Completing taxes can be a daunting task, but having the right forms can make the process much easier. The Internal Revenue Service (IRS) provides a variety of forms for individuals and businesses to report their income, expenses, and deductions. While many forms can be filed electronically, some individuals prefer to fill out their forms by hand. This is where printable IRS forms come in handy.

Printable IRS forms are available on the IRS website, allowing taxpayers to easily access and fill out the necessary documents. These forms can be downloaded and printed at home, making it convenient for those who prefer to file their taxes manually. Whether you need to report income, claim deductions, or request an extension, there is a printable form available for your specific tax situation.

Save and Print Printable Irs Forms

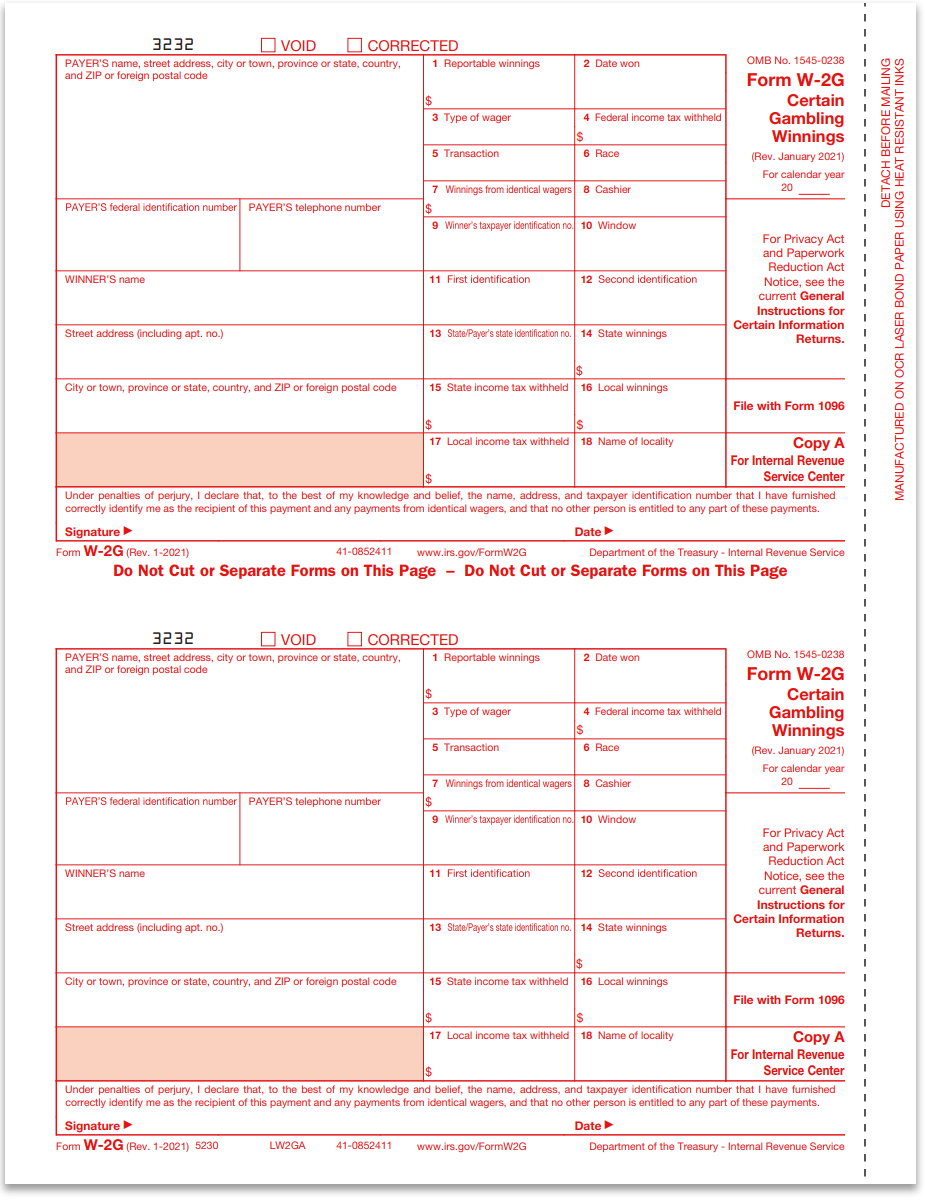

W2G Forms For Gambling Winnings Red Copy A DiscountTaxForms

W2G Forms For Gambling Winnings Red Copy A DiscountTaxForms

One of the most common printable IRS forms is the 1040 form, which is used by individuals to report their annual income and calculate their tax liability. This form includes sections for income, deductions, and credits, making it comprehensive for most taxpayers. Additionally, there are printable forms for various schedules and worksheets that may be needed to complete your tax return accurately.

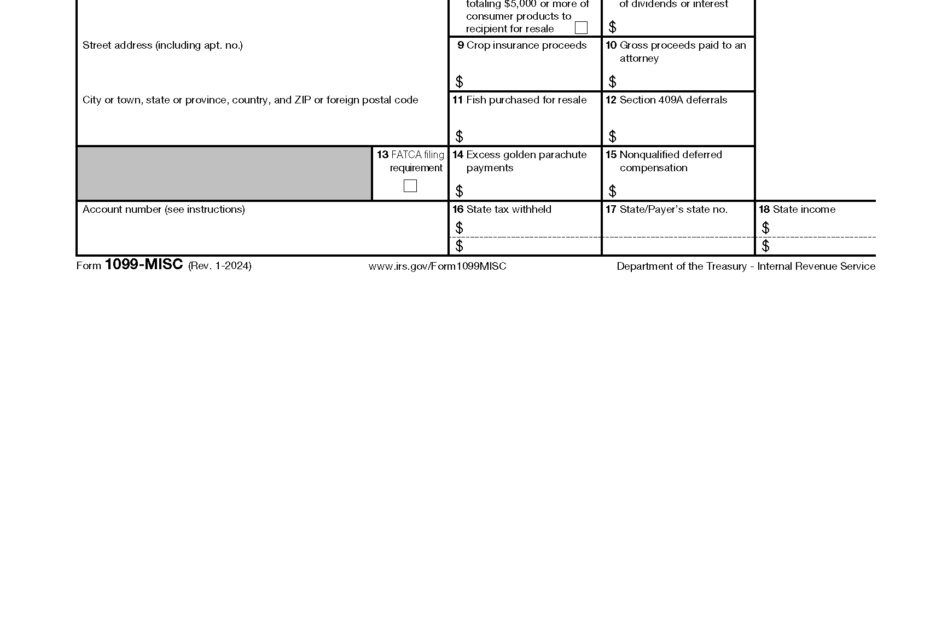

Businesses can also benefit from printable IRS forms, such as the 1099 form used to report income paid to contractors and freelancers. This form is essential for businesses that hire independent workers and must report their payments to the IRS. By having access to printable forms, businesses can ensure that they are compliant with tax laws and avoid any potential penalties for late or inaccurate reporting.

Overall, printable IRS forms offer a convenient and efficient way for individuals and businesses to file their taxes accurately. Whether you prefer to file by hand or simply need a hard copy of a form for your records, printable IRS forms can help simplify the tax-filing process. By utilizing these forms, taxpayers can ensure that they are meeting their tax obligations and avoiding any potential issues with the IRS.

In conclusion, printable IRS forms are a valuable resource for taxpayers looking to file their taxes manually. By accessing these forms online, individuals and businesses can easily download and print the necessary documents to complete their tax returns accurately. Whether you are reporting income, claiming deductions, or filing as a business, there is a printable IRS form available for your specific needs.