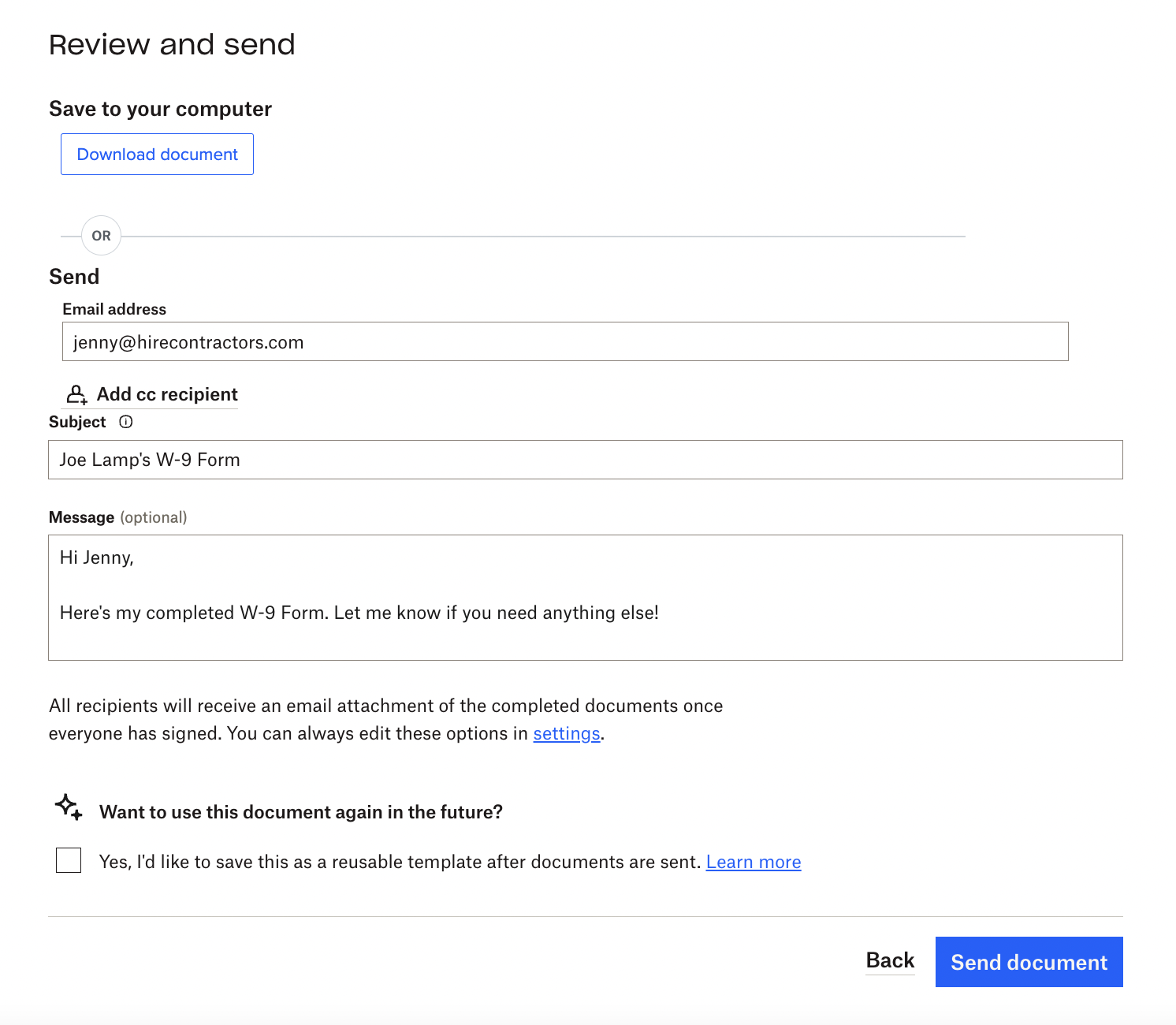

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

Having a printable version of the W9 form readily available can make the process of collecting and storing vendor information much easier. With a simple internet search, you can find various websites that offer downloadable versions of the W9 form that can be easily printed and distributed to your vendors.

It is important to note that the W9 form should be kept on file for at least four years in case of an IRS audit. By having a printable version of the form, you can easily make copies for your records and ensure that you are in compliance with tax laws.

In conclusion, the W9 form is a critical document for businesses and individuals who work with independent contractors and vendors. By utilizing a printable version of the form, you can streamline the process of collecting and storing important tax information, ultimately helping to avoid potential penalties and ensuring compliance with IRS regulations.