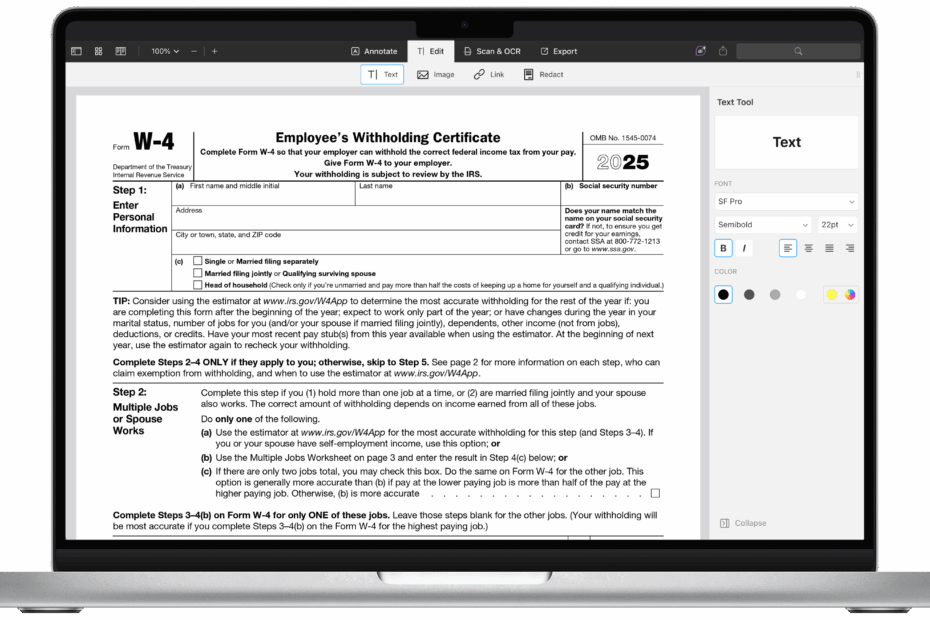

When starting a new job, one of the first tasks you will encounter is filling out a W-4 form. This form, also known as the Employee’s Withholding Certificate, is used by employers to determine how much federal income tax to withhold from your paycheck. It is important to fill out this form accurately in order to avoid any surprises come tax season.

For the year 2025, the W-4 form has been updated with new guidelines and regulations. It is crucial to stay informed about these changes in order to properly complete the form and ensure that the correct amount of taxes are being withheld from your paycheck.

