When it comes to tax forms, the W-9 form is an important document that is commonly used in businesses and other financial transactions. The W-9 form is used to request the taxpayer identification number (TIN) of a person or business for tax purposes. It is essential for businesses to have this form on file for any vendors or contractors they work with.

For the year 2024, the W-9 form remains a crucial document for businesses and individuals alike. It is important to ensure that the form is filled out accurately and submitted in a timely manner to avoid any issues with tax compliance. Having a printable version of the W-9 form makes it convenient for both parties to complete the necessary information.

Download and Print W-9 Form 2024 Printable

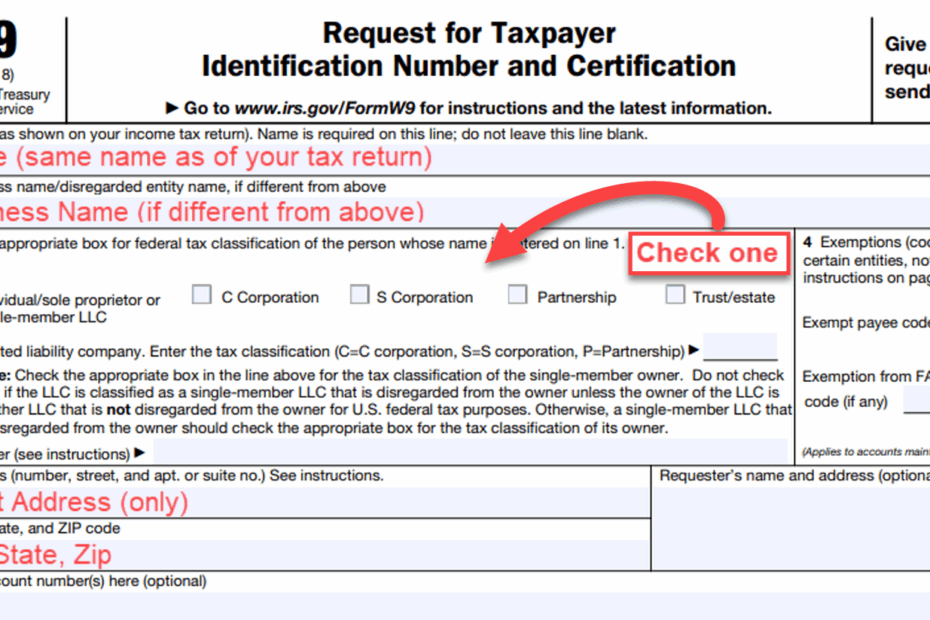

Completing the W-9 form requires providing basic information such as name, address, and TIN. It is important to double-check the information provided to ensure accuracy and prevent any delays in processing. Once completed, the form can be submitted to the requesting party either electronically or via mail.

Businesses often rely on the W-9 form to verify the identity and tax status of vendors and contractors. By collecting this information, businesses can accurately report payments made to these individuals or entities to the IRS. This helps to ensure compliance with tax laws and regulations.

Having a printable version of the W-9 form for the year 2024 makes it easy for individuals and businesses to access and fill out the necessary information. It is a simple yet important document that plays a key role in tax compliance and reporting. By understanding the purpose of the W-9 form and completing it accurately, both parties can ensure smooth and efficient financial transactions.

Overall, the W-9 form for the year 2024 remains a vital document for businesses and individuals when it comes to tax compliance. By having a printable version of the form, it is easy to access and complete the necessary information. Ensuring that the form is filled out accurately and submitted on time is essential for smooth financial transactions and compliance with tax laws.