Are you running out of time to file your taxes? Do you need an extension to submit your tax return? The IRS 4868 Printable Form might be the solution you are looking for. This form allows individuals to request an automatic extension of time to file their tax return.

By filling out the IRS 4868 Printable Form, you can get an additional six months to file your tax return. This extension gives you until October 15th to submit your paperwork, providing you with more time to gather necessary documents and ensure accuracy in your filing.

Quickly Access and Print Irs 4868 Printable Form

Form 4868 2024 2025 Fill Edit Download Forms PDF Guru

Form 4868 2024 2025 Fill Edit Download Forms PDF Guru

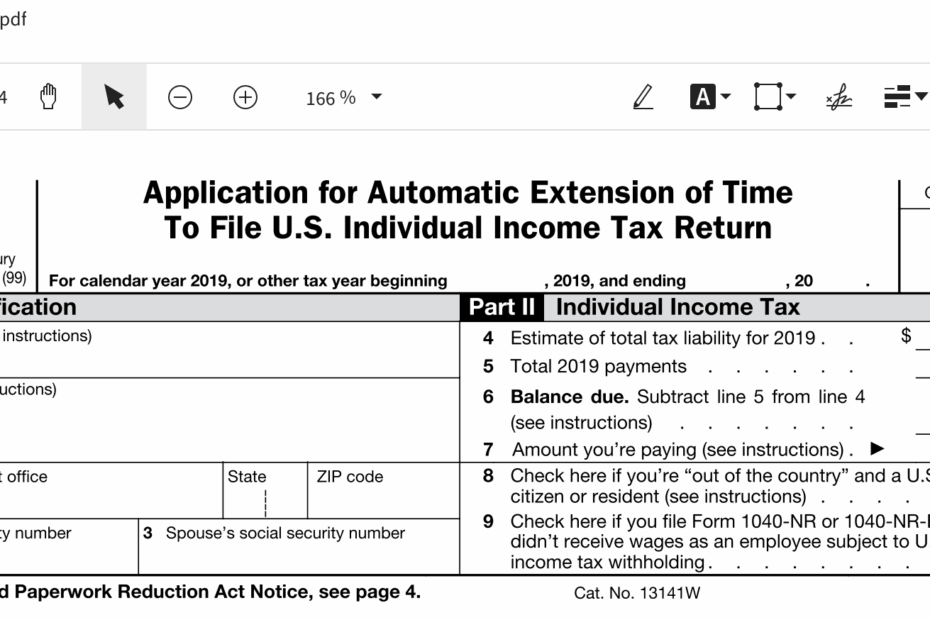

When completing the form, you will need to provide basic information such as your name, address, social security number, and estimated tax liability. It is essential to estimate your tax liability accurately to avoid penalties for underpayment. Once the form is filled out, you can either mail it to the IRS or submit it electronically.

It is important to note that while the IRS 4868 Printable Form grants an extension for filing your tax return, it does not extend the deadline for paying any taxes owed. If you anticipate owing taxes, it is recommended to make a payment with your extension request to avoid interest and penalties.

Keep in mind that requesting an extension with the IRS 4868 Printable Form does not exempt you from late filing penalties if you fail to submit your tax return by the extended deadline. It is crucial to meet the October 15th deadline to avoid any additional fees or consequences.

In conclusion, the IRS 4868 Printable Form can be a helpful tool for individuals who need more time to file their tax return. By accurately completing the form and submitting it on time, you can avoid penalties for late filing. Remember to also pay any taxes owed to prevent interest and penalties for underpayment. Take advantage of this extension opportunity to ensure a smooth and stress-free tax filing process.