When it comes to filing your taxes, having the right forms is crucial. For the year 2024, the IRS has released a variety of federal tax forms that are available for download and printing. These forms are essential for reporting your income, deductions, and credits accurately to ensure you are in compliance with the law.

Whether you are an individual taxpayer or a business owner, knowing which forms to use can save you time and prevent errors on your tax return. By utilizing the printable federal tax forms for 2024, you can streamline the filing process and make sure you are meeting all of your tax obligations.

Federal Tax Forms 2024 Printable

Federal Tax Forms 2024 Printable

Download and Print Federal Tax Forms 2024 Printable

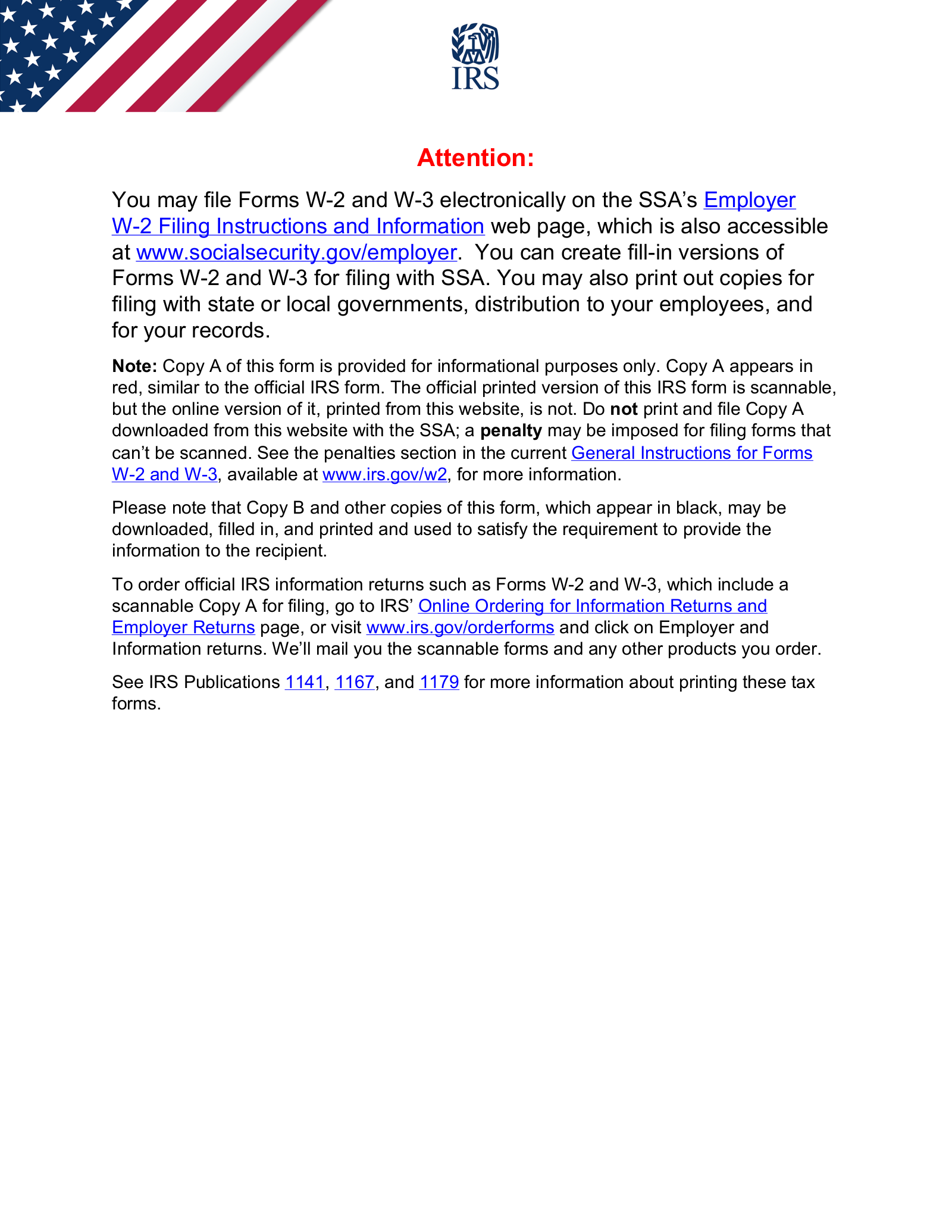

Free IRS Form W 2 Wage And Tax Statement PDF EForms

Free IRS Form W 2 Wage And Tax Statement PDF EForms

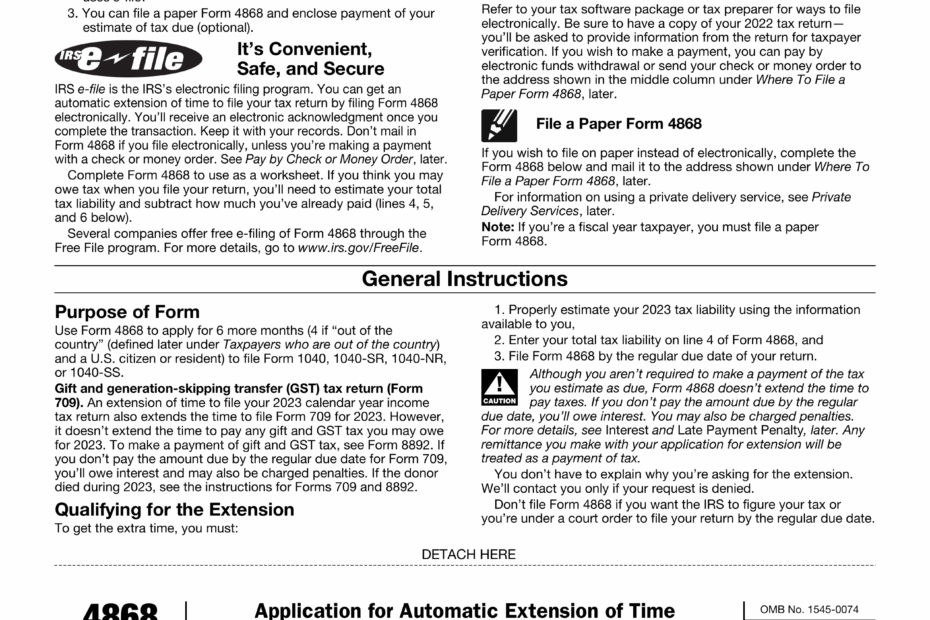

One of the most commonly used federal tax forms is the 1040 form, which is used by individuals to report their income and claim deductions and credits. Additionally, there are various schedules and worksheets that may need to be filed depending on your specific tax situation. These forms can be easily found on the IRS website and are available for download and printing.

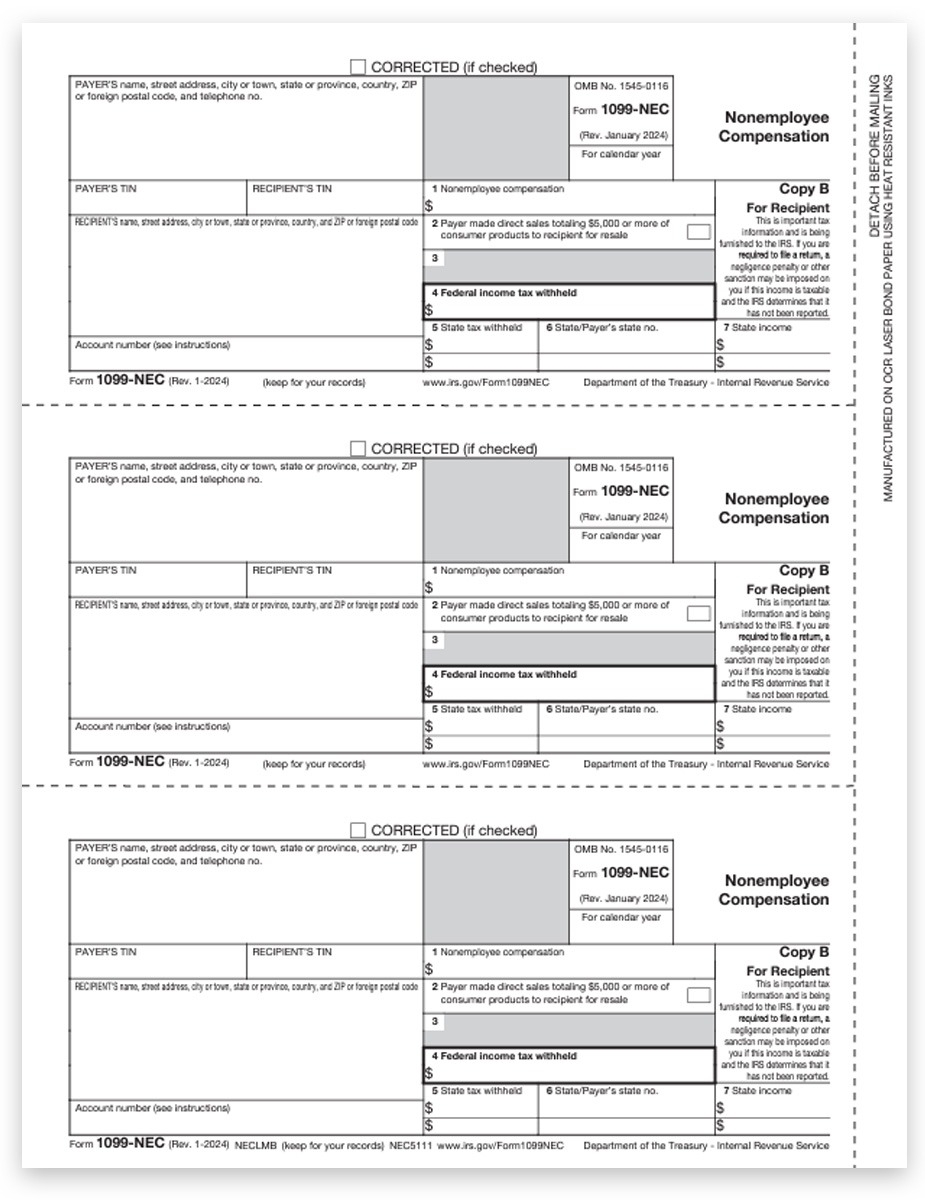

For business owners, there are specific forms such as the 1065 for partnerships, the 1120 for corporations, and the 990 for tax-exempt organizations. These forms are essential for reporting the income and expenses of your business accurately to ensure you are in compliance with the tax laws.

It is important to note that some individuals may qualify for free tax filing through the IRS Free File program, which allows taxpayers with an adjusted gross income below a certain threshold to file their taxes for free using participating software providers. This can be a great option for those who have a simple tax situation and do not need to hire a professional tax preparer.

In conclusion, having access to printable federal tax forms for 2024 is essential for accurately reporting your income and claiming deductions and credits on your tax return. By utilizing these forms, you can ensure that you are meeting all of your tax obligations and avoid any potential penalties for non-compliance. Make sure to download the necessary forms from the IRS website and consult with a tax professional if you have any questions about your tax situation.