Easily Download and Print W-4 Form 2025 Printable

How To Complete The 2025 W 4 Form A Simple Guide For Household

How To Complete The 2025 W 4 Form A Simple Guide For Household

W-4 Form 2025 Printable

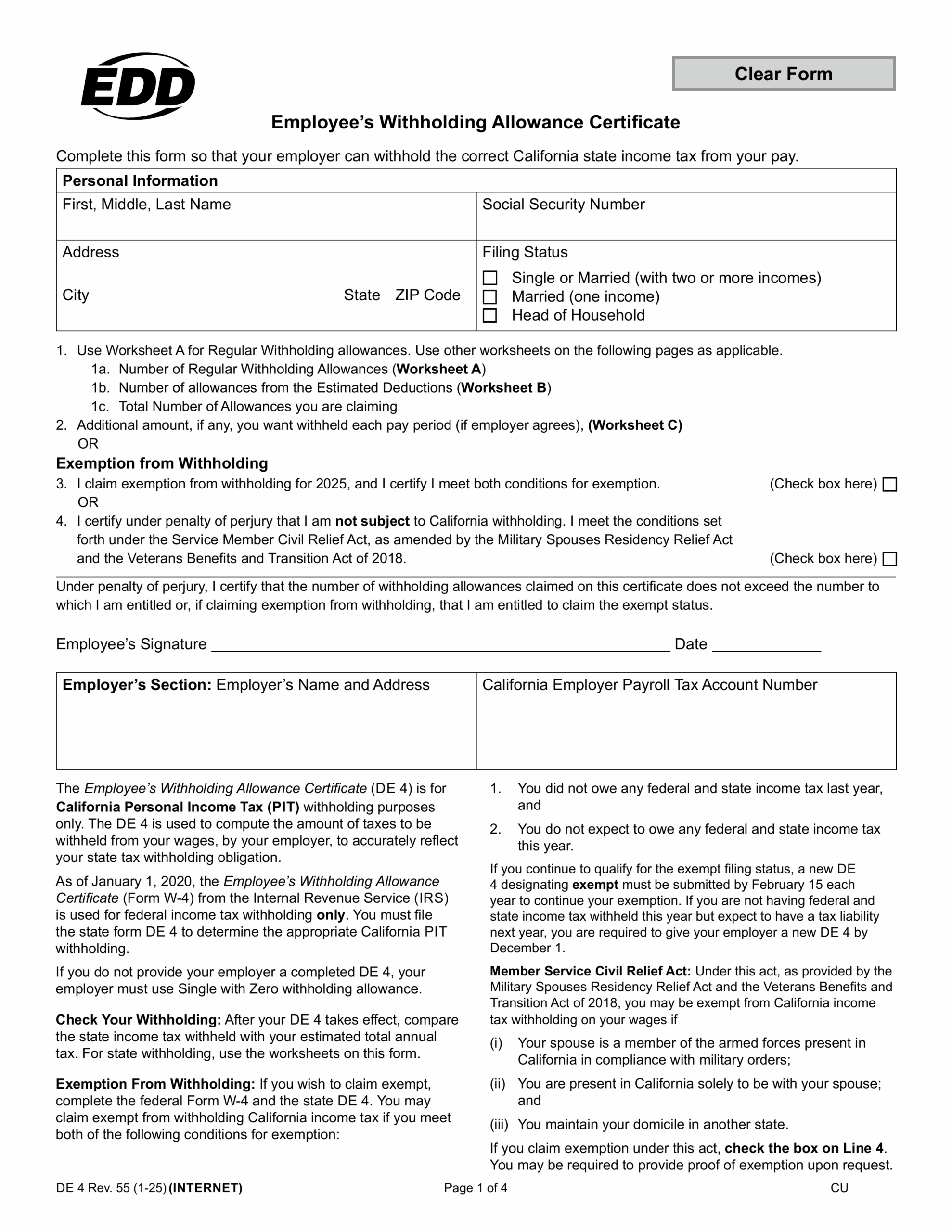

The W-4 form for 2025 is available in a printable format, making it easy for employees to fill out and submit to their employers. This form will ask for basic information such as your name, address, filing status, and number of allowances. It will also include new sections related to any additional income, deductions, and credits that may impact your tax withholding.

One of the key changes in the 2025 W-4 form is the elimination of allowances. Instead, employees will now use a series of check boxes to indicate any additional income or deductions that may affect their tax liability. This new format aims to simplify the process and provide a more accurate withholding amount.

It is important to review the instructions carefully when filling out the W-4 form for 2025. If you have any questions or need assistance, don’t hesitate to reach out to your employer or a tax professional. By taking the time to complete this form accurately, you can ensure that you are not overpaying or underpaying your taxes throughout the year.

Once you have completed the W-4 form for 2025, be sure to submit it to your employer as soon as possible. This will ensure that the correct amount of taxes are being withheld from your paycheck starting with your next pay period. By staying informed and proactive with your tax withholding, you can avoid any potential issues and be better prepared for tax season.

In conclusion, the W-4 form for 2025 is an important document that all employees must complete when starting a new job. By understanding the changes and guidelines for this year, you can accurately fill out the form and ensure that the correct amount of taxes are being withheld from your paycheck. Remember to review the instructions carefully, seek assistance if needed, and submit the form promptly to your employer. Taking these steps will help you stay compliant with tax regulations and avoid any surprises down the road.