When it comes to tax season, one of the most important forms you will need to fill out is the W4 form. This form is used by employers to determine how much federal income tax should be withheld from an employee’s paycheck. It’s crucial to fill out this form accurately to avoid any issues with your taxes later on.

Printable W4 forms make the process of filling out this important document much easier. Instead of having to track down a physical form and fill it out by hand, you can simply download a printable version from the internet and complete it electronically. This can save you time and hassle, especially if you need to make changes to your withholding throughout the year.

Save and Print Printable W4 Forms

Guide To Filling Out Form W 4 How To Keep More Money In Your Paychecks

Guide To Filling Out Form W 4 How To Keep More Money In Your Paychecks

There are several websites that offer printable W4 forms for free. Simply search for “printable W4 form” in your favorite search engine and you’ll find a variety of options to choose from. Once you’ve found a form that suits your needs, you can download it, fill it out, and submit it to your employer.

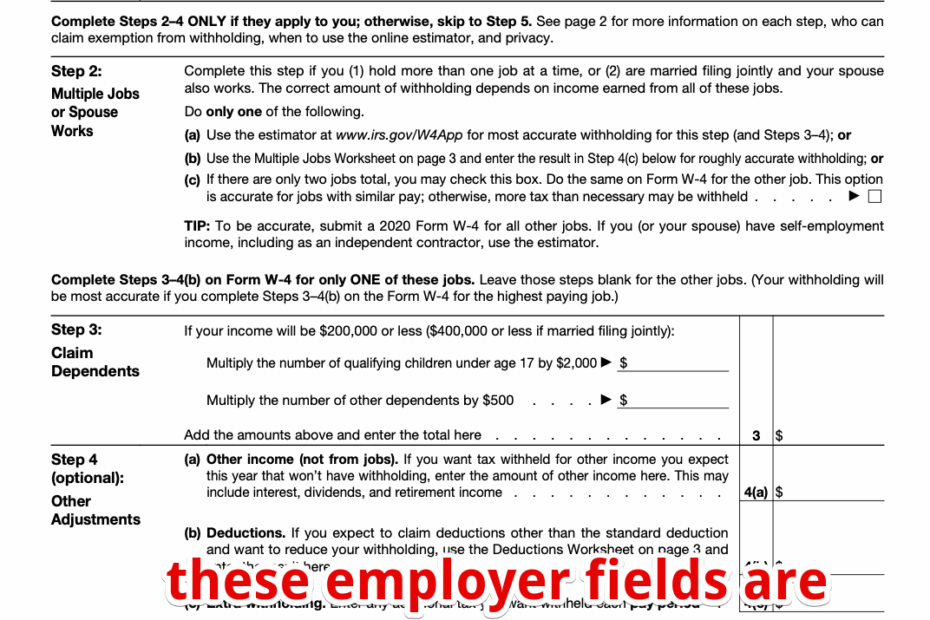

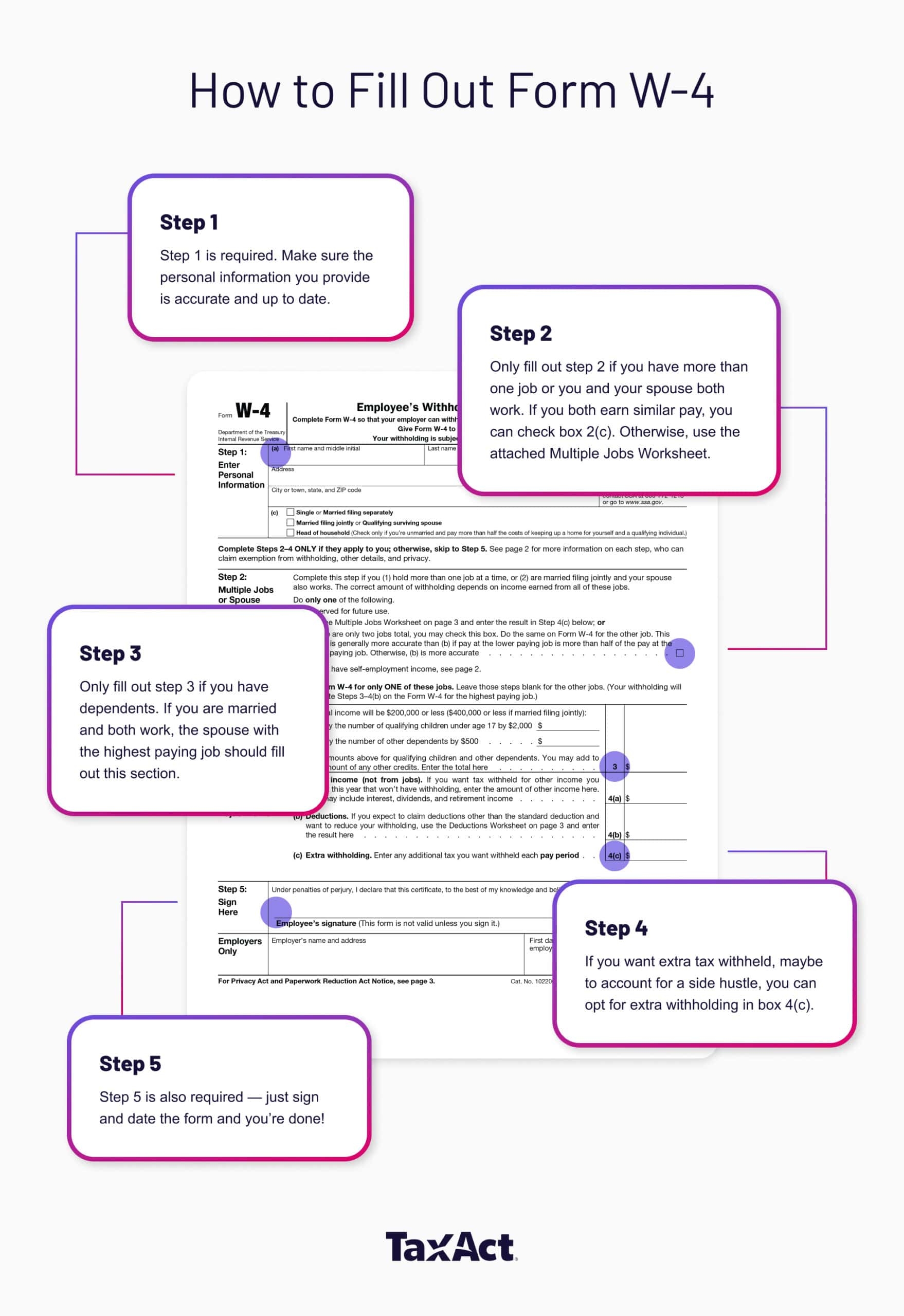

When filling out a printable W4 form, be sure to follow the instructions carefully. You’ll need to provide information such as your name, address, Social Security number, and filing status. You’ll also need to indicate how many allowances you want to claim, which will affect how much tax is withheld from your paycheck.

Once you’ve completed the form, double-check your entries to ensure accuracy. Any mistakes could result in incorrect withholding amounts, which could lead to issues when it comes time to file your taxes. If you’re unsure about how to fill out the form, consider seeking guidance from a tax professional.

In conclusion, printable W4 forms are a convenient and efficient way to ensure that your tax withholding is accurate. By taking the time to fill out this form correctly, you can avoid any surprises when it comes time to file your taxes. So don’t wait until the last minute – download a printable W4 form today and get ahead of the game